Top Takeaways from Matthew Gardner’s 2025 Economic Forecast

On January 22nd, my office hosted an Economic and Housing Market Forecast for our clients with renowned economist and housing market specialist Matthew Gardner. His presentation included a look back at 2024, some discussion about what to expect with the new administration, and a look ahead to 2025 and beyond. Please let me know if you want to receive a link to the recording or a PDF of his PowerPoint slide deck.

He presented his data using a macro-to-micro approach, starting with the national economy and then narrowing down locally by presenting stats, figures, and predictions about the King and Snohomish County economies and housing markets. Here are my top takeaways.

✅ NATIONAL ECONOMY:

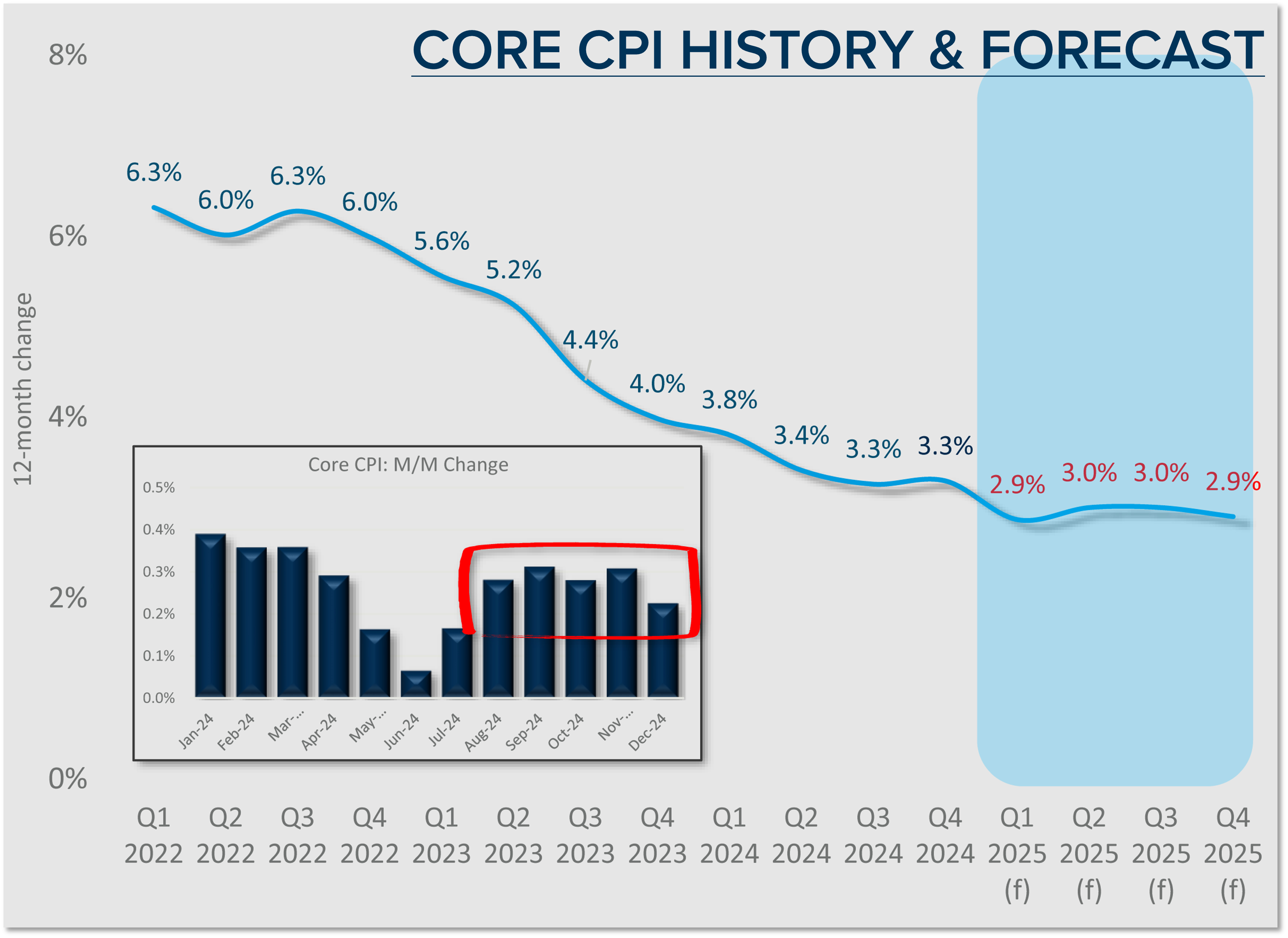

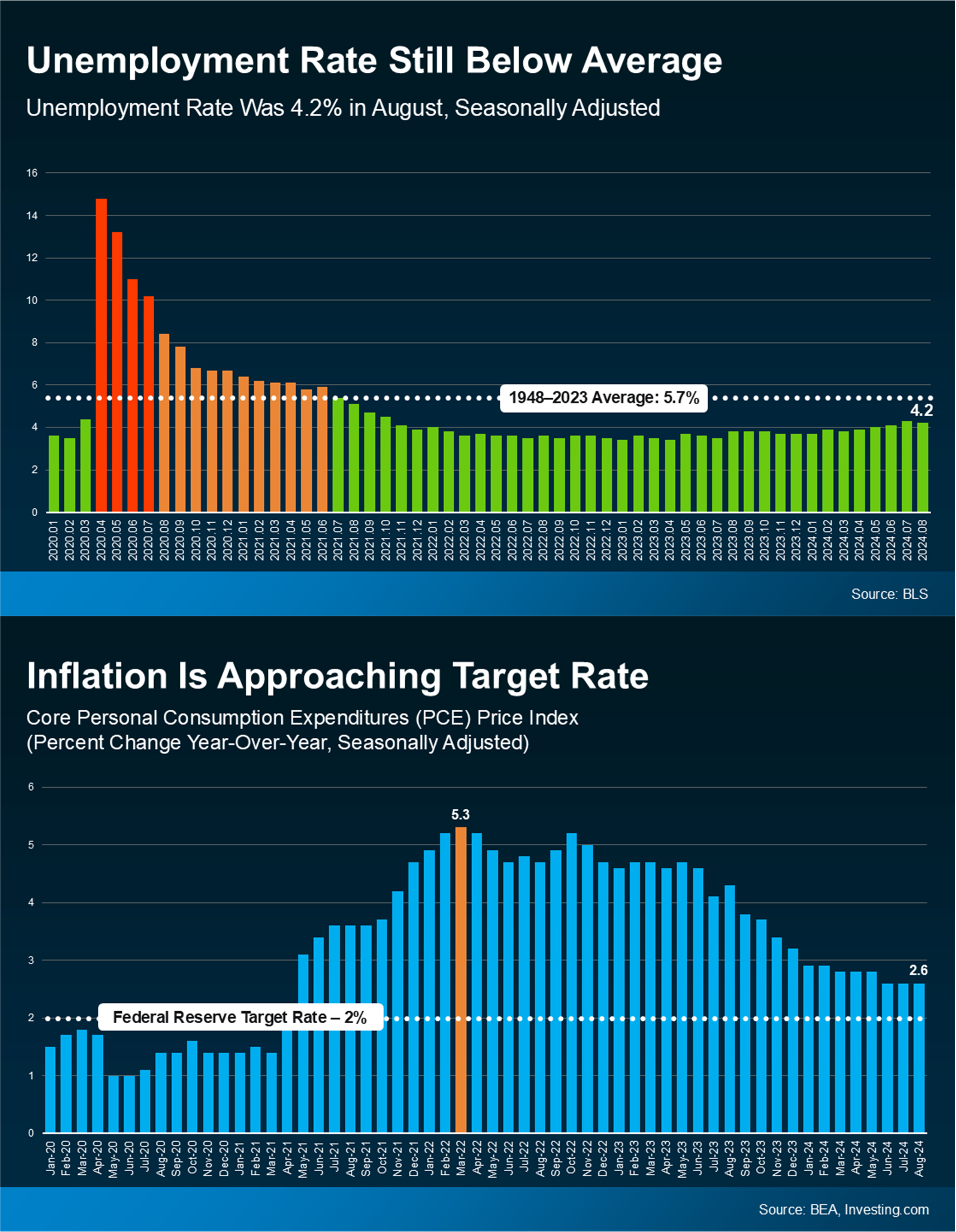

Inflation has become “sticky”! It slowly trended down in 2024 but could tread water in 2025, depending on what happens with tariffs under the new administration. If tariffs are instituted across the board, many countries are predicted to respond by implementing their own tariffs, which would increase the cost of goods.

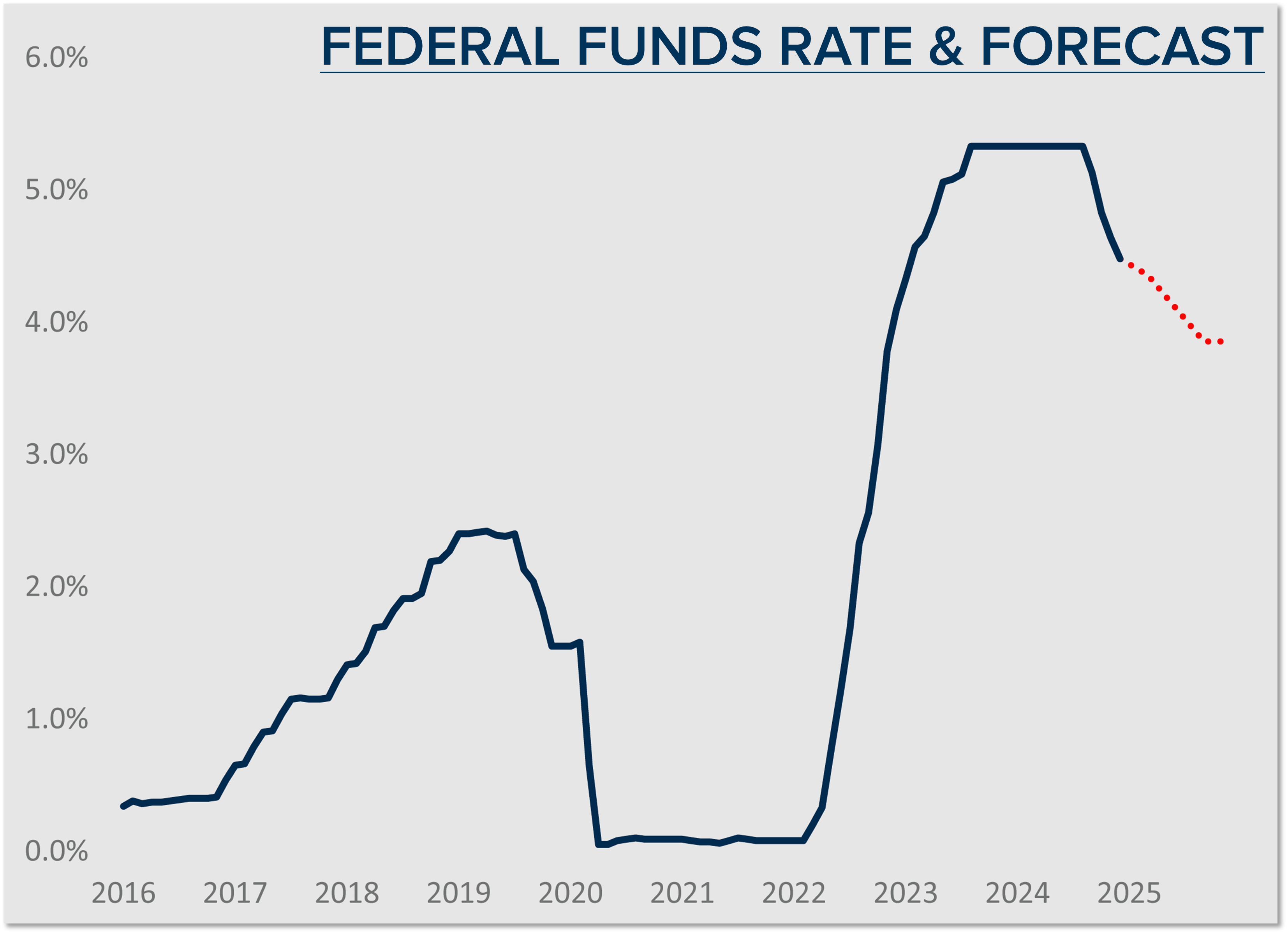

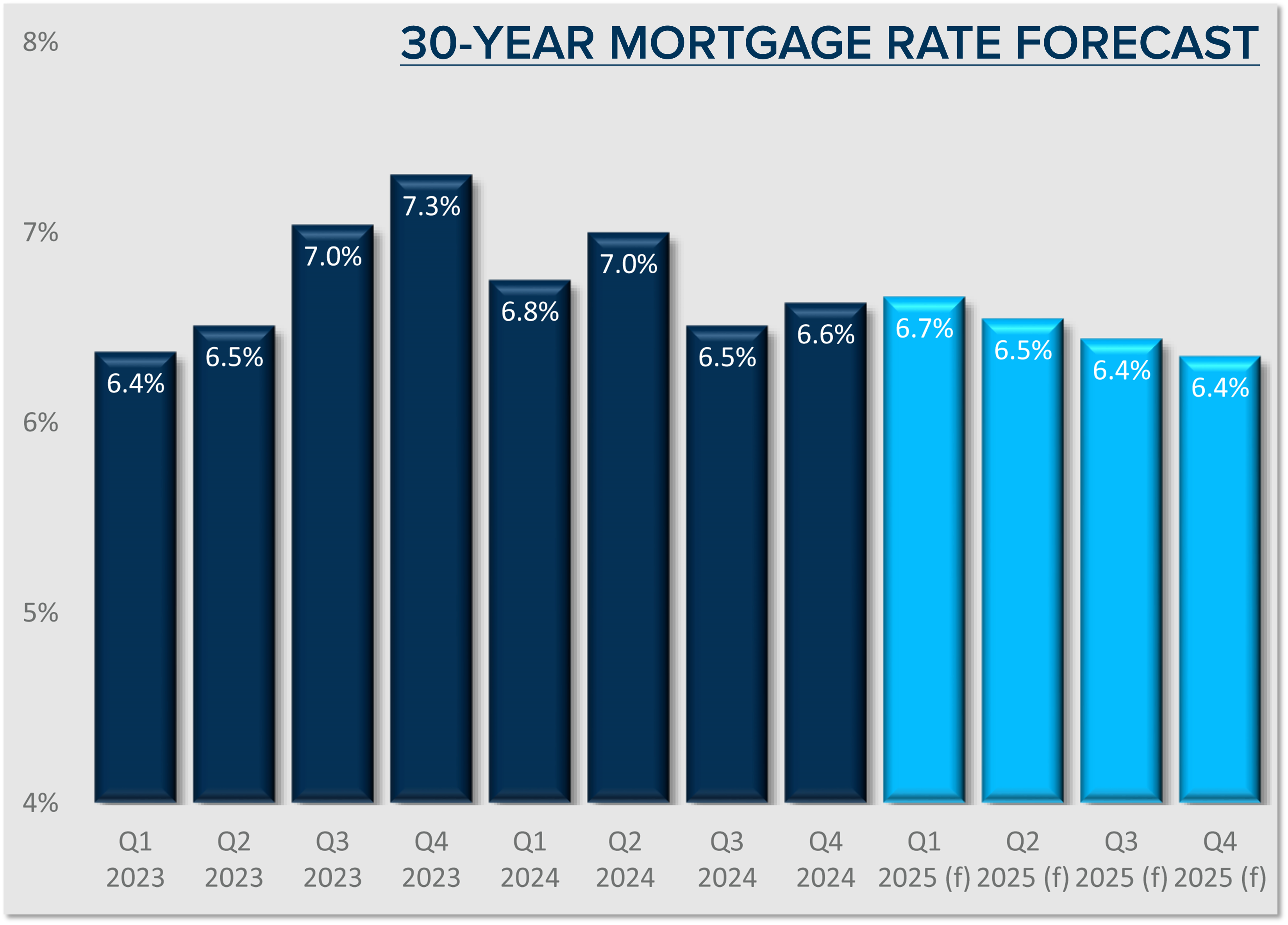

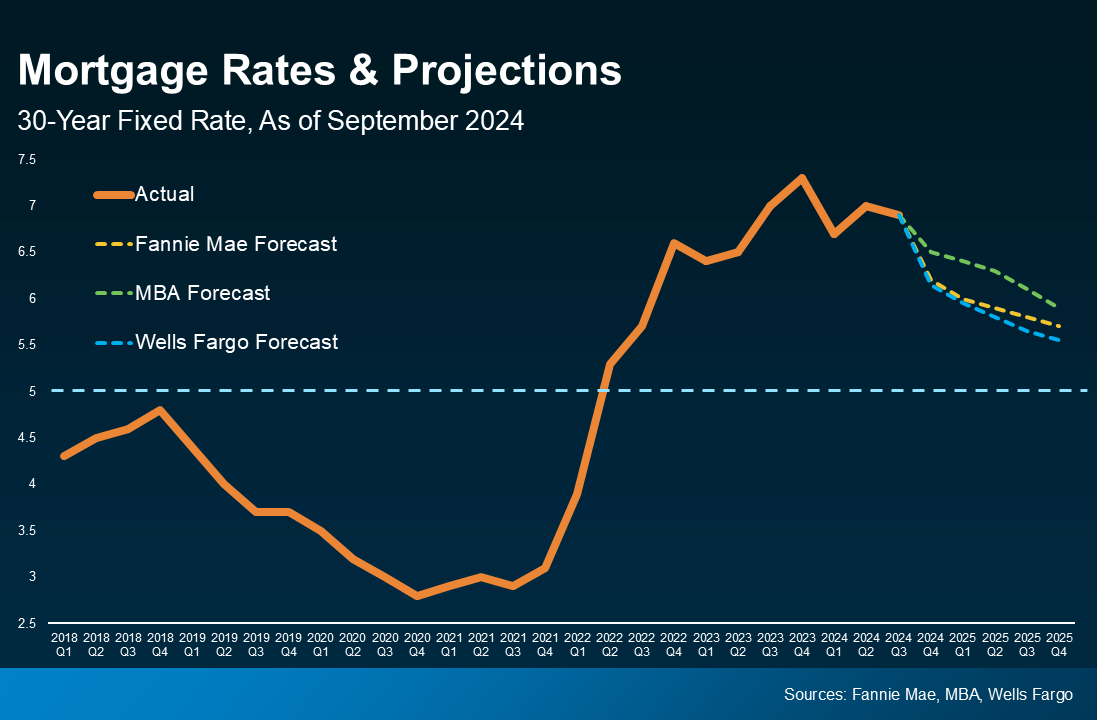

The Federal Funds Rate will slowly decrease over the course of 2025. Until we get clarity on proposed tariffs on U.S. trade partners, the Federal Reserve will remain aggressive with rates to combat inflation. The current consensus is for the Fed to make two rate cuts instead of four, with the first possibly being in February. NOTE: The Federal Funds Rate is the short-term interest rate (credit cards, car loans, etc.), not Mortgage Rates.

There is no sign of a recession. The balance of inflation, rates, and the overall health of the economy has created a soft landing that avoided a recession. In fact, GDP is up by 2% and the textbook definition of a recession is when the GDP decreases over two successive quarters.

