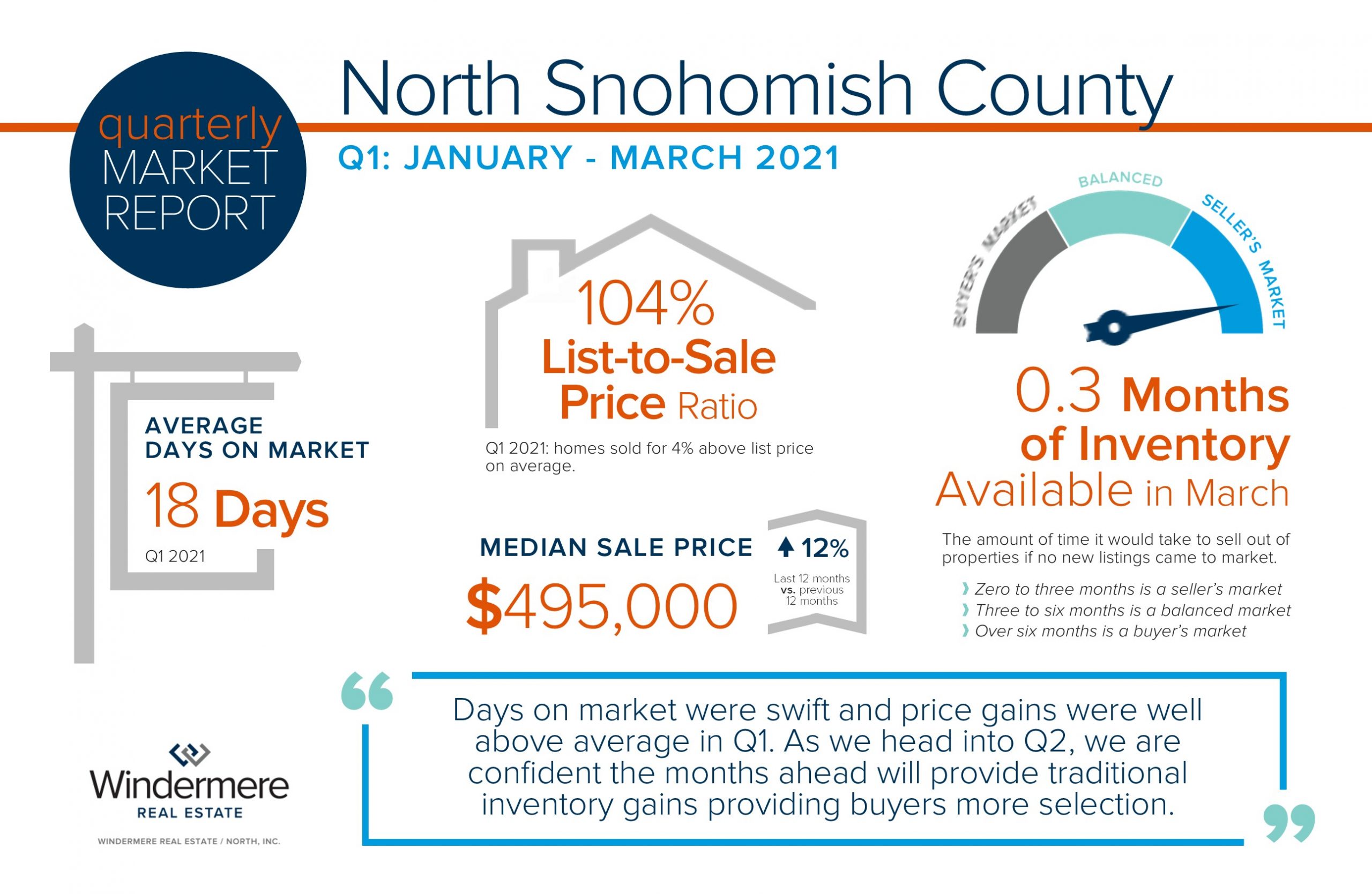

North Snohomish County Quarterly Market Trends – Q1 2021

Q1 2021 signified a measurable shift in the real estate market. Demand since the first of the year has been brisk, proving Q1