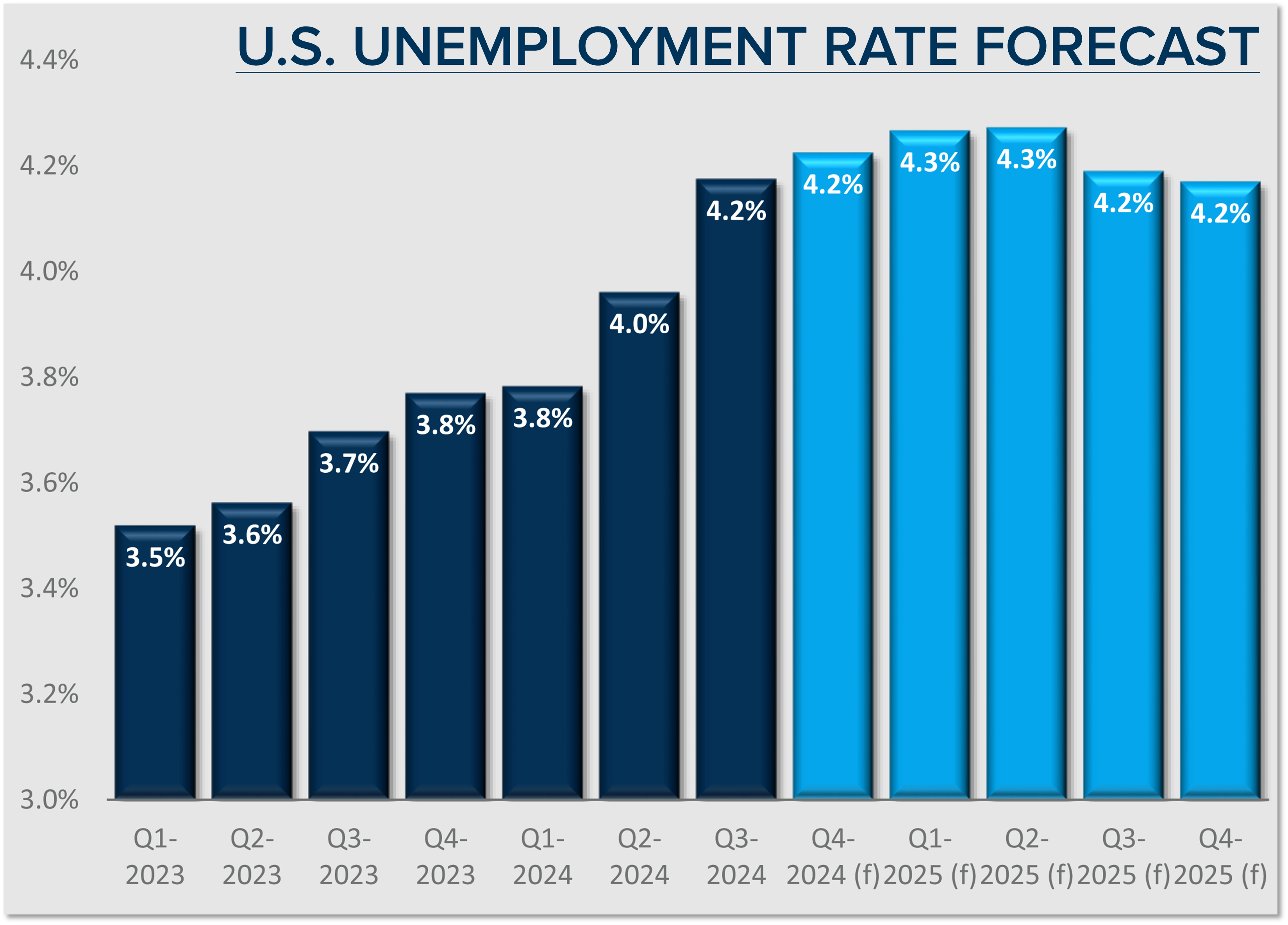

Tepid job growth in 2025. The labor market has cooled nationally after the “catch-up” period post pandemic. Going forward, proposed immigration reform could weigh on labor force growth and hamper job creation. Weak labor force growth keeps the unemployment rate from rising in any meaningful way and is anticipated to peak around 4%.

✅ GREATER SEATTLE AREA JOB MARKET:

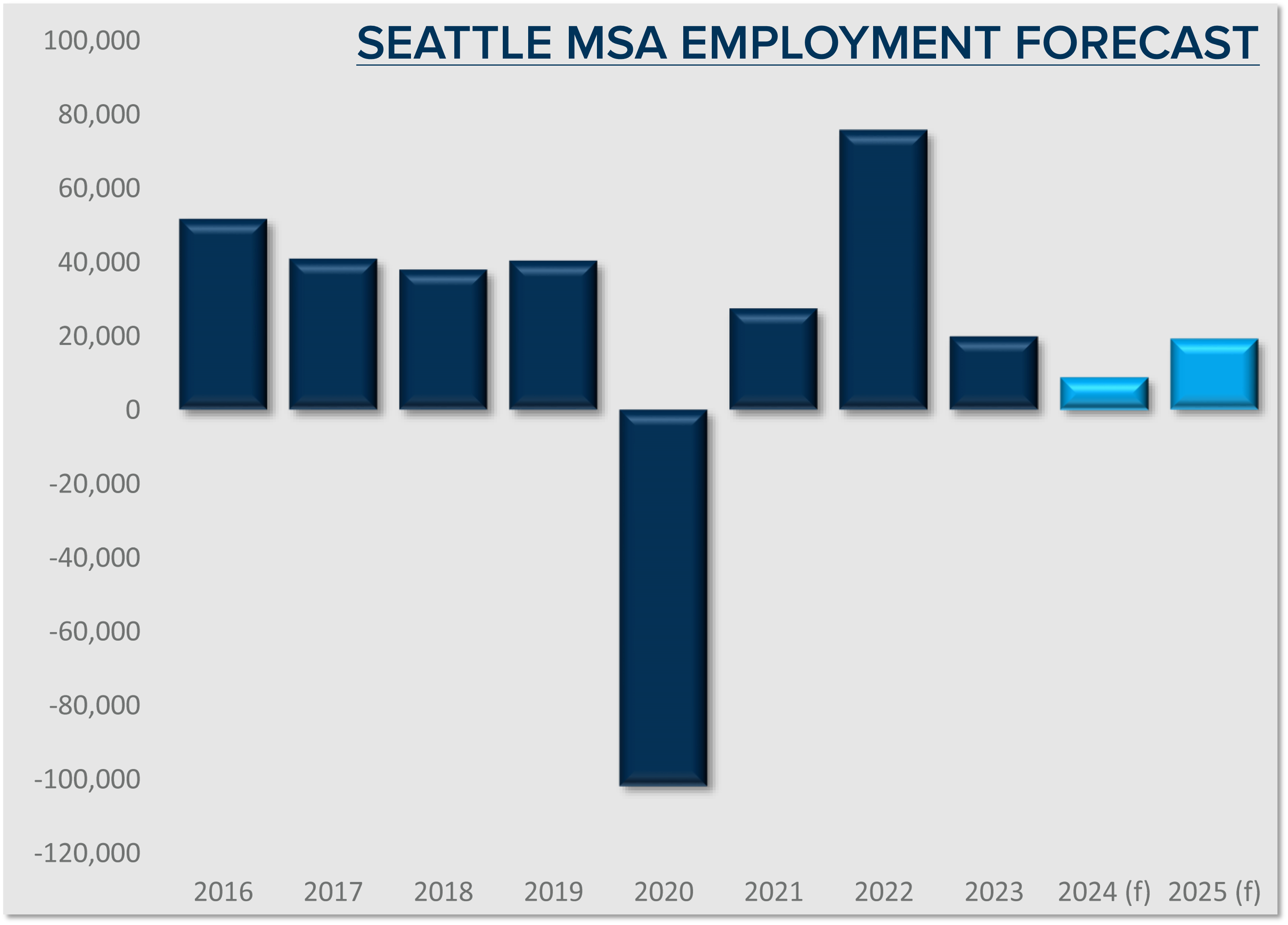

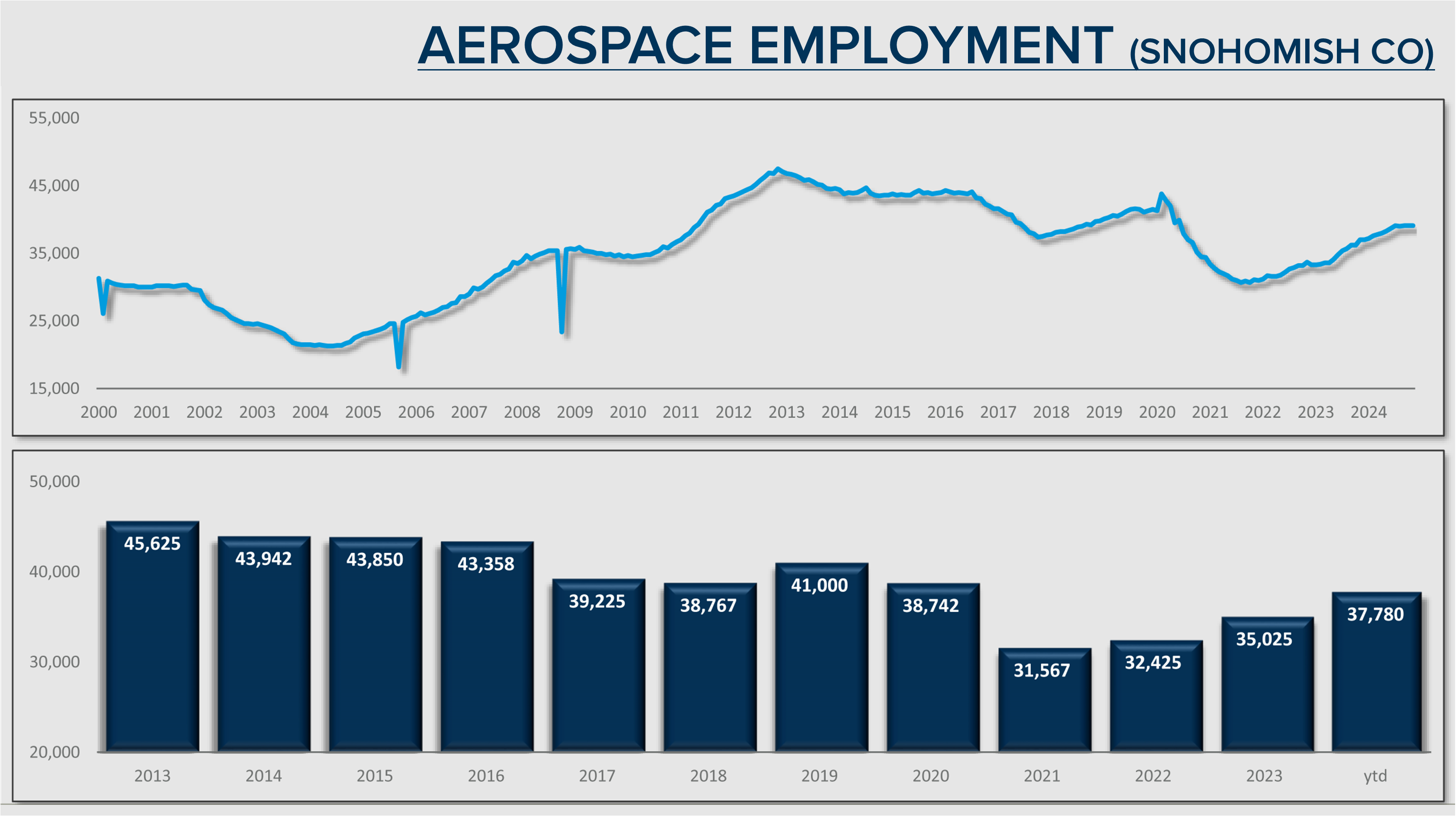

Job growth is still happening, yet ever so slightly! Jobs expanded by 1.2% in 2024 and should expand by 1.5% in 2025. The tech sector props up King County, and Snohomish County had a relatively positive recovery post-Boeing strike. The construction sector is down, and some businesses will “wait and see” about growth once the administration starts to take shape with trade and immigration policies, which will directly affect labor costs.

✅ GREATER SEATTLE HOUSING MARKET:

Inventory will increase in 2025 over 2024 by 8-10%. In 2024, inventory increased by 14% over 2023, which saw the lowest levels since the Great Recession. Lower inventory has been driven by the “lock-in” effect created by the previous low interest rates. Moves have been less discretionary and more so motivated by death, divorce, and diapers. More discretionary moves will happen when homeowners see mortgage rates closer to within 2% of their current rate. However, equity levels are high (over 50% of homeowners have 50% or more equity), enabling buyers who are also sellers to reposition their equity to a home that better fits their lifestyle, should the monthly payment work for them.

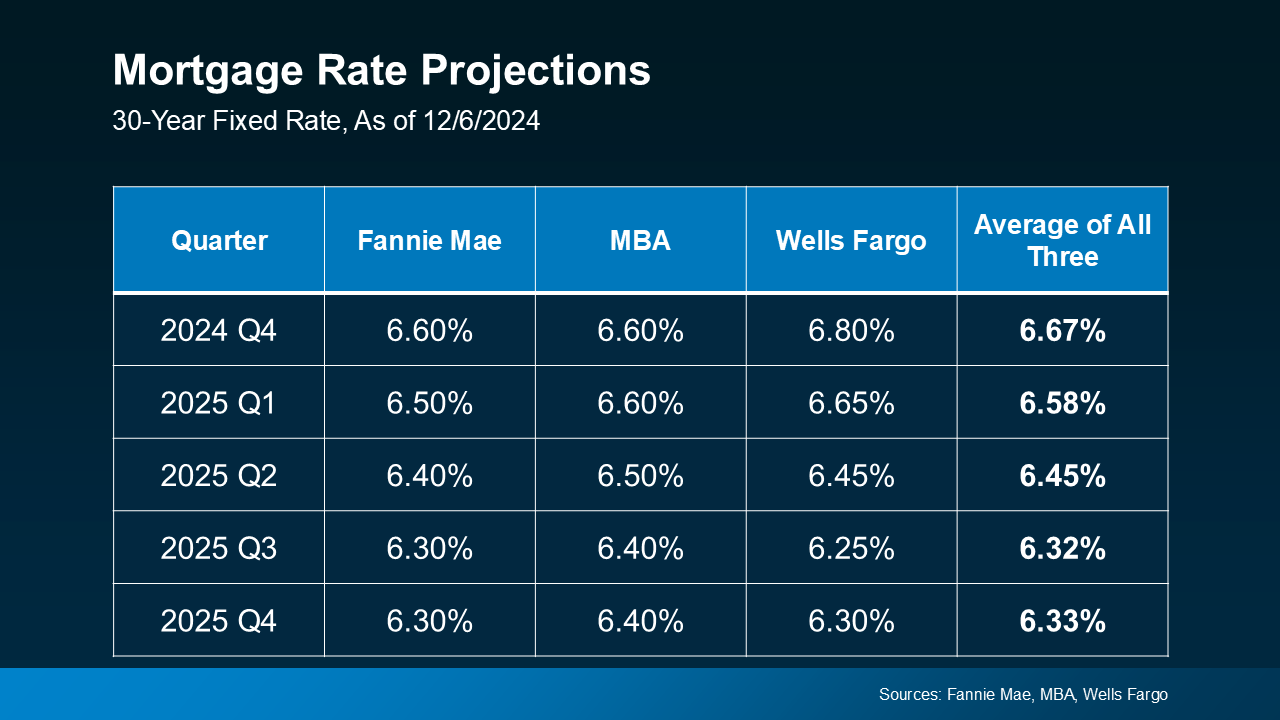

Mortgage rates will modestly decrease throughout 2025 and should end up in the low 6%. The biggest headwind is deficit spending now that inflation has settled. This spending will keep the 10-year treasury high, which will have a direct impact on mortgage rates. These are two key factors to watch if you’re waiting for mortgage rates to drop significantly.

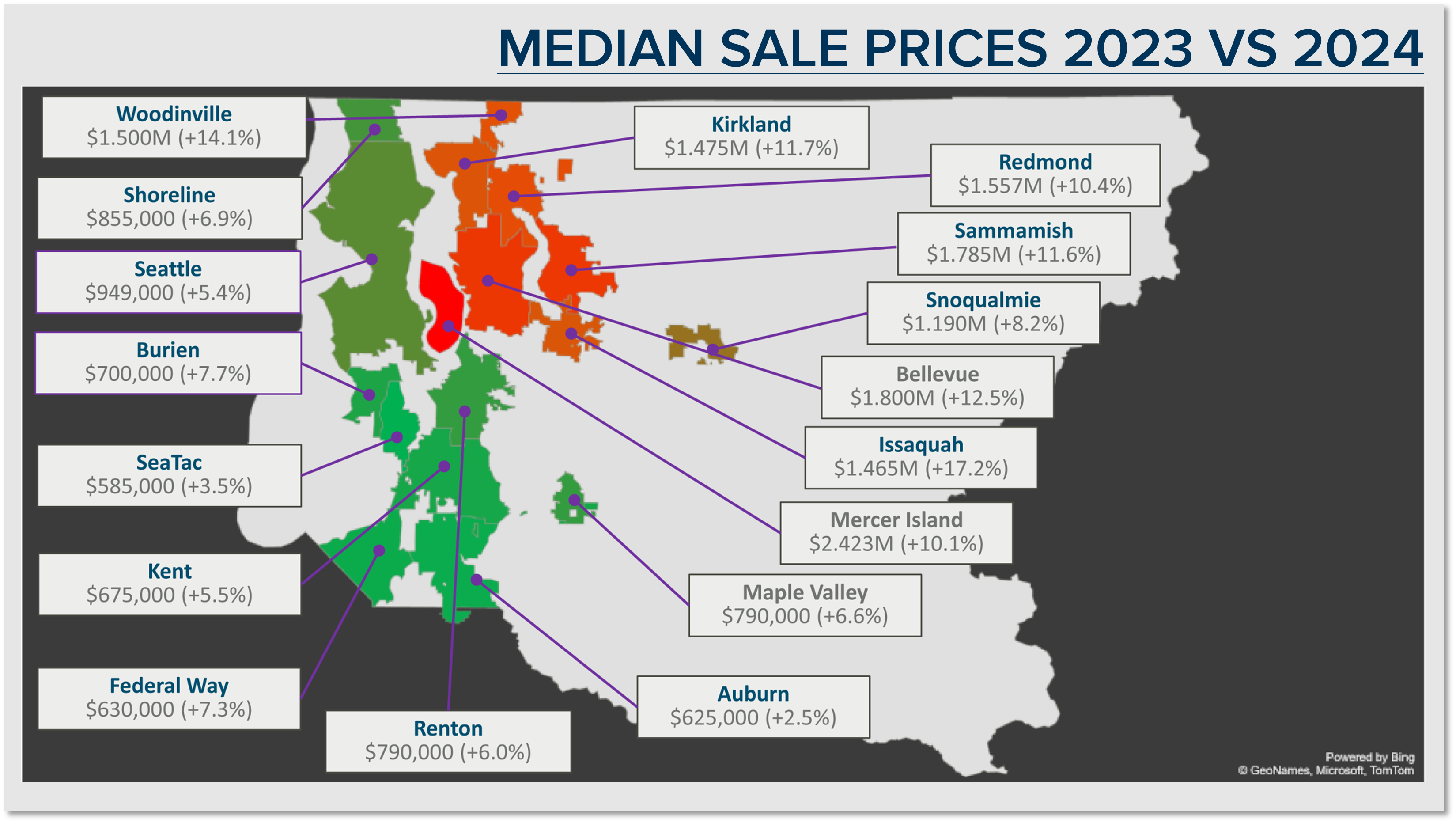

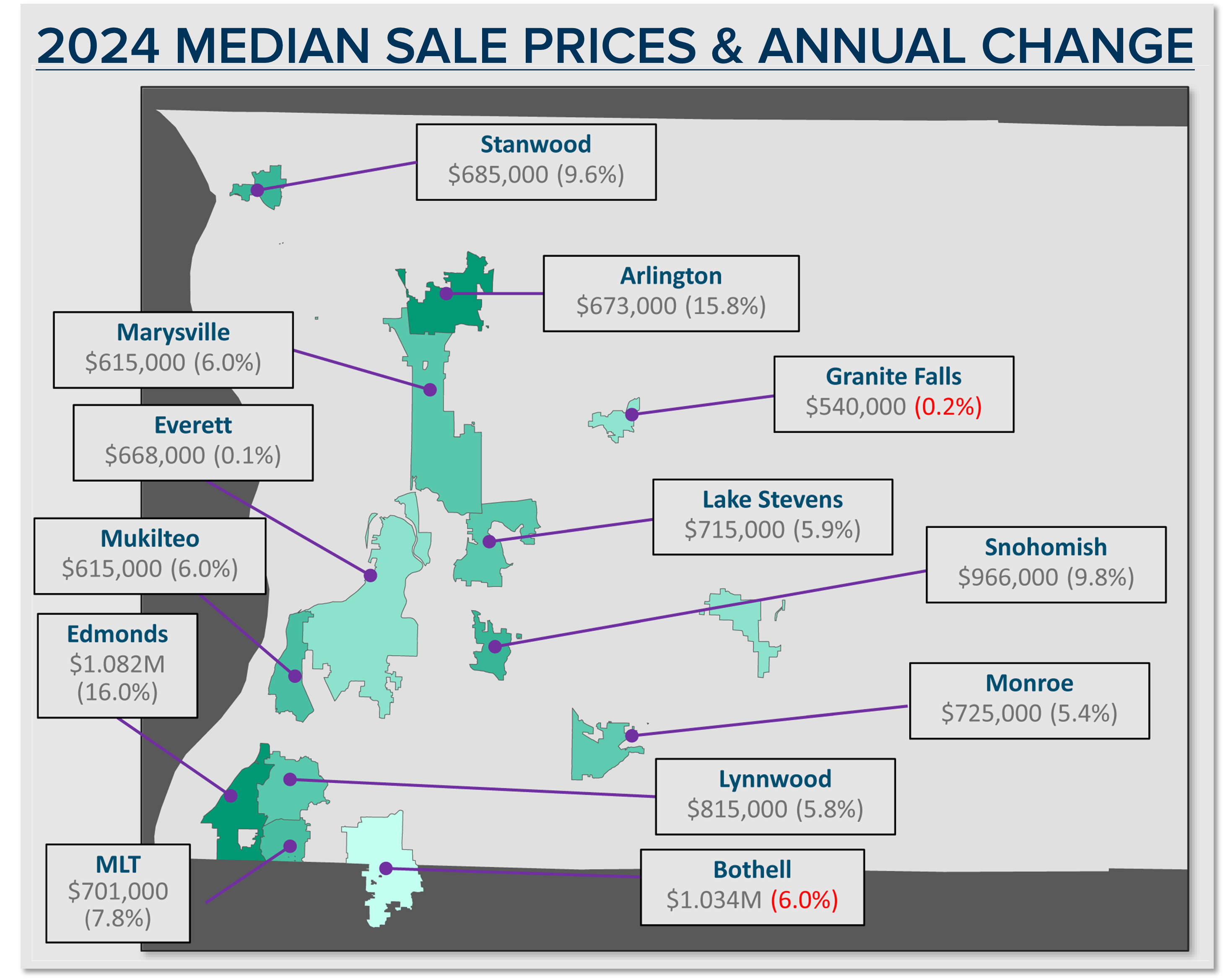

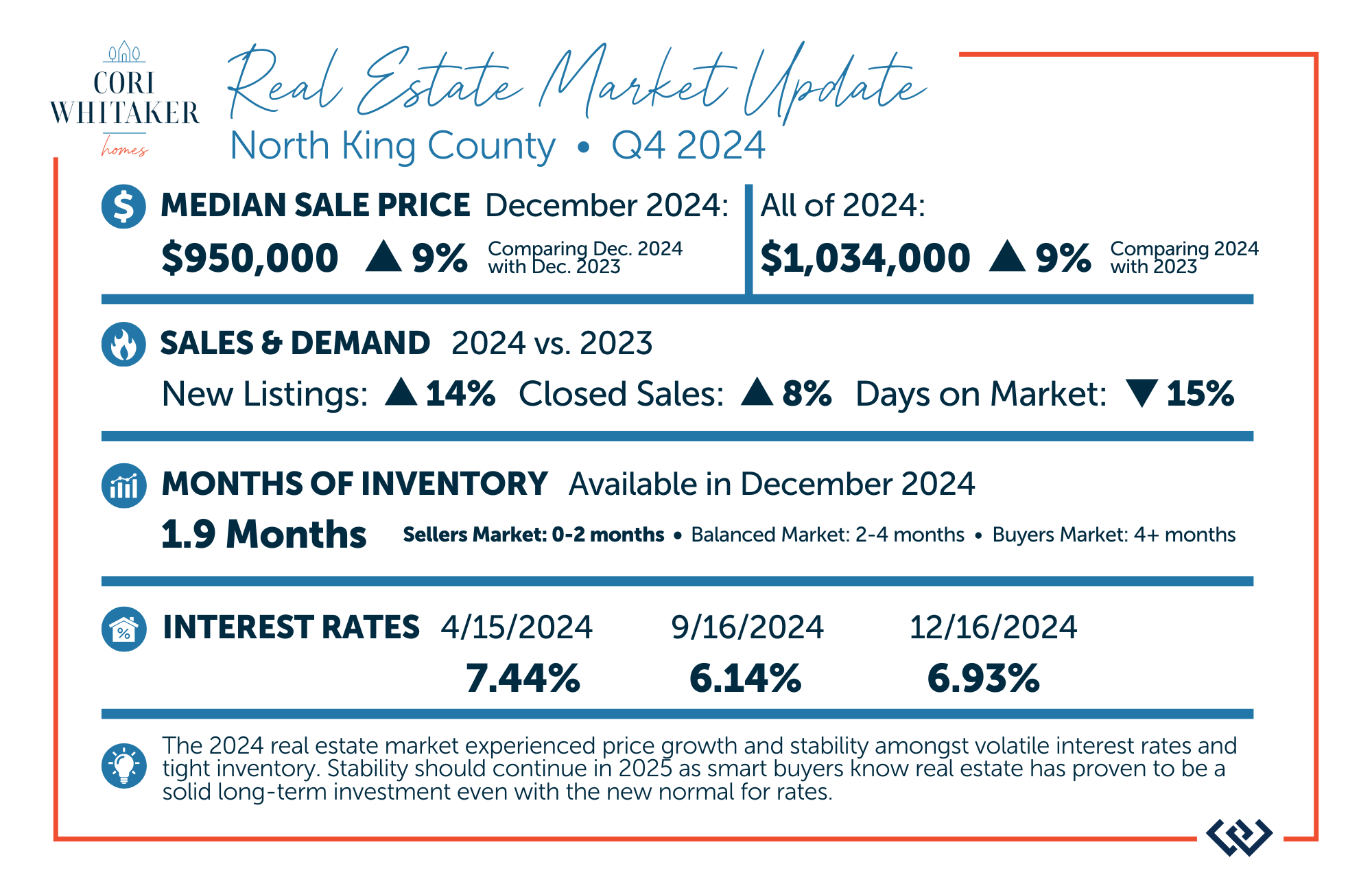

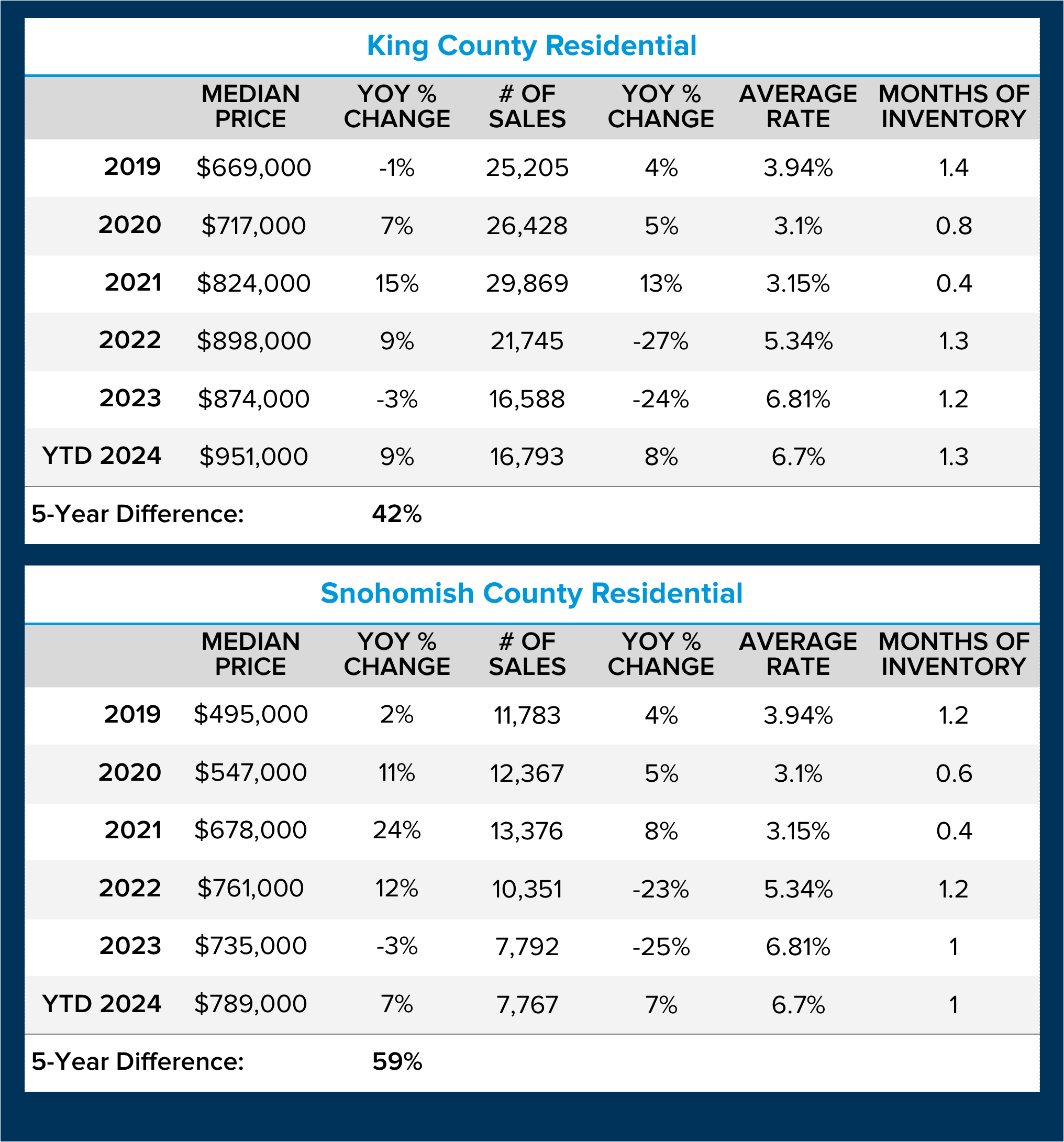

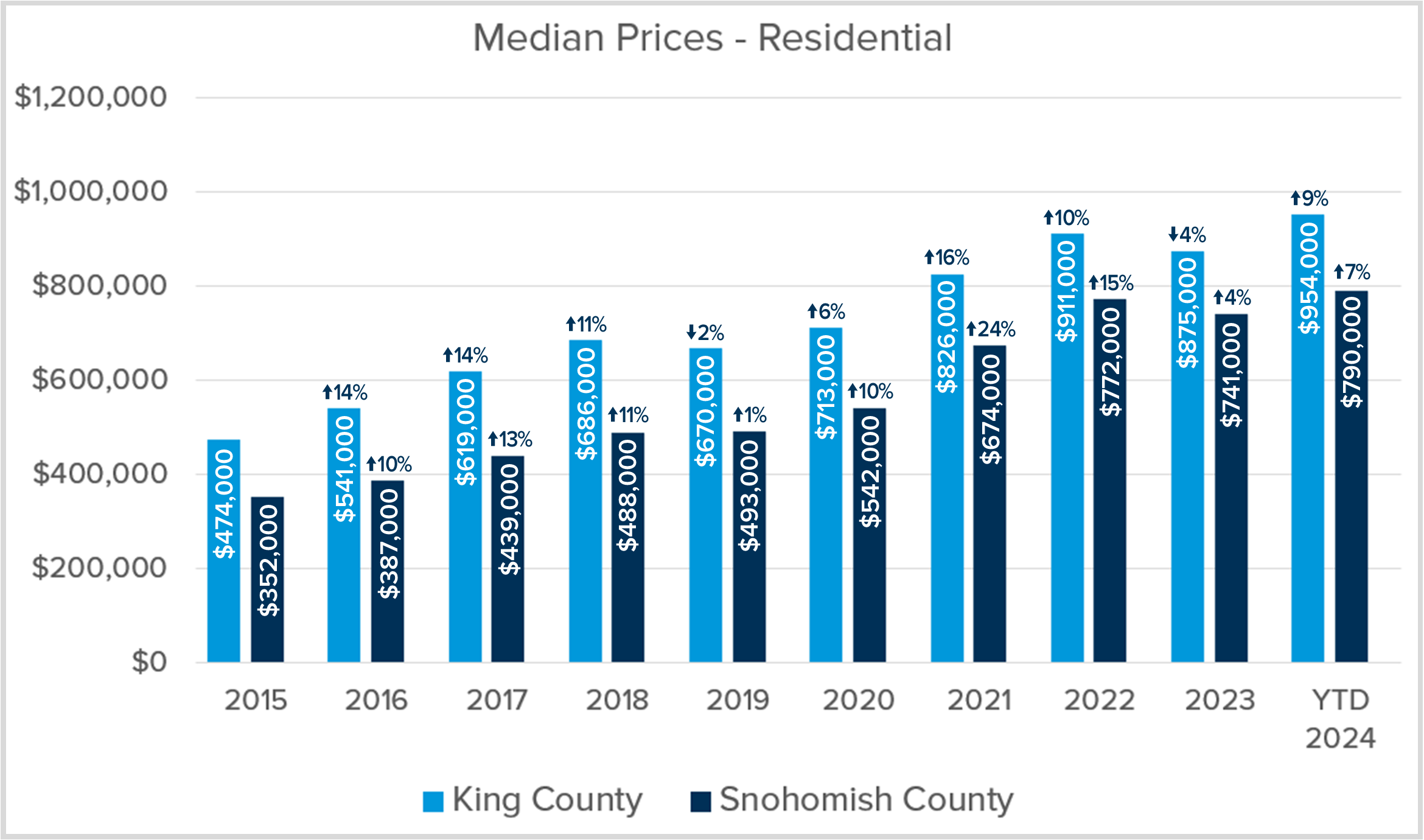

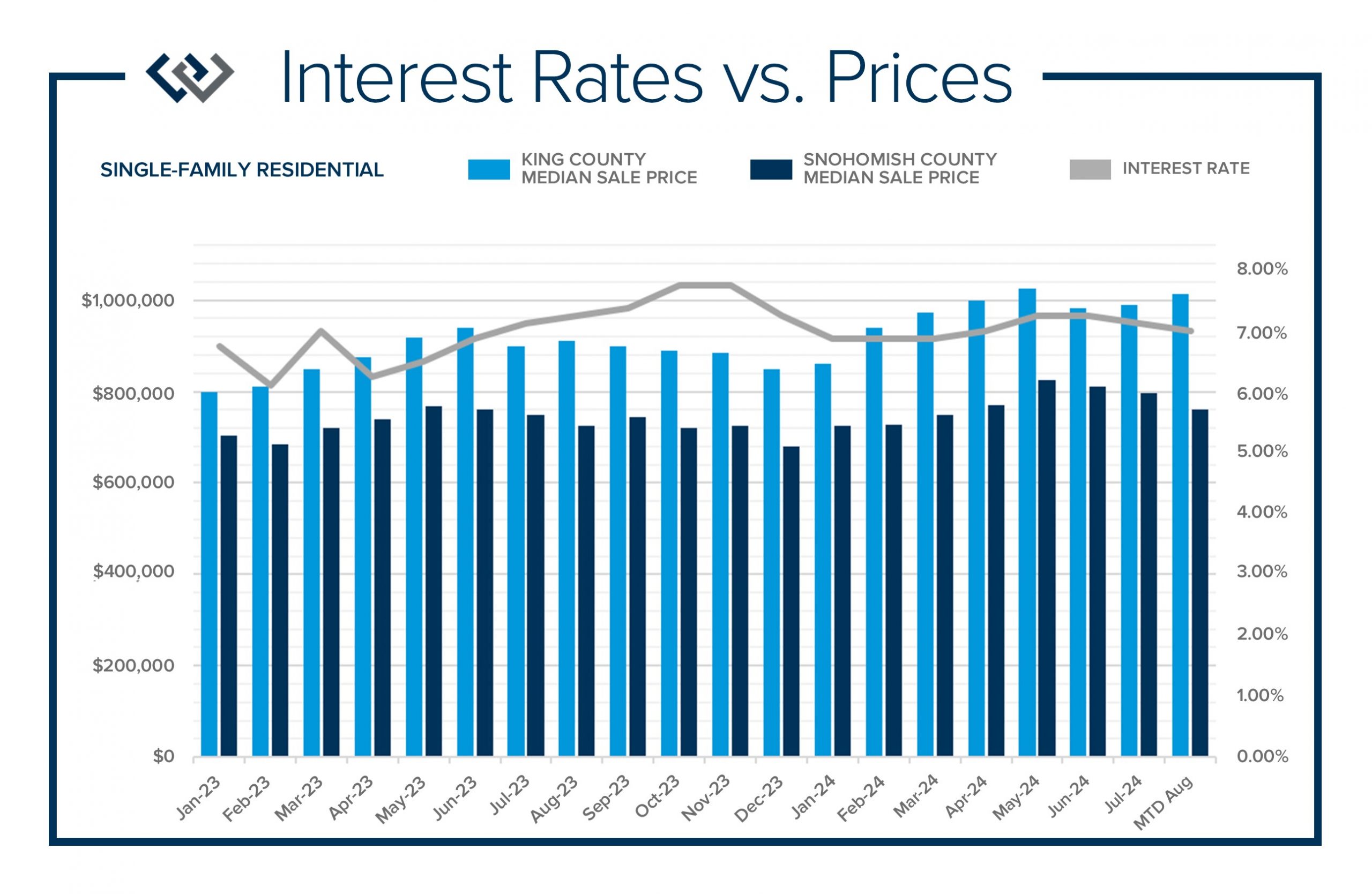

Prices increased in King and Snohomish counties in 2024 and are expected to grow again in 2025 despite stubborn mortgage rates. In King County, inventory was up by 10%, sales were up 12%, and the median price was up 10.7% year-over-year. Price growth is predicted to increase by 4% in 2025, which is higher than the historical national annual average. In Snohomish County, inventory was up by 17%, sales were up 8%, and the median price was up 9.9% year-over-year. Price growth is predicted to increase by 5% in 2025.

Affordability is the biggest challenge. With price growth steady coupled with higher interest rates, monthly payments have grown faster than incomes. This has put first-time homebuyers at a disadvantage in core job center locations. Down payment assistance (gift funds) from family and/or high-paying salaries in the tech, biotech, and big corporate companies have differentiated the ability of some first-time homebuyers compared to others with limited down payment funds and higher debt-to-income ratios.

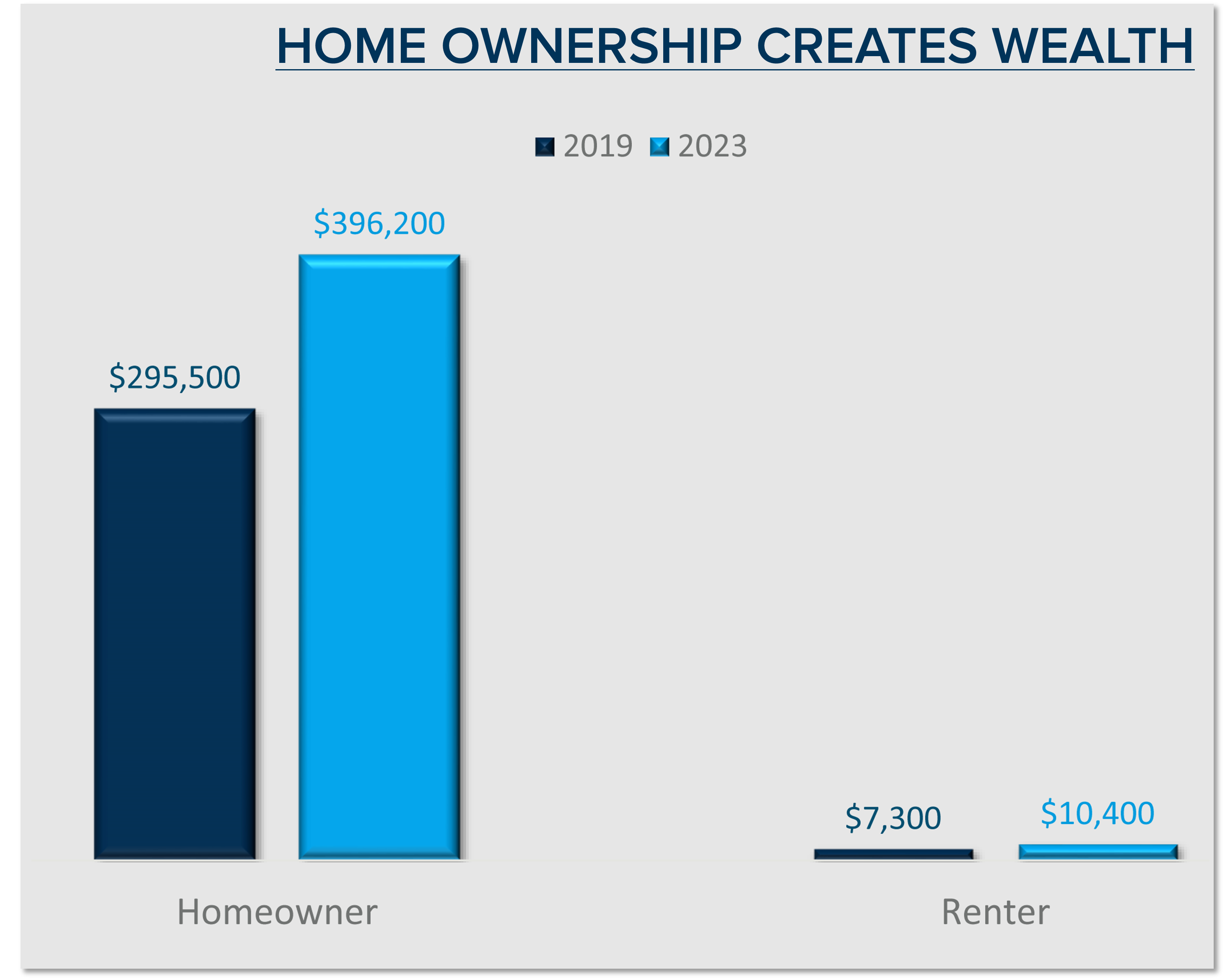

The American Dream is still alive! Homeownership has proven to be one of the strongest hedges against inflation and the single most lucrative wealth-building asset a household can have over time. A key piece of advice for first-time homebuyers would be to do what you can with what you have, which may mean buying a smaller property or going further out in location. Regardless of where one buys, this will put them on the trajectory of building household wealth through real estate and open up an opportunity to upgrade later. In fact, the net worth of a homeowner in 2023 was $396,200 vs. $10,400 of a renter.

This is certainly a lot to absorb as we head into 2025. Stay tuned for even more insights on what we learned from Matthew in my next newsletter. In the meantime, I am here to encourage you and point out that this is a lot of good news. We look forward to more moderate growth in 2025, which is good. Severe increases are not healthy. While we are combating an affordability crisis, the steady wave of moderation on top of incredibly high equity levels should play out to create a stable and fruitful 2025 real estate market.

If you are curious about how all of this relates to your real estate goals, or you know someone that needs some guidance, please reach out. I will continue to keep you well informed so you can make strong decisions.

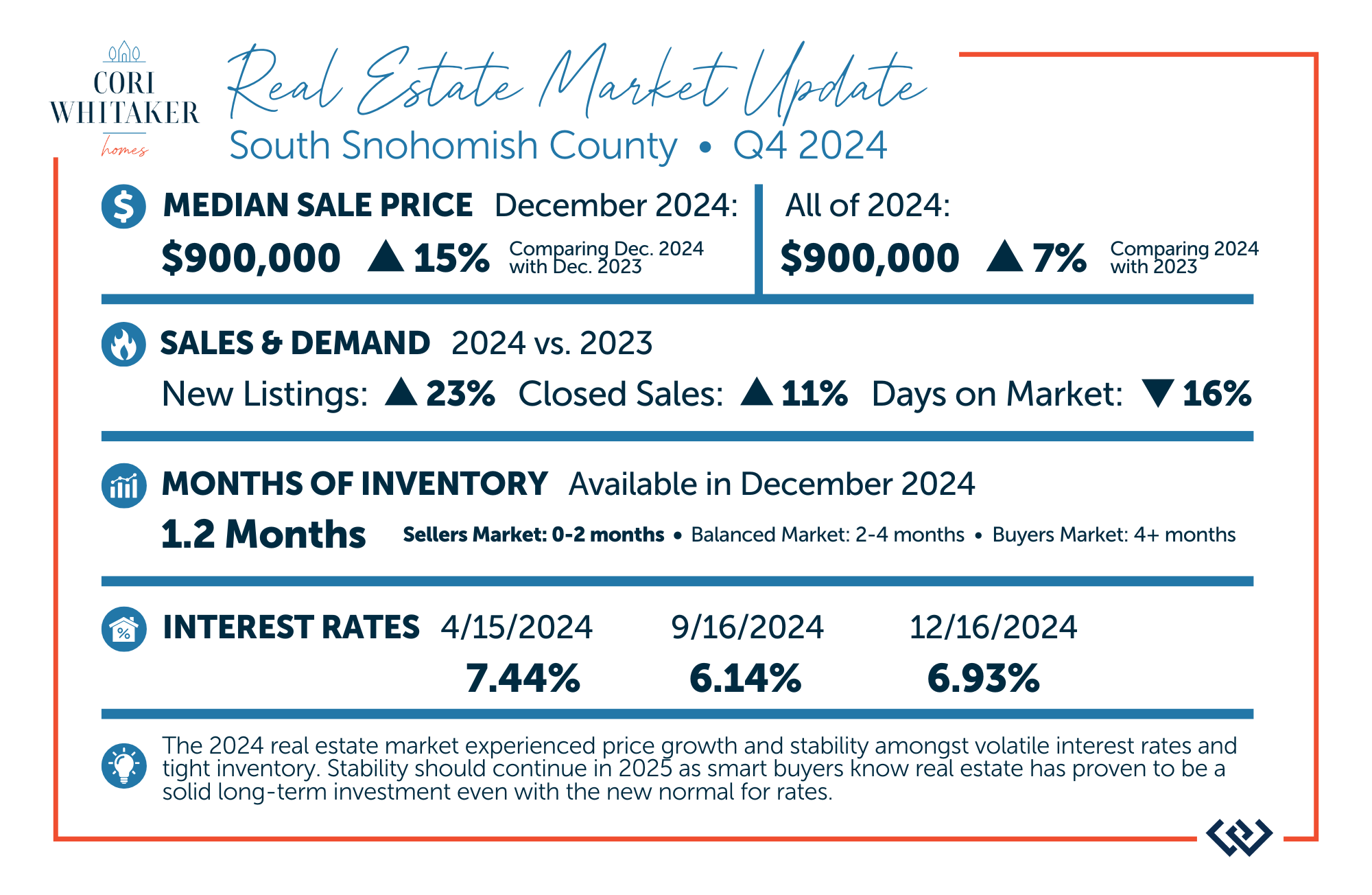

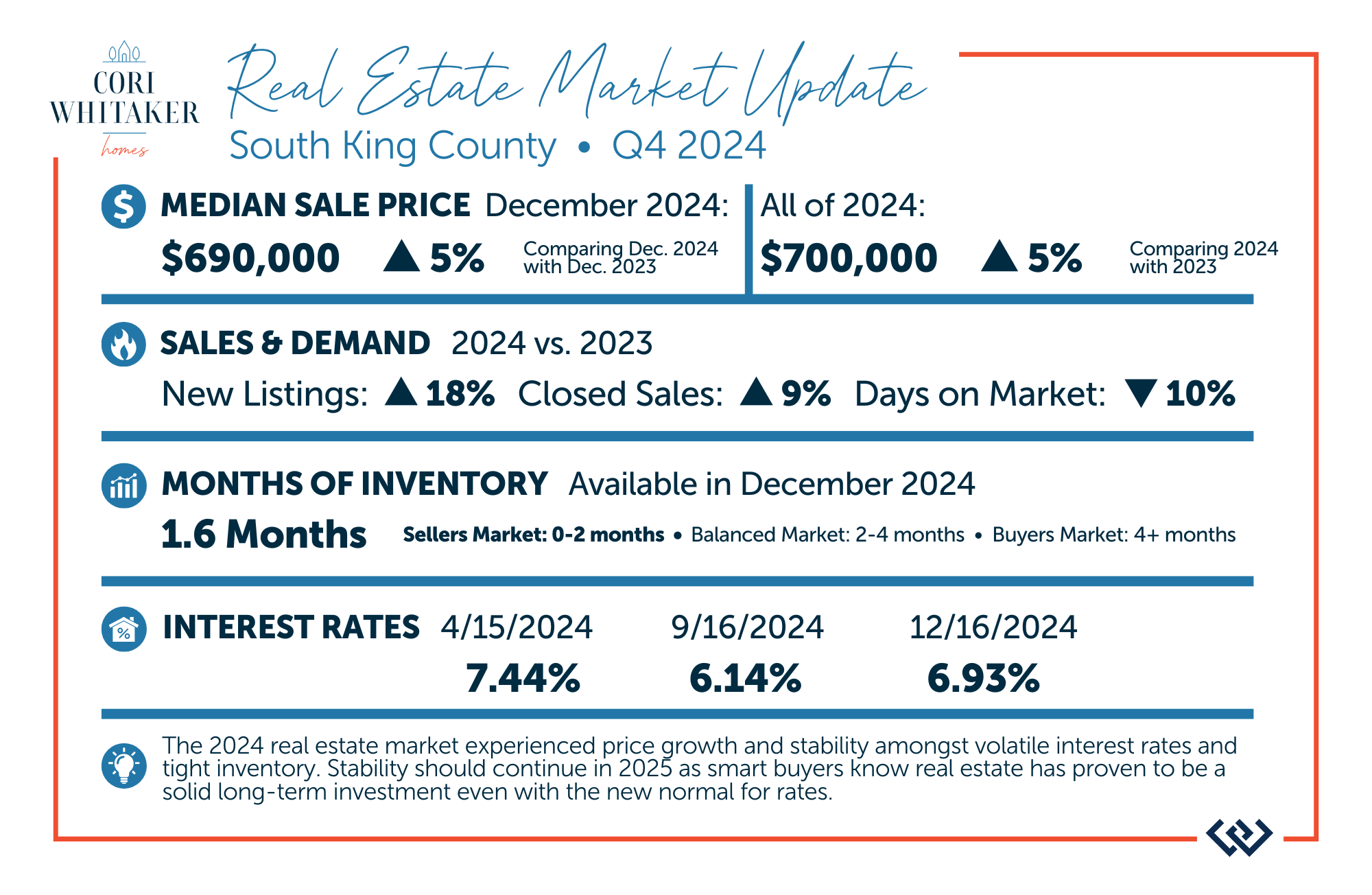

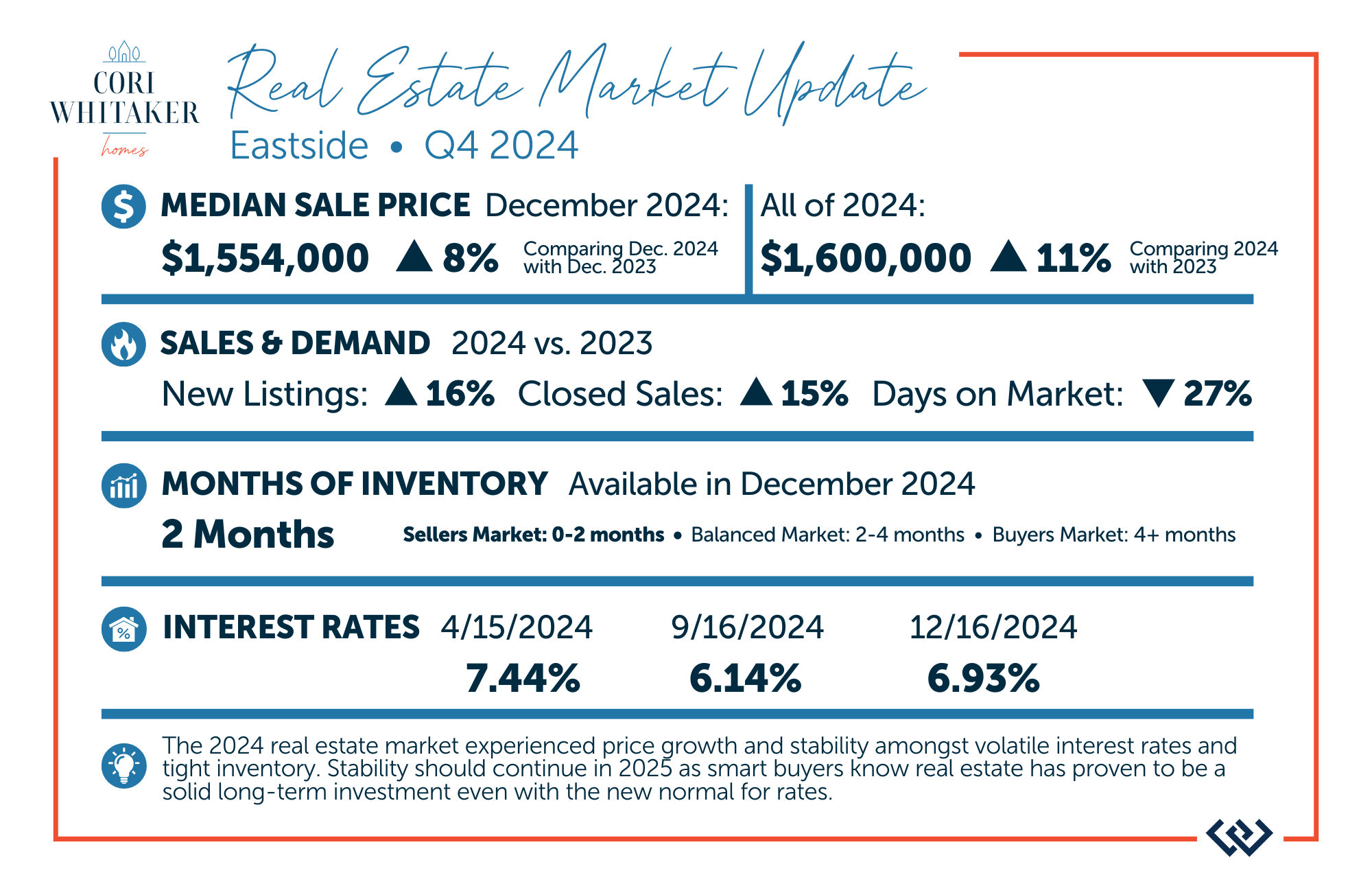

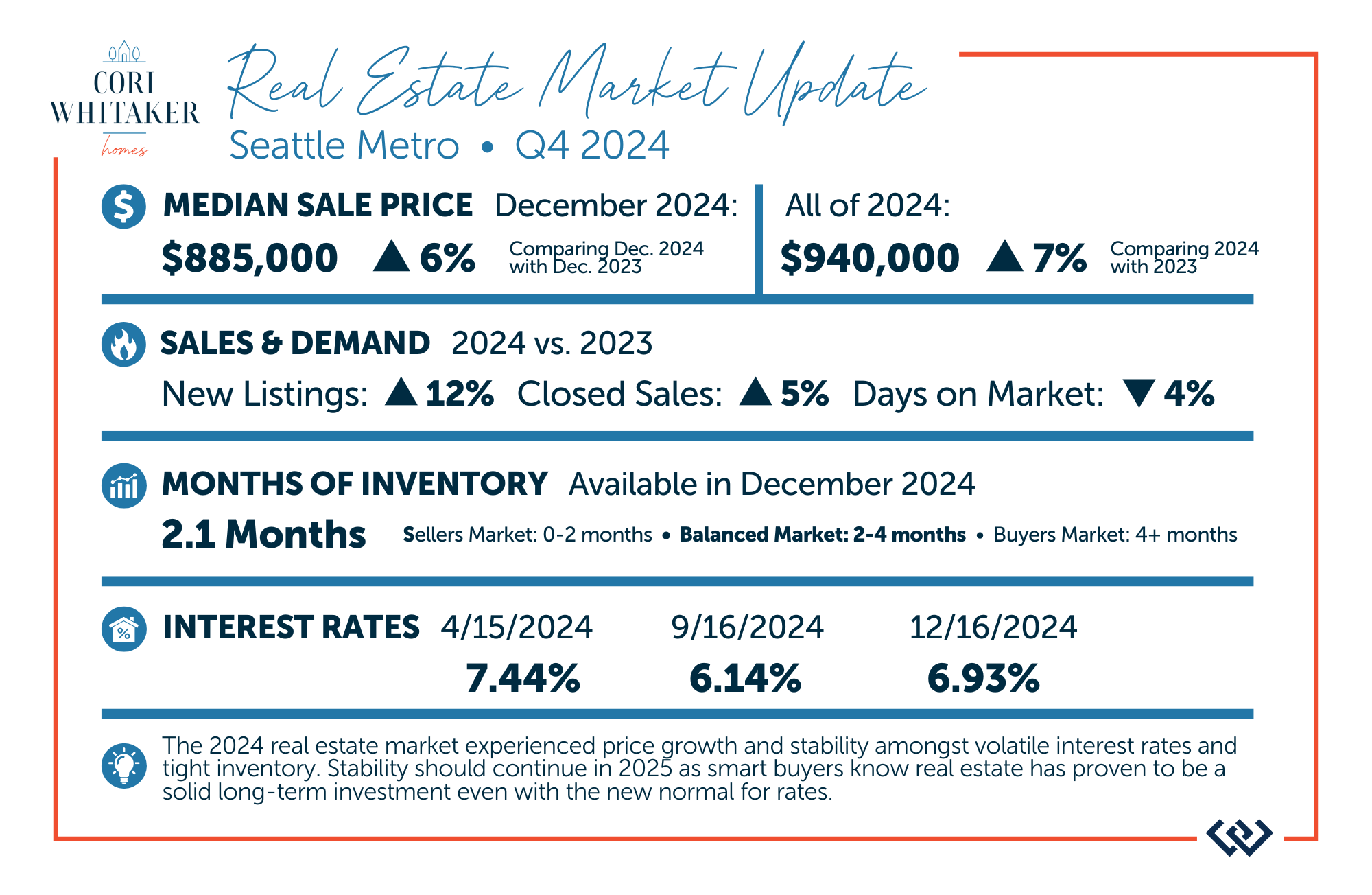

QUARTERLY REPORTS Q4 2024

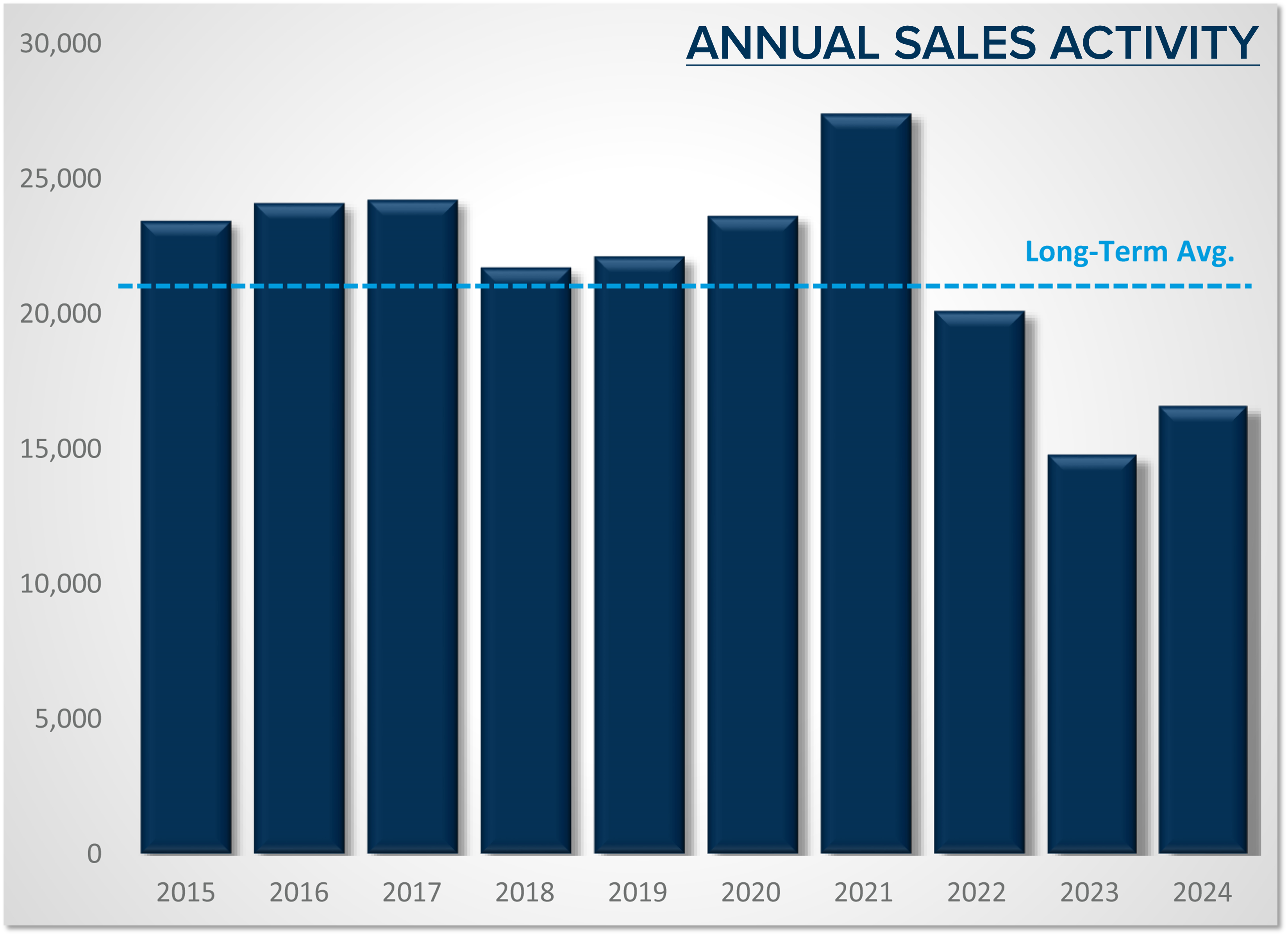

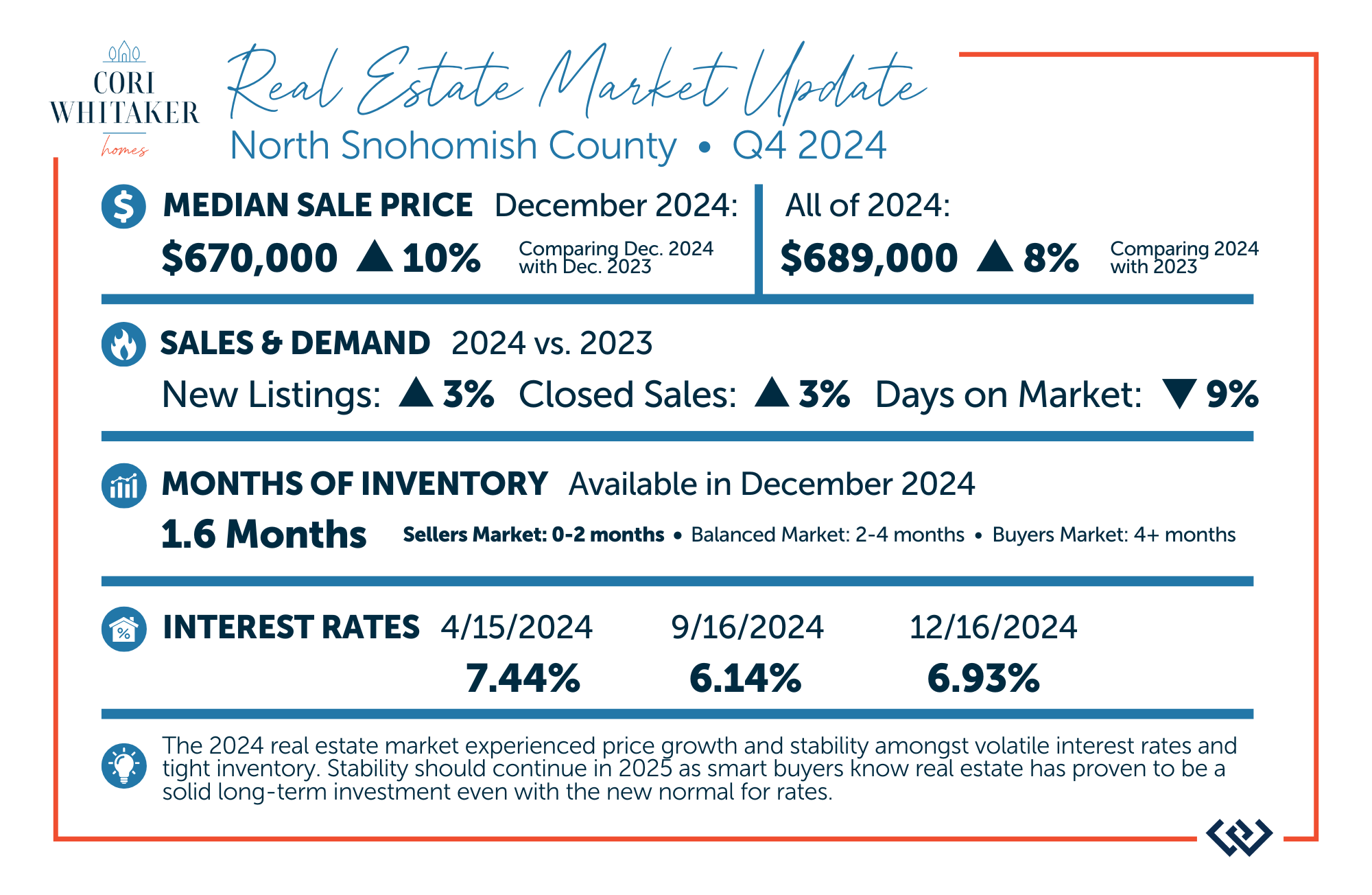

The 2024 real estate market experienced price growth and stability amongst volatile interest rates and tight inventory. There was a welcomed increase in closed sales in 2024 compared to 2023, which recorded the lowest level of closed sales since 2008.

Low inventory levels were driven by the “lock-in effect” from the previous lower interest rates. Price growth over the last decade has been abundantly strong despite a correction in 2018 and 2022. This has provided would-be home sellers the opportunity to reposition their equity and take on a higher rate. We are starting to see more sellers give up their lower rate to move to a home that better fits their lifestyle. This should continue in 2025 as smart buyers know real estate has proven to be a solid long-term investment even with the new normal for rates.

If you are curious about how the trends relate to your real estate goals, please reach out. It is my goal to help keep you well-informed, find opportunities, and empower strong decisions.

A December to Remember

Reflecting on the joy of the holiday season always brings with it gratitude. One of the most important pieces of my business is working with an office that always makes it a priority to come together as a team throughout the year to lift up our neighbors in need and give back to our communities. Our collective gratitude runs deep, and spreading some love and support within our community is the best way we can celebrate everything we are thankful for.

This year our holiday food drive brought in $1,372 and 1,422 pounds of food for Volunteers of America Western Washington food banks. These numbers are all thanks to friends and clients like you. Thank you for your generosity! The current need in our area is high, and our local food banks need all the help they can get.

Next, we had the absolute joy of helping bring some Christmas magic to homeless/housing-insecure youth in our area. We partnered again this year with Washington Kids in Transition, who work with social workers in Edmonds School District schools (includes the communities of Edmonds, Lynnwood, Brier & Mountlake Terrace) to collect wish lists from homeless/housing insecure students living in shelters, tents, cars, transitional housing or other temporary housing and partners with the community to fulfill those wishes. The brokers in my office all came together and we adopted the wish lists of 24 local youth, who would have otherwise gone without this holiday season.

The rest of the year, Washington Kids in Transition provides emergency closets (coats, diapers, toiletries, etc.), hotel vouchers, utility assistance, rental deposits, and recently started a teen mentorship program. This new program is in high demand, but does not yet have reliable funding, so we decided to also raise funds for that as well over the holiday. We raised a total of $3,815 for this new program, which helps teens learn basic life skills as well as have fun activities they otherwise wouldn’t have access to.

Another holiday staple at my office is putting together volunteer groups at Christmas House and also Holly House this year. Both organizations are local non-profits (100% volunteer-run) that provide opportunities for qualifying, low-income parents to select free holiday gifts for their children. This is always an amazing time helping families in need have a joyful Christmas.

You can access any of the links above to learn more about these organizations or to donate yourself. As we head into 2025, our commitment to giving back to the community that we serve will remain a cornerstone of our business. Here’s to a happy, healthy, and heartwarming 2025 and beyond.

Real Estate Year in Review: Looking back at 2024 to look forward to 2025.

As we head into the holidays and mark the final stretch of the year, I wanted to report on the 2024 real estate market and where we might be headed in 2025. To set the stage, I must mention the ride that it has been over the last five years. Since 2019, we have experienced some key market factors that have influenced market activity and prices.

2019 was a year of recovery after the market corrected in 2018 (due to the Seattle Head Tax), and we all know what happened in 2020. The pandemic threw the real estate market into a frothy uptick from mid-2020 to mid-2022, fueled by work-from-home moves and historically low interest rates. Sales counts and price appreciation were ” off the charts,” specifically in 2021. Once interest rates climbed over 5% in the spring of 2022, price appreciation capped, started to correct, and sales declined. Since then, prices have recovered and stabilized, and the sales count has slowly started to increase.

After reviewing the last 10 years of closed sales, we are down about 25% YTD in King County and 30% in Snohomish County from a normal average closed sales rate. This has remained stubborn due to the lock-in effect that the previous low rates have created. For example, many homeowners who purchased or re-financed to obtain a rate of 3-4% are holding tight to their monthly payments. This has caused many people to stay in homes that don’t ideally fit their lifestyle due to wanting to keep the monthly payment and overall affordability.

This has created tight inventory, which has insulated prices and helped the market recover from the 2022 correction. The dance between rates and low inventory is directly related, and despite rates being higher in 2024 than they were in 2022, prices remain strong. A seller’s market is defined by 0-2 months of inventory (if no new homes came to market, we would sell out of homes in this amount of time), a balanced market is 2-4 months, and a buyer’s market is 4+ months. Over the last 5 years, we have primarily been in a seller’s market. This has caused prices to increase by 59% in Snohomish County over the last 5 years and by 42% in King County.

The age-old principle of supply and demand has had the most significant impact on prices despite volatile interest rates. Several experts predict that interest rates will slowly decrease throughout 2025. As you can see from the chart below, we will not return to the historic levels we saw in 2020-2021 (we may never). As would-be sellers contemplate the lock-in effect vs. what they want/need out of their housing and line it up against interest rates, we should see a gradual increase in closed sales in 2025 over 2024. The market is slowly starting to accept this new normal. Also, in some cases, moves cannot be delayed due to life circumstances, and the lock-in effect is not a driver.

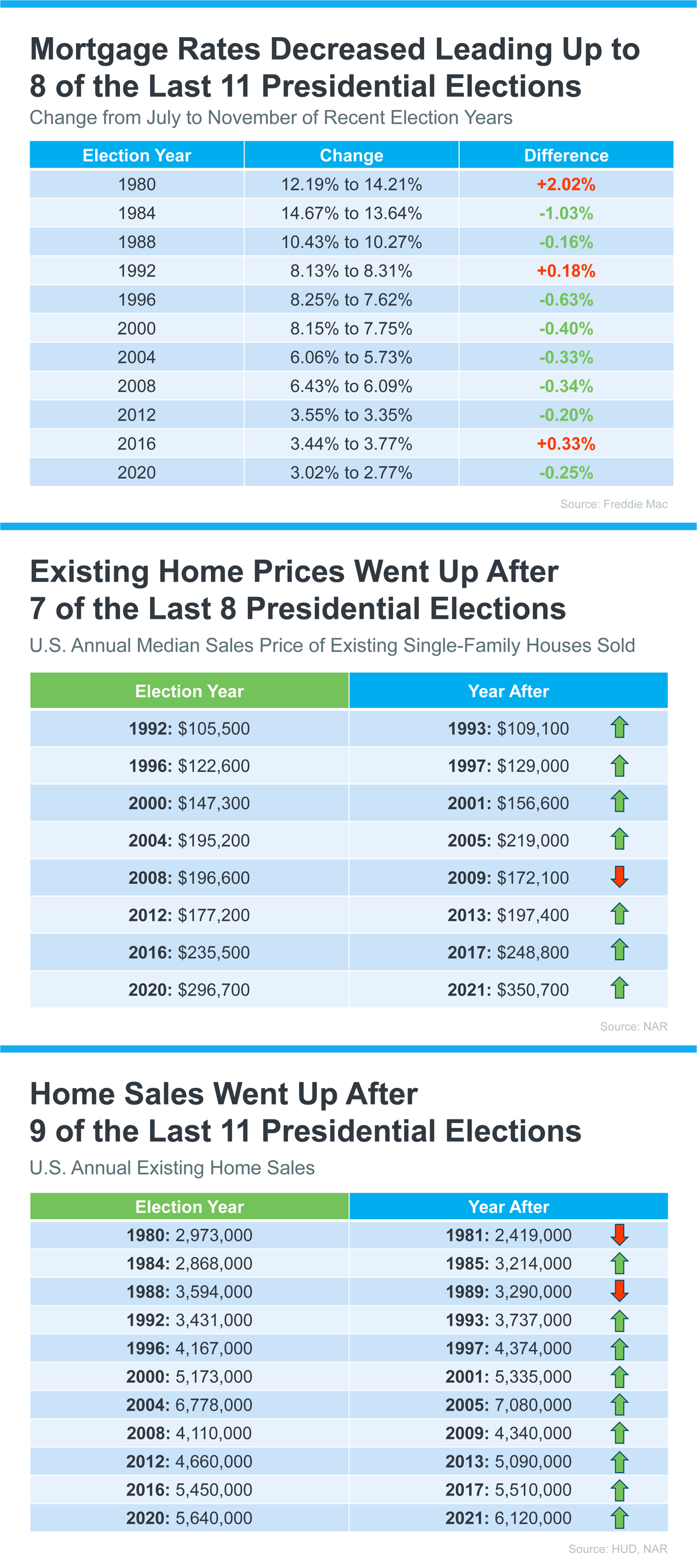

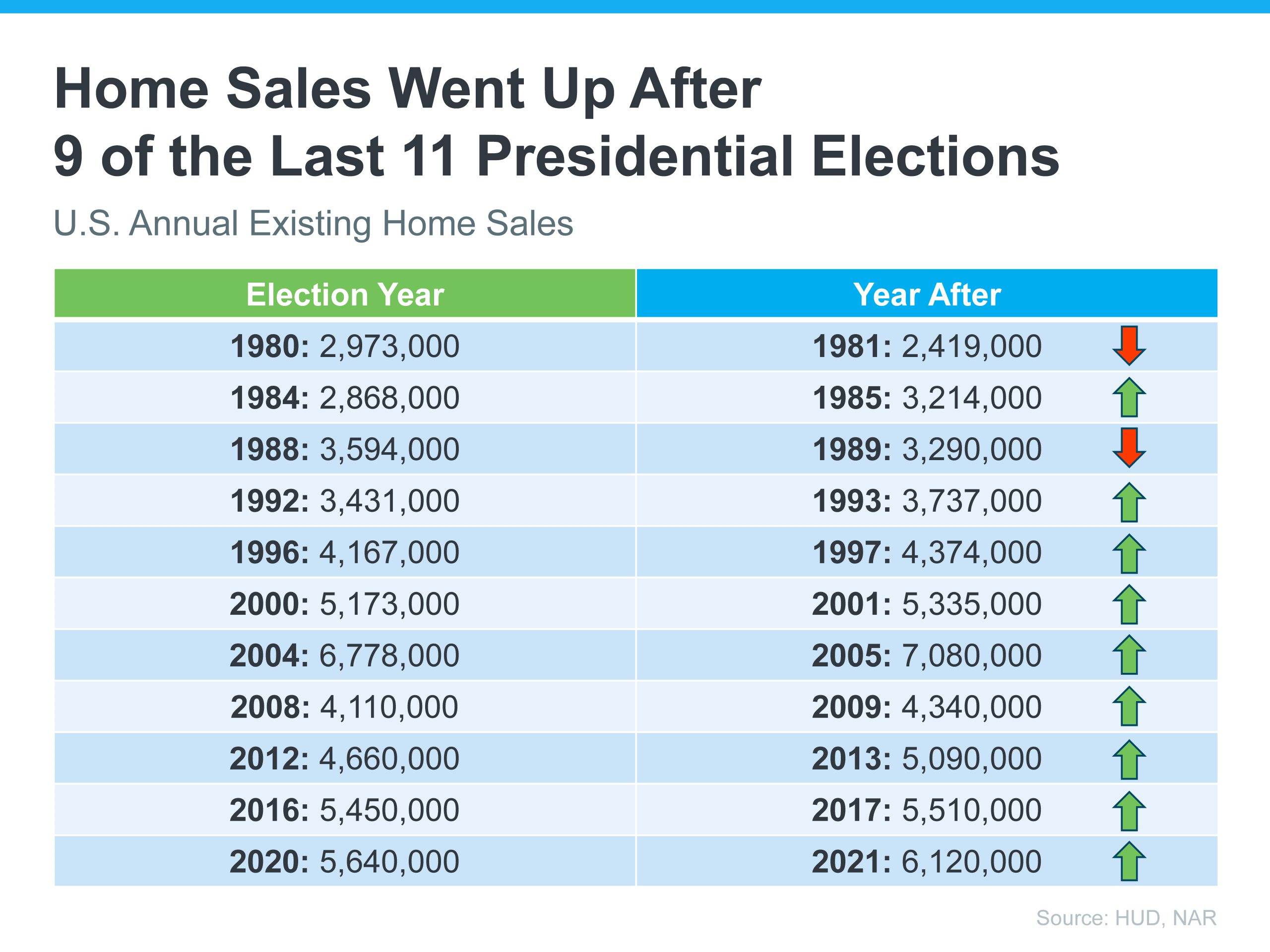

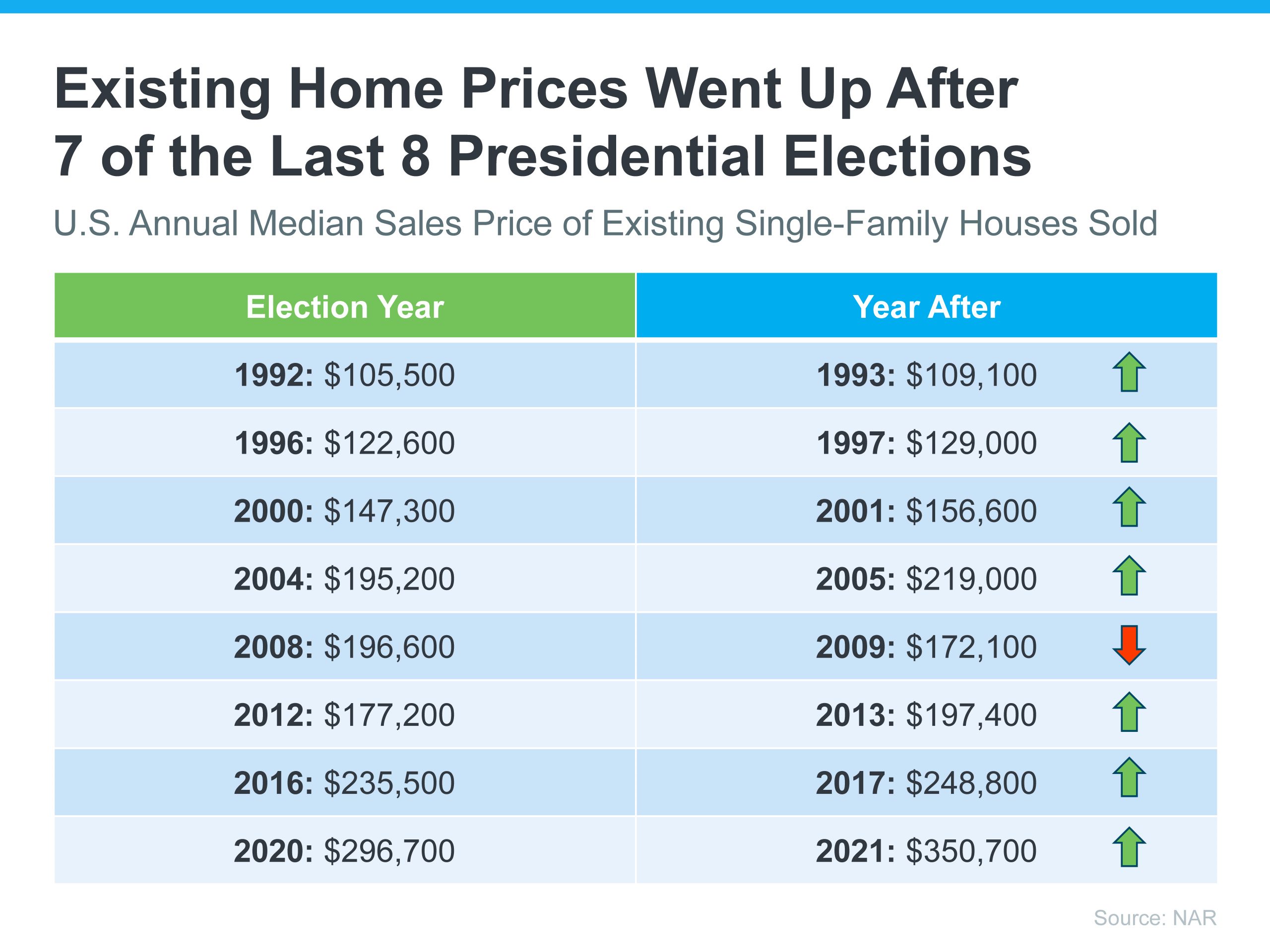

Another aspect to point out is the trends we typically see in post-election years. Historical data indicates increased closed sales, lower interest rates, and price growth. This data, coupled with pent-up seller demand and gradually decreasing interest rates, should drive sales to increase slightly and prices to appreciate and remain stable. Most homeowners are sitting on well-established equity, enabling them to make fluid moves.

If you or someone you know is considering buying, selling, or both, now is a great time to reach out. Executing a purchase and/or sale and a move takes strategic planning to achieve the best outcome. I love helping my clients identify their goals, curate a detailed list of items to create the ideal results, and help guide the process to a successful finish. A new year brings a fresh start, and why not start to verbalize, visualize, and start your planning now, whether your goals are immediate or in the distant future? Please use me as your real estate resource, as my goal is to be your trusted advisor rooted in data and market education.

Risk, Reward, and Starting at Square One: What potential first time homebuyers need to know.

As 2024 starts to come to a close, I want to spend some time talking about first-time homebuyers. Even if you already own a home, this is an important message to share; it can change someone’s life! In 2023, according to the National Association of Realtors (NAR) 2023 Profile of Home Buyers and Sellers, first-time home buyers represented 24% of the market share, which was down from 32% in 2022. First-time homebuyers are a critical part of the real estate market cycle, and we need to empower this group to invest in their future. They are also the audience that purchases inventory, enabling sellers to move on to their next home, which creates a domino effect as it travels up the market.

Often, first-time homebuyers purchase entry-level properties such as condos, townhomes, or smaller single-family residential homes based on affordability. It is also important to note that a buyer does not need a 20% down payment to purchase a home. In fact, according to NAR, the typical down payment for a first-time homebuyer in 2023 was 8%. There are loan programs that only require 3% down payments and even assistance programs requiring zero down. It is important to explore options so one knows their opportunity potential. For example, lenders will often advise borrowers to focus on saving vs. paying down debt in order to better qualify for a loan.

Sometimes, first-time homebuyers are able to skip that first level of home ownership and purchase a home that they plan to be in for many years, yet that is rare. I have found that it is critical that first-time homebuyers are focused on what monthly payment they feel comfortable taking on and commit to shopping at that price point. They then apply that price point to a combination of location, property type, and the condition/features they can afford.

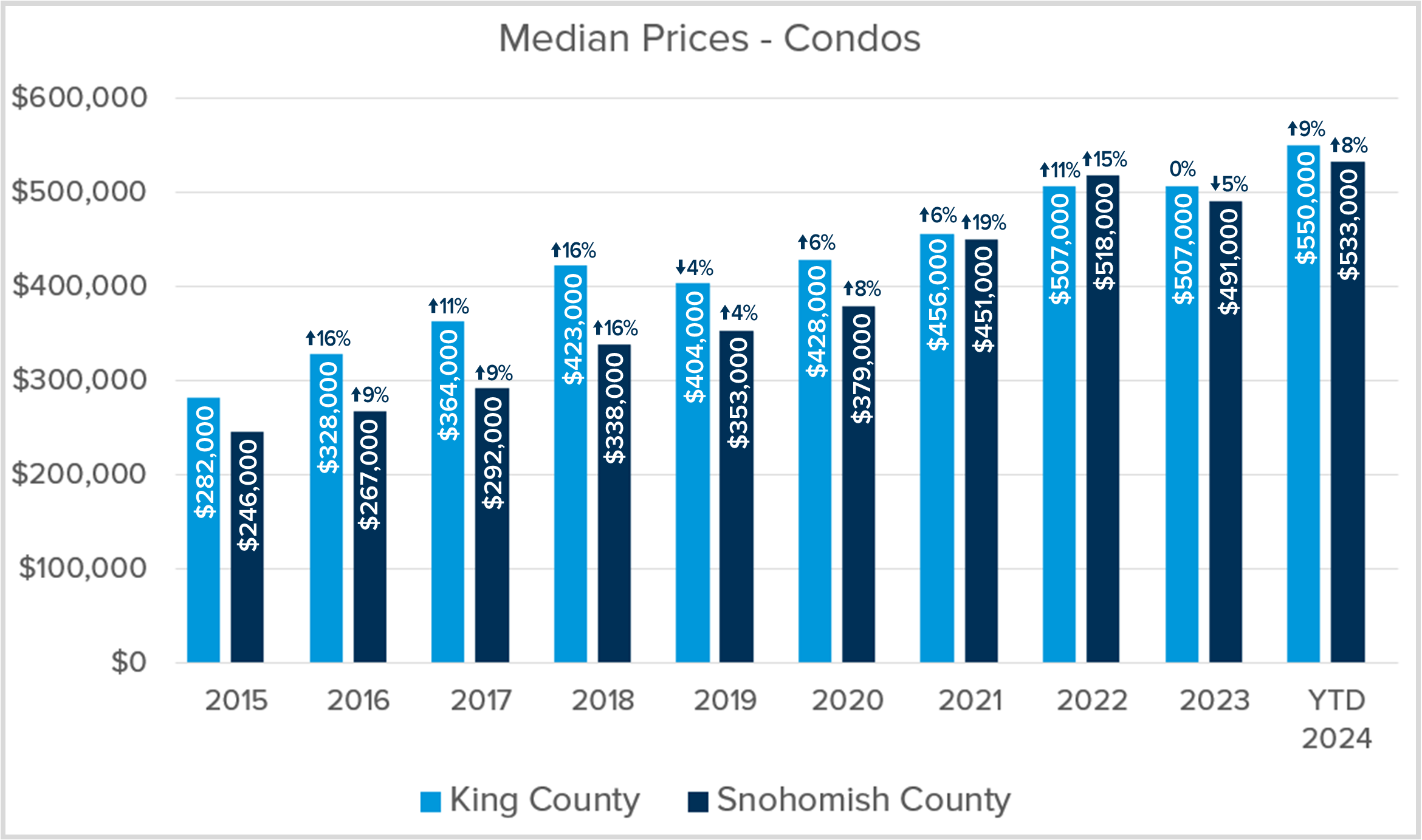

The primary benefit of ditching the rent payment and becoming a first-time homebuyer is getting on the trajectory of building household wealth. As you can see from the charts below, real estate has appreciated in both King and Snohomish counties over the last 10 years, whether it be a condo or a single-family residential property. This appreciation becomes a nest egg of savings for the homeowner over time.

For example, if you use the data from the Snohomish County Condo chart, a first-time homebuyer who bought a condo in 2020, the median price in the market was $379,000. That is now $533,000, which is a 41% gain. Granted, these are raw numbers and represent a 30,000-foot view of the market, which illustrates the trends. We can’t simply apply the percentage growth in the market overall; we would analyze comparable properties in the specific area of the subject property to find the accurate value. The appreciation trend, however, shows that the first-time homebuyer who bought in 2020 is now sitting on a healthy nest egg of savings to utilize to purchase their next home if they desire a different property based on life changes. Plus, there is no other investment vehicle that allows tax-free capital gains up to $500,000.

I point this out because I often encounter would-be first-time homebuyers who call off their search because they cannot afford the type of home or area they want, and continue to rent in the hopes of saving more to afford what they want later. While I would never want anyone to buy a home they don’t want, I do encourage my clients to consider what they can compromise on in order to start building wealth through homeownership sooner rather than later. Even if you apply the home appreciation for condos in Snohomish County prior to the pandemic, the median price in 2015 was $246,000, and four years later, it was $353,000, which is a 44% gain. Most people would not be able to save that much over that period of time, hence the advantage of building wealth via homeownership.

An exercise I often use with my buyer clients is applying the Triangle of Buyer Clarity to their budget and search. I am the first person to say that shopping for a home is exciting and even romantic, which results in starry eyes focused on dream homes and HGTV lore. I find that the quicker a buyer is able to put the dreaming part aside and get to the brass tacks of the market, the quicker they succeed in a purchase. Monthly payment is the single most important element to focus on to bring clarity to a buyer’s search. This figure should direct the price range for a buyer, which will determine which location, condition/features, and property type they can afford.

As you can see from the example of the Triangle of Buyer Clarity, buyers often have to adapt their search to meet their budget needs; it is rarely the perfect balance of an equilateral triangle. That could mean adapting by buying a townhome instead of a single-family home, going to a location that is a little further out, or being OK with a 90’s kitchen instead of a perfectly modern masterpiece. Getting into the market is more important than finding the perfect fit. The good news is that market trends show that townhomes, all locations throughout each county, and even 90’s kitchens appreciate! One could even tap into their equity down the road once it is built up and remodel that 90’s kitchen.

Homeownership provides many benefits. Wealth-building opportunities are huge because we all need a place to live, so why not pay your own mortgage and gain appreciation instead of building your landlord’s portfolio? There are tax benefits, too, as you can use the interest as a write-off. Plus, you get the freedom to make your house your own and build a community where you live. You can paint the walls and dig in the dirt, and you don’t have to answer to your landlord. Overall, homeownership provides stability, freedom, and community. Helping my clients gain tangible and intangible benefits is the primary goal I work towards.

This is why I couldn’t let 2024 end without giving a shout-out to the would-be first-time homebuyers out there. My best piece of advice if you are considering buying your first home is to come up with a plan. I offer all of my clients a buyer consultation meeting where we review the market trends, apply their goals and search criteria, get them connected with a reputable lender, and devise a custom plan for them. The plan could start right away or sometime in the future; what matters is working towards the goal.

My mission is to help people gain the benefits of homeownership when they are ready. When I hand off the keys to a first-time homebuyer, it is one of the most rewarding aspects of my job because I know we have changed their lives for the better. If you are a potential first-time buyer or know someone who is, please reach out, I’d be honored to help.

What is your home worth, and why do you want to know?

Your home is not only your shelter and a place to create memories, but a large part of your financial nest egg and a vehicle for creating wealth. Knowing what your home is worth is important. You may need to update your insurance, do some estate/tax/financial planning or prepare for a re-finance, line of credit or a remodel. Or, perhaps you are considering a move down the road and need to know what you will net for planning purposes. Relying on accurate home valuations is critical for all these endeavors.

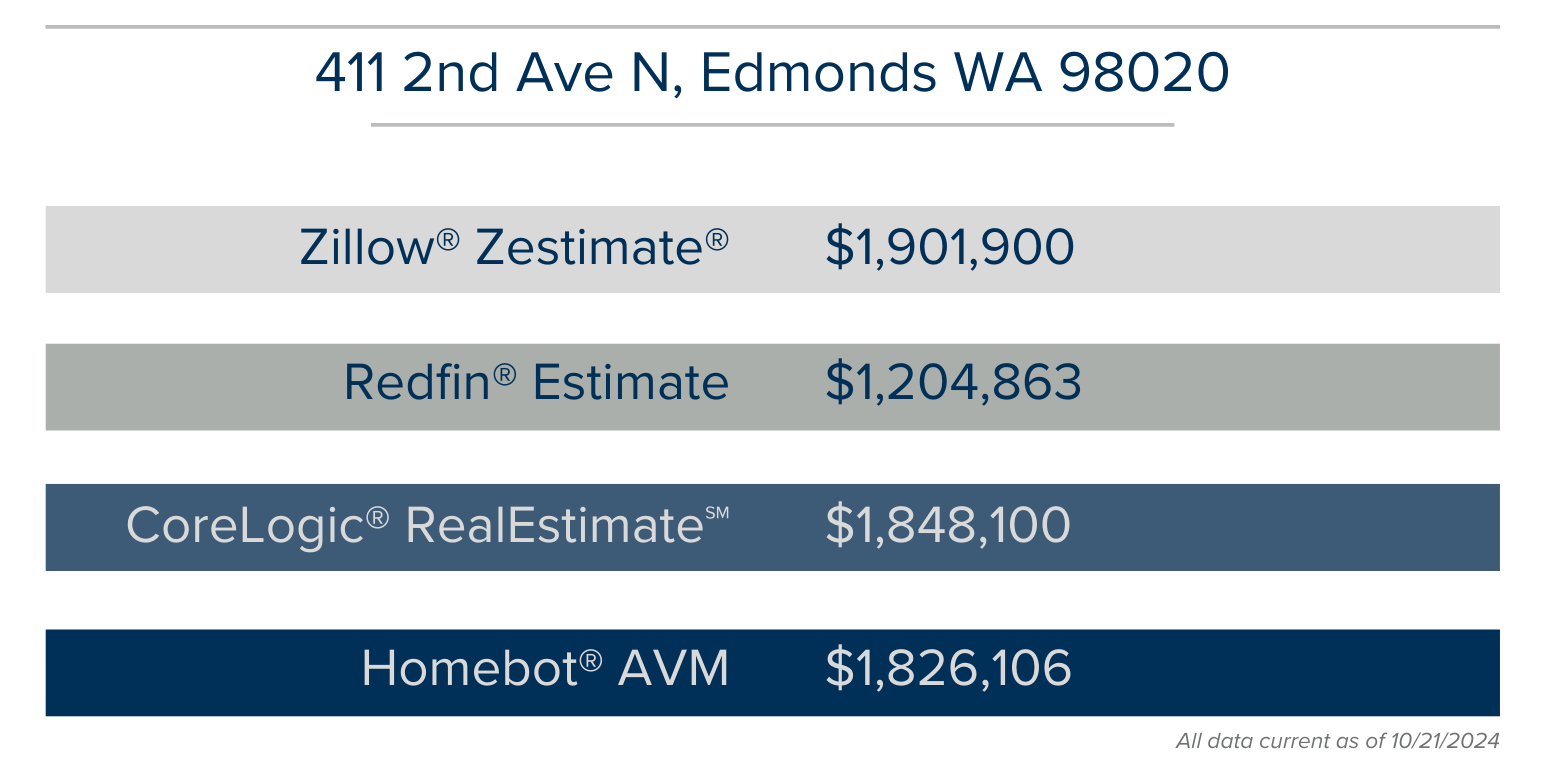

To estimate your home’s value, you can easily access a public website that will produce a value. This is called an AVM (Automated Valuation Model). There are a handful of AVMs such as Zillow, Redfin, and RealEstimate. These sites are free for the consumer and are based on a AI-generated algorithm that is typically a recipe of tax assessment data, CPI figures, market trend data, computer-picked comparable properties, and user-submitted data. They do not take into consideration important value points such as the condition of your home, improvements you’ve made, or nuances of the neighborhood; factors that only an actual person can evaluate.

It is important to note that on all three of these free sites, the algorithm and AVM tool are funded by the advertisers on the site, which are real estate brokers and lenders who want your business. The AVM is the carrot to get you in front of these high-paying advertisers who hope you click to connect so they can convert you into their real estate client. This is unlike the relationship-based business that I foster. AVMs are an OK starting point, but should not be considered the final word.

Here are the current AVM (Automated Valuation Model) values for a subject home from four sources (3 free and 1 fee-based). As you can see, the values vary. If you have a need to know the value of your home, don’t rely on an algorithm. According to Zillow, their accuracy varies by 7.49%; that is a huge swing! For example, that is $75,000, either high or low, for a $1M home. Depending on what you are planning for, that inaccuracy can severely cost you.

The AVMs above vary by 58%. If you apply the average Zillow accuracy percentage, the Zestimate® above could be off by $143,000 or more. It is important in this new world of AI that we do not underestimate the power of the human algorithm. An experienced Realtor with local expertise is the key ingredient for establishing a home’s true value.

Just as the AVMs vary, Realtors vary substantially as well. Seek out a full time professional (like me!) when it comes to receiving guidance on your largest asset and be careful about Realtors who engage part-time as a side hustle or have little or no experience. One mistake could cost you substantially!

Please reach out if you are interested in having me tour your home and complete a reliable Comparative Market Analysis (CMA) so you can plan for your future with confidence.

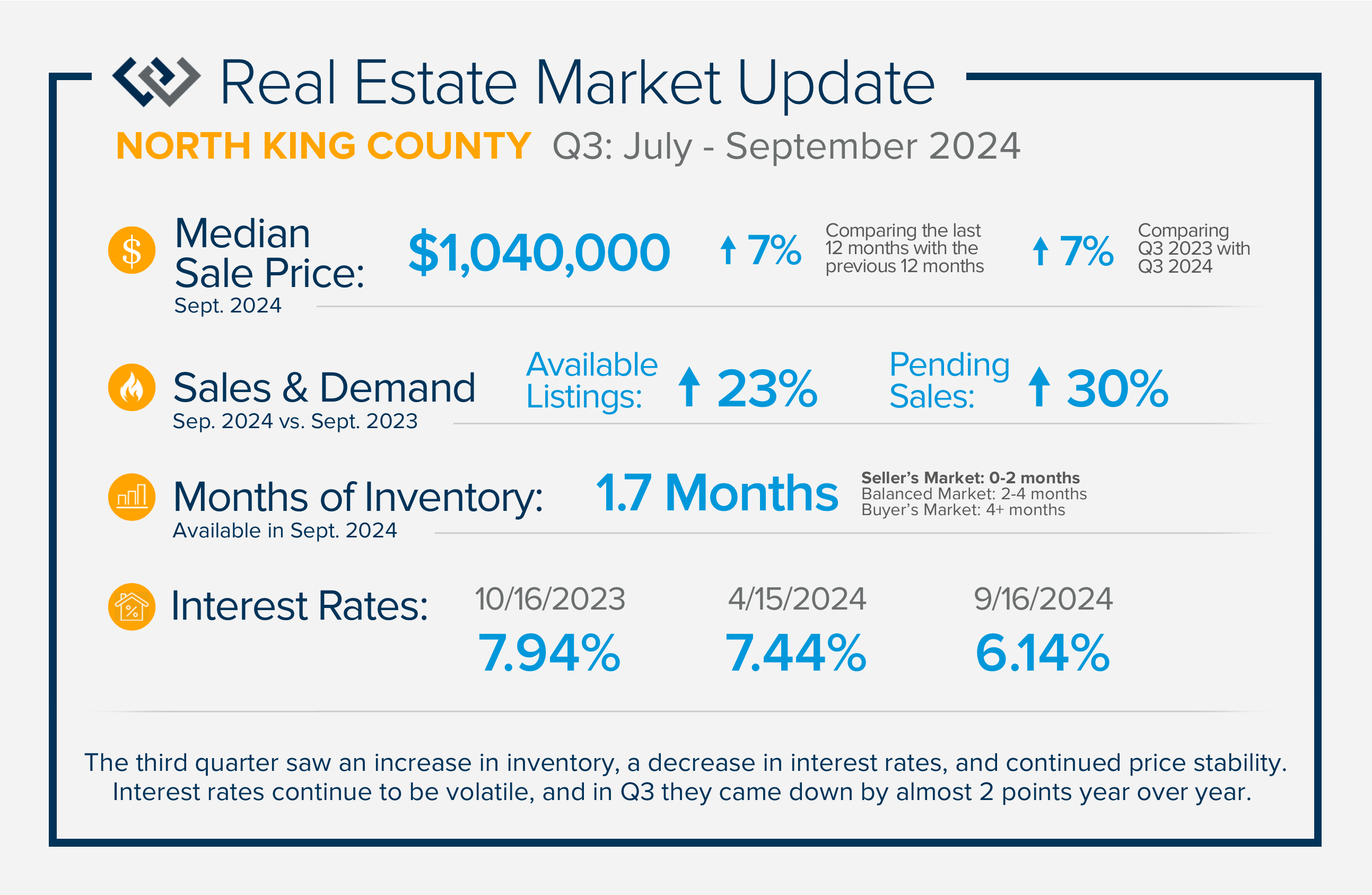

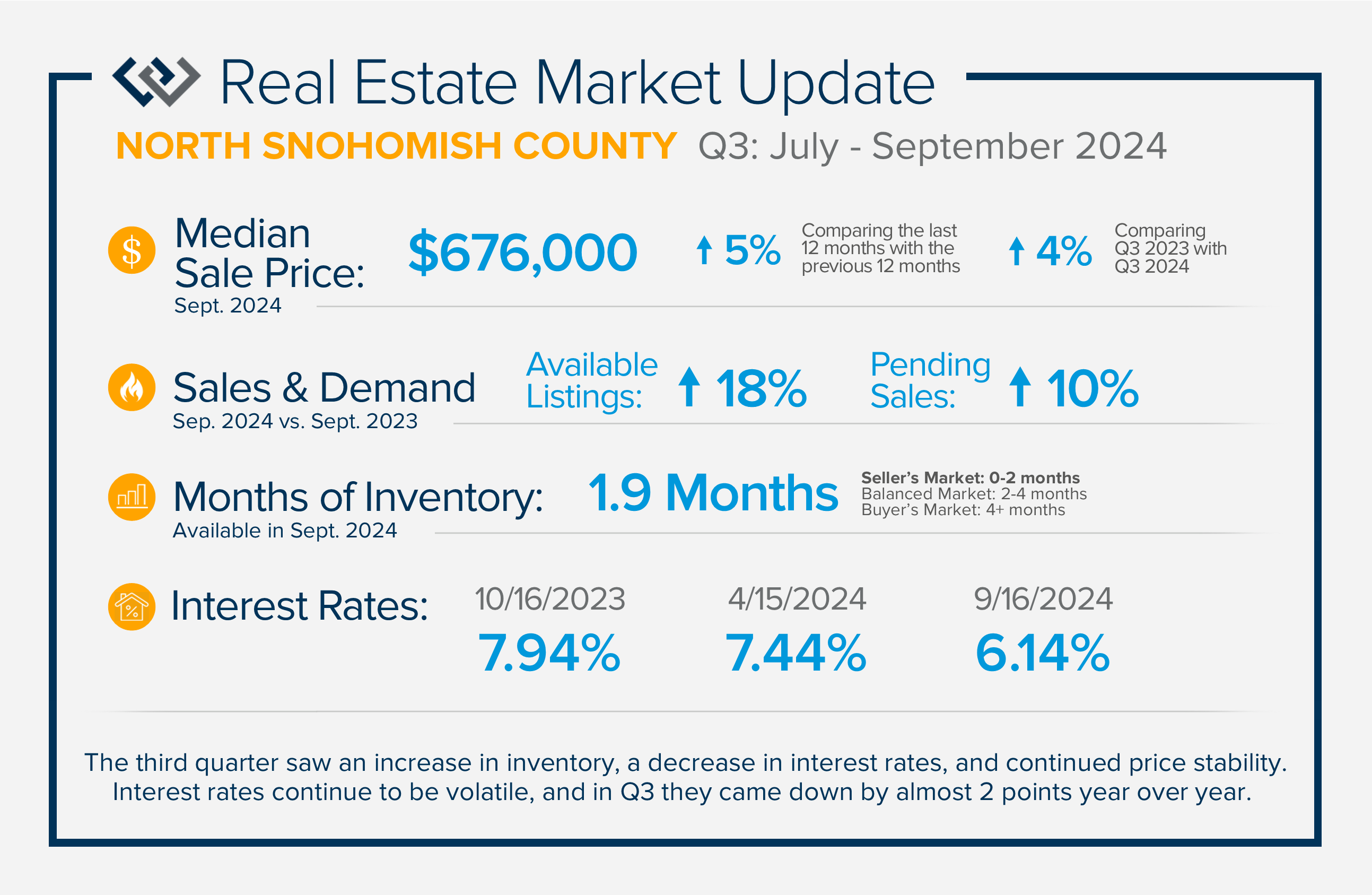

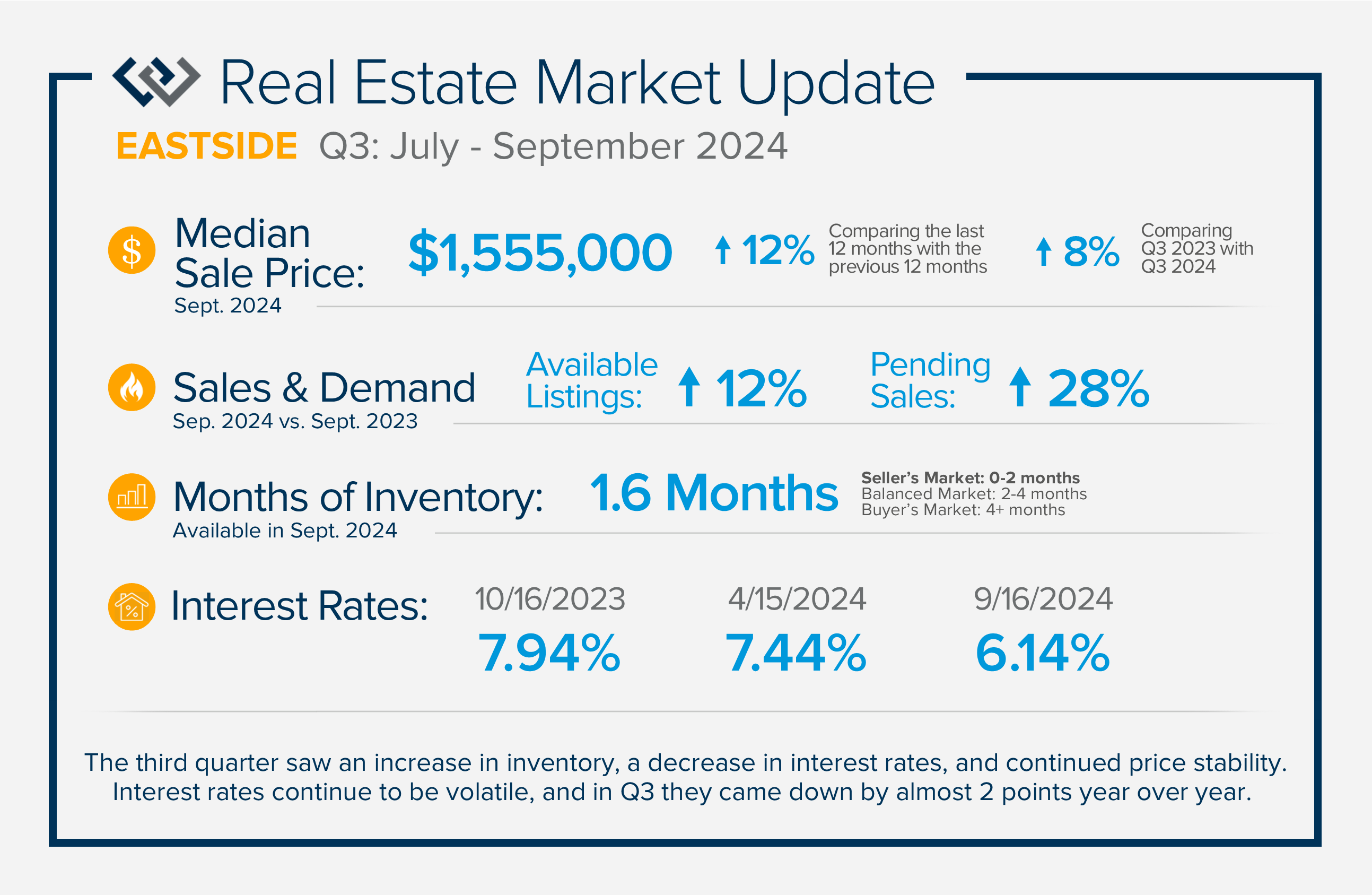

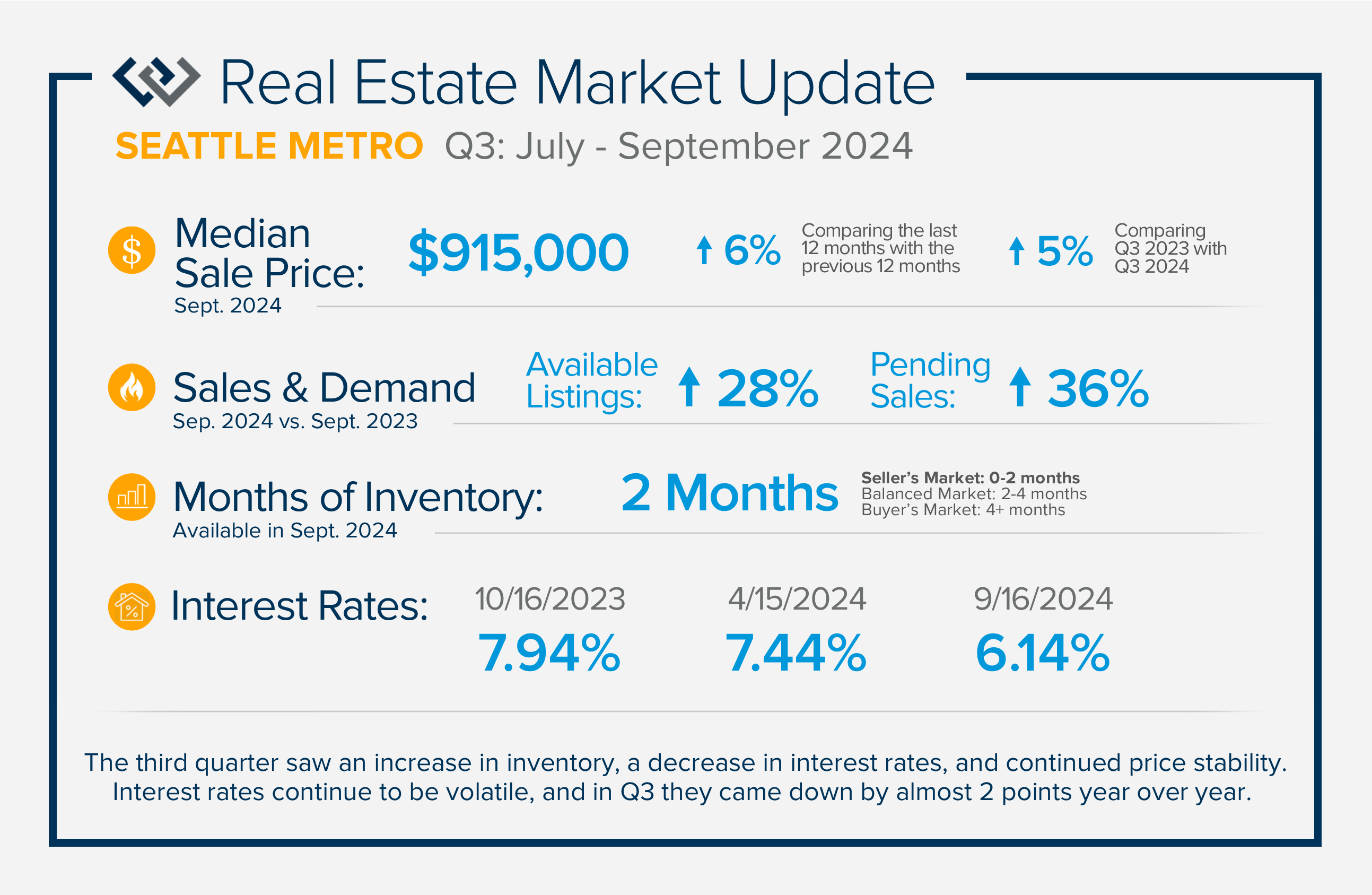

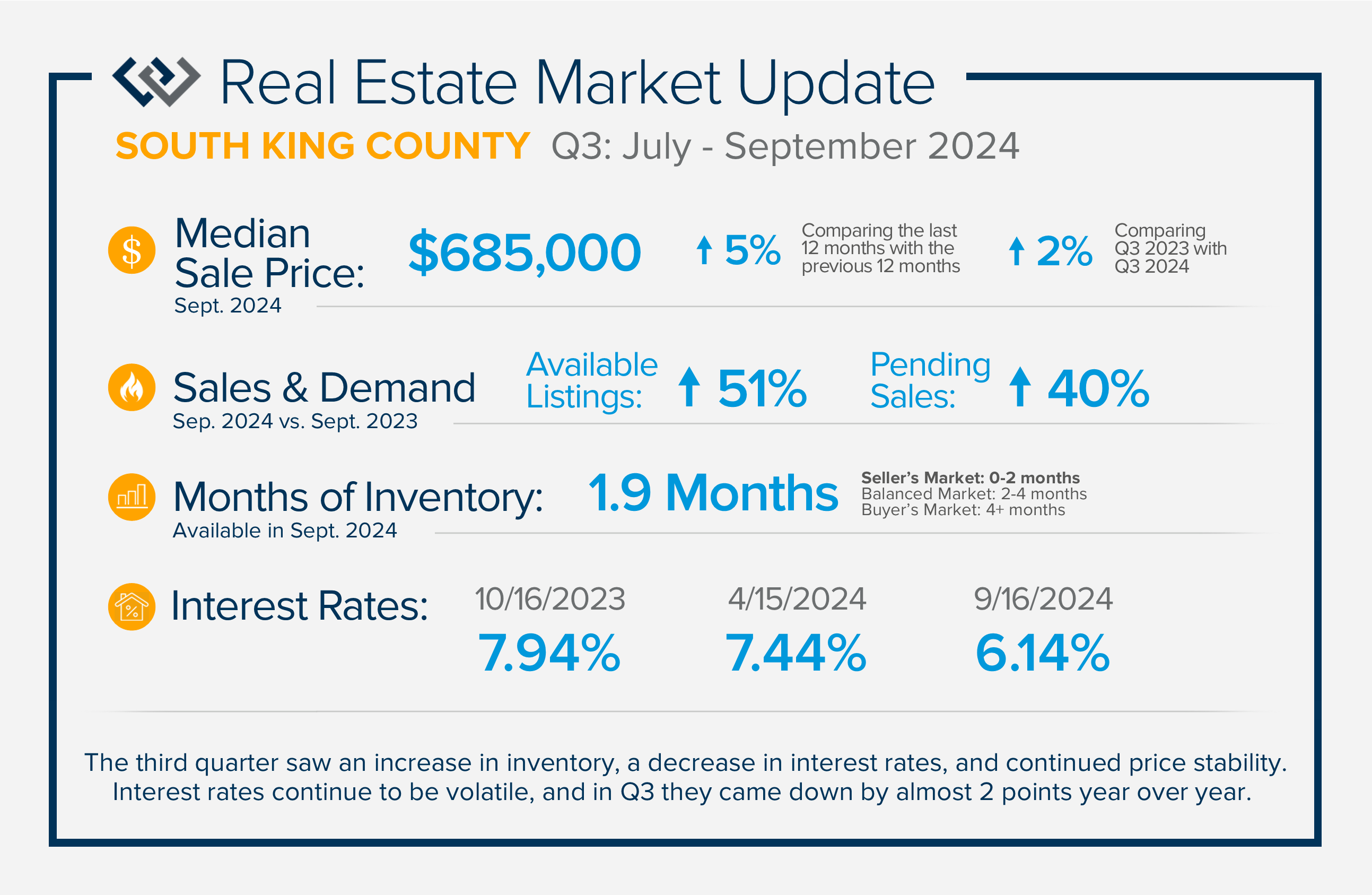

QUARTERLY REPORTS Q3 2024

The third quarter saw an increase in inventory, a decrease in interest rates, and continued price stability. Interest rates continue to be volatile, and in Q3 they came down by almost 2 points year over year. This caused more buyers to enter the market and pending sales to rise. The number of available listings has improved after a very tight start to the year. Some sellers have been willing to forego their previous low rates for a new house, creating more movement in the market. The combination of lower rates and more selection should have buyers excited to make a move. Equity levels remain strong in our region as prices have remained steady and appreciated year over year.

If you are curious about how market conditions affect you, please reach out. I aim to educate my clients to empower strong decisions.

Interest Rates Falling & Inventory Rising: Opportunity Knocks!

As we celebrate the start of autumn, the season of change, the leaves on the trees are not the only things that are falling. Interest rates have gradually fallen throughout the year. Just 11 months ago, rates were almost 2 points higher; in the frothy spring market, they were nearly 1.5 points higher. During this same time, the median price in King County and Snohomish County grew. In King County, the median price was recorded at $975,000 this August and at $775,000 in Snohomish County, which are both up 7% year-over-year from August 2023.

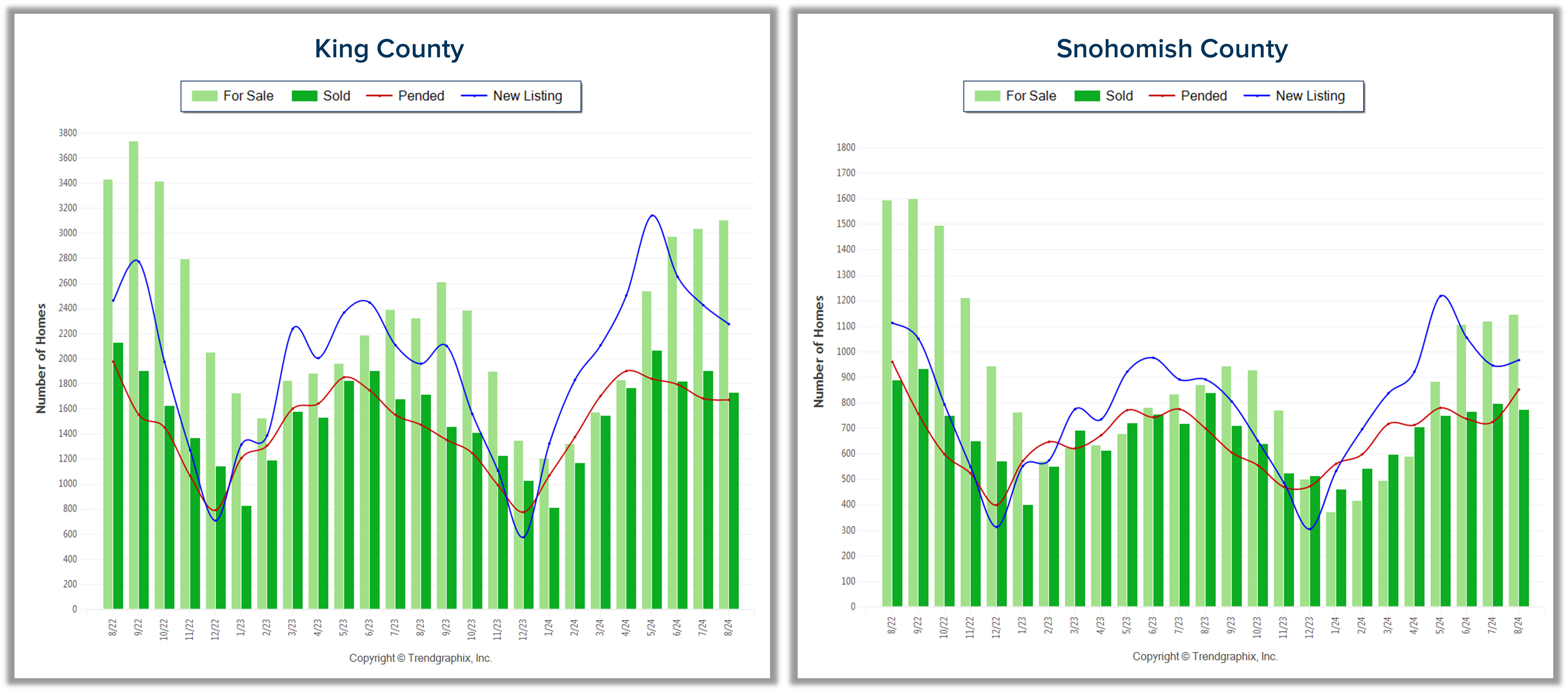

Another trend that we are witnessing is a rise in available inventory for sale. August recorded the highest level of available homes for sale since the fall of 2022, two years ago. There were 3,105 available homes for sale in King County in August 2024 compared to 1,207 in January 2024, and 1,147 in Snohomish County in August 2024 compared to 374 in January 2024.

The combination of lower borrowing costs and more selection should be a welcome change for buyers. When the inventory was much tighter in the first half of 2024 and interest rates were higher, prices were increasing at a rapid rate. We are starting to see new buyers enter the market and some who have sidelined themselves return. This indicates that prices will remain stable as we finish out 2024.

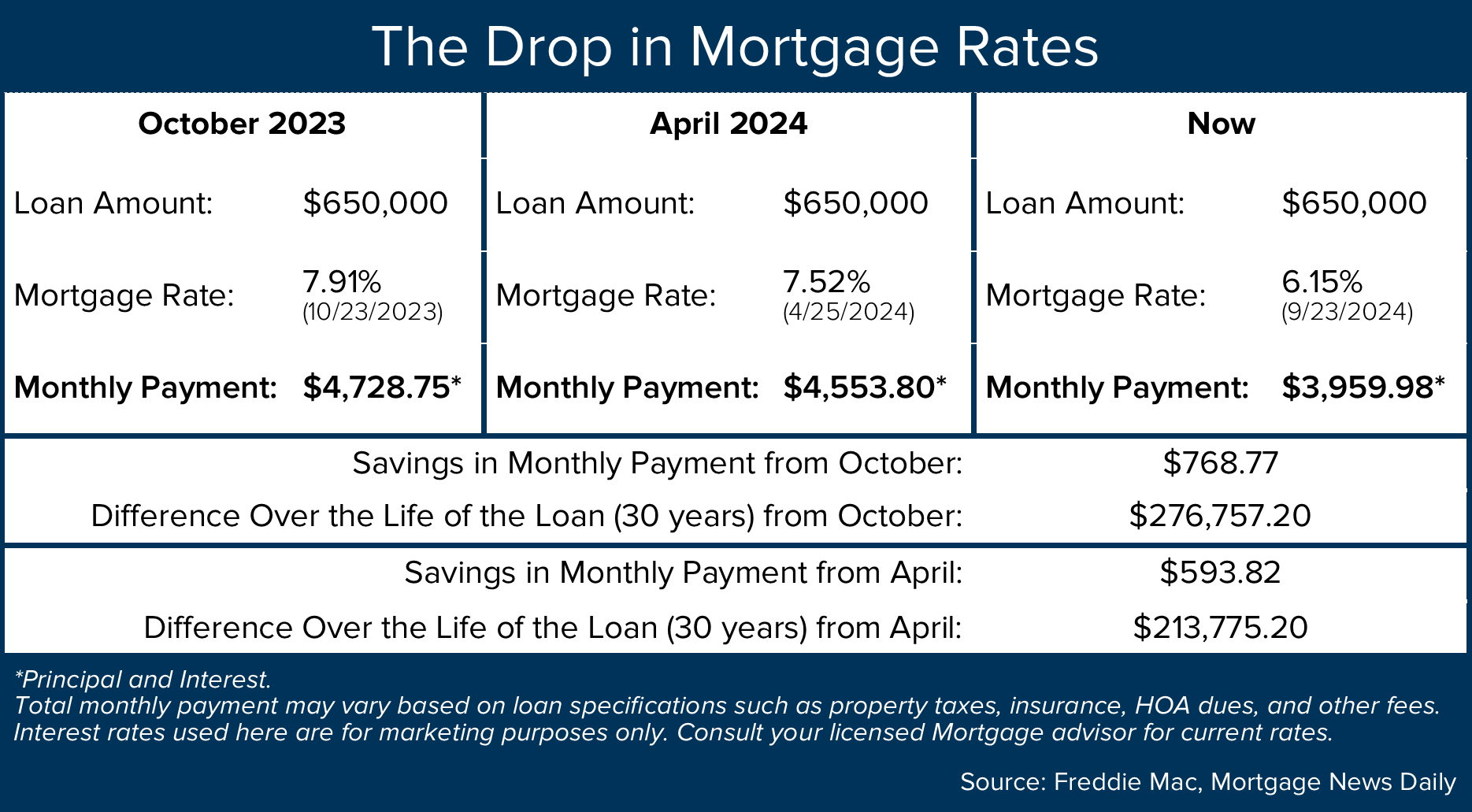

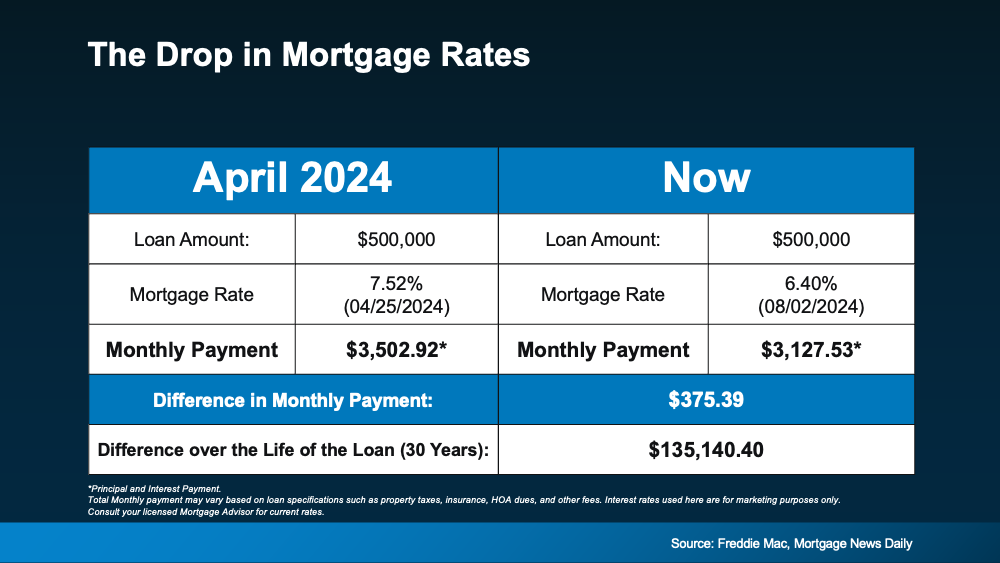

Currently, buyers have more selection and the opportunity to grab a lower monthly payment. As you can see from the chart below, buyers have a significant opportunity to afford a higher price point at a lower rate or stay at the same price point and have a lower monthly payment. The reduction in rate over the last year is reducing monthly payments and creating great long-term savings over the life of the loan. The rule of thumb for affordability is a 1-point shift in rate affects a buyer’s buying power by 10%. For example, a home priced at $800,000 with a 7% interest rate will have a similar monthly payment as a home at $880,000 with a 6% rate.

The hesitation I am seeing in the marketplace is a desire for rates to come down even further. The good news is that they are predicted to continue this gradual decline. Where I am concerned is a decrease in selection. If we look at seasonality, it is common for inventory to be low in the first half of the year, especially in Q1 (see the King & Snohomish graphs above). If rates continue their slide and fewer new listings come to market, buyers will find themselves duking it out in 2025. Right now, while there are multiple offers on some properties, there are more properties that are being negotiated into contracts with one buyer.

marketplace is a desire for rates to come down even further. The good news is that they are predicted to continue this gradual decline. Where I am concerned is a decrease in selection. If we look at seasonality, it is common for inventory to be low in the first half of the year, especially in Q1 (see the King & Snohomish graphs above). If rates continue their slide and fewer new listings come to market, buyers will find themselves duking it out in 2025. Right now, while there are multiple offers on some properties, there are more properties that are being negotiated into contracts with one buyer.

This has created a more nimble market, particularly for buyers who also have to sell their homes to reposition their equity into a downpayment. While tight inventory provides great leverage for a seller, many sellers are also buyers. Analyzing the market conditions to align the environmental influences to create the best possible outcome for your goals is paramount, and it will not be the same for everyone. Depending on my client’s goals, timing can vary.

Oh, and another sentiment I often hear is, “Will rates under 5% ever be back?” That is rather unlikely and will go down as a historic time in our economy. With that said, if you are in your “forever home” and you captured a historically low rate, kudos to you! Truly, so awesome! If you are not in the home that is right for you, now may be the time to curate a plan to get you into your next home. If homes were selling at a rapid rate and prices were appreciating this last spring with 10% less buyer power, I imagine next spring will be much of the same, if not more.

One final item to note is the election.  History shows that post-election year markets are brisk with sales and experience price growth and rate decreases. I am paying attention to key indicators such as inflation figures, unemployment measurements, the gap between the 10-year treasury yield and mortgage rates, and our local market conditions in order to provide my clients with the most accurate and up-to-date information to empower strong decisions.

History shows that post-election year markets are brisk with sales and experience price growth and rate decreases. I am paying attention to key indicators such as inflation figures, unemployment measurements, the gap between the 10-year treasury yield and mortgage rates, and our local market conditions in order to provide my clients with the most accurate and up-to-date information to empower strong decisions.

Are you curious how all of this affects you? Real estate is the number one tool for building wealth, and you also get to live there. I think that is pretty important, and I love nothing more than providing valuable insights, having strategic conversations, and helping people align their homes with their lives. Home is where the heart is and also where your nest egg has the most reliable long-term growth. Please reach out if you’d like to dig into the details and apply them to your housing and investment goals.

End of Summer Market Update

Summer 2024 welcomed an increase in available inventory, a drop in interest rates, and continued price stability, which has upheld strong home equity levels. After a double-digit ramp-up in price appreciation in the first half of 2024, prices have slightly come off the peak of May 2024 and found stability. This trend is historically consistent with seasonal patterns and nothing to be alarmed about.

Increased selection for buyers was a welcome relief as inventory was extremely tight in the spring. While there are still homes getting multiple offers and escalating, we have also seen some buyers make purchases contingent on the sale of their current home. The market has become a bit more nimble for buyer’s terms in some cases. It is important to understand the nuances of each location, product, and price point, as the environment can vary which would indicate whether a buyer would need to compete or be able to negotiate more.

These trends are coupled with rates dropping below 7% in June and they have recently sat in the mid-6%. Rates were a point and a half higher in October 2023; this is a great improvement! We anticipate rates slowly dropping further which will put upward pressure on prices. The Fed meets again this month and if rates come down even more, buyer activity will increase. Between the lower rates and higher inventory, buyers should be excited and ready to act!

As you can see from the chart below, this shift in rate directly relates to a buyer’s monthly payment. Homes are expensive, so the cost to carry a loan is critical. These recent drops are helping out and should be paid close attention to as buyers are payment-driven in most cases. The opportunity to secure a home now with today’s rate could mean a buyer could enjoy a stable price and choose to re-finance or adjust to a lower rate later keeping their same basis. Buyers should also understand that homeownership is a key component to building wealth.

I anticipate a healthy late summer and fall market. Over the Labor Day Weekend, buyer traffic was busy despite the holiday and activity is bubbling up. The lower rates are helping some folks jump off the fence. Even some sellers are getting ready to sell and relinquish their lower rate, so they can move to a home that better fits their needs. I’m excited about the real estate market for the remainder of 2024 and into 2025. If you are curious about how the trends relate to your goals, please reach out. I am committed to staying connected and up-to-date on the latest trends so my clients make well-informed decisions.

Election Year Market Trends: A Look Back to Look Forward

As we approach November and the Presidential election nears, it would be good to look back on how election years have historically affected the real estate market. There is certainly a lot going on and this stimulation can cause pause. Buying and selling real estate is a big life event and the election is a big national event. Some buyers and sellers will delay their moves until after they know how the election is going to pan out. Sometimes this delay is caused by pure distraction and sometimes there is a level of uncertainty that is created until a decision is made.

Here is some interesting data that illustrates the trends of consumer behavior surrounding a Presidential election. Interest rates, the rate of home sales, and price growth are all analyzed below. Looking back to look forward provides some concrete evidence of how a Presidential election can affect the performance of the housing market.

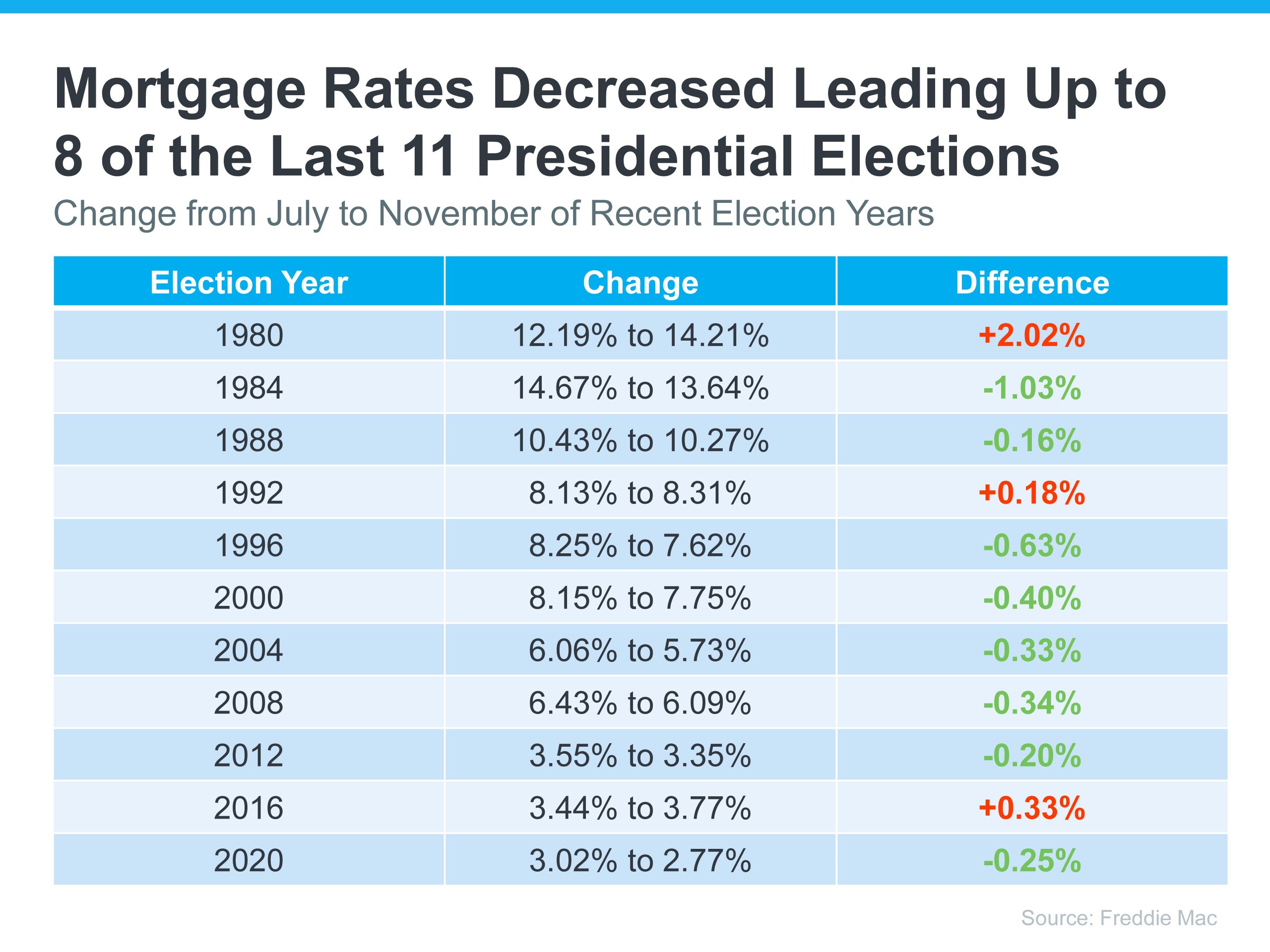

First, interest rates! We have recently experienced a nice drop in rates. Rates have been extremely volatile over the last two years. Last October, rates peaked at almost 8%, came down to 6.75% in January 2024, went back up to 7.4% in April 2024, and have recently dropped to the lowest level we have seen since April 2023 and are hovering around 6.5%. This is largely due to inflation finally settling and a recent jobs report showing increased unemployment. This trend is predicted to continue as the Fed considers a rate cut in September with the plan of easing rates as we finish 2024 and head into 2025.

The chart below shows what rates have done over the last eleven election cycles and it certainly looks like the current trend with rates follows historical norms. This is an opportunity for buyers to jump into the market as this reduction in rate is accompanied by an increase in inventory. With lending costs lower and more selection buyers could even find themselves in a position to negotiate a further reduction in rate to help with the overall affordability of a purchase.

The market is very much driven by what a buyer’s monthly payment would be. Lending costs are a huge factor that will play into consumer confidence and the amount of sales happening. Further, we expect more home sellers to come to market as rates ease as they will be more inclined to give up their low rate to move to a home that is a better fit for their lifestyle.

The chart below shows the increase in home sales in nine out of the eleven past election cycles. In fact, the first year after an election is historically robust with activity. If history repeats itself in 2025, buyers who are ready may want to consider making a move now. With the dip in rate, increased selection, and some buyers sidelined it could be a great time to make a purchase with a little less competition.

Even better news is that historically prices increase after an election year. In seven out of the last eight post-election years, prices increased. The only year they did not, was 2008 which was in the hollows of the Great Recession. Of course, we will not be able to measure this until a year from now and this will be something that I will be paying close attention to.

So far, 2024 has been a year of price growth. We experienced huge gains in the first half of the year over 2023. 2024 marks the year of recovering from the 2022 post-pandemic correction and re-gaining price stability. Equity levels in our area are very strong with close to 60% of homeowners having at least 50% home equity. We expect the movement of this equity to become more nimble as the cost of borrowing money comes down.

What we have in store over the next three months will be distracting, stimulating, and just a lot. I hope the information above provides some history that helps ground the facts during a time of heightened angst and uncertainty. As always, life dictates changes in real estate needs. If you or someone you know has come up on some life changes that indicate a move would be beneficial, please reach out.

Despite the chaos of the election, you can never plan too early for these big life transitions and there might be some great opportunities amongst the noise. Whether it’s a purchase, a sale, or both, I am equipped to help you assess your goals and help you devise a plan. The best time to make a move is when you’re ready and I’m here to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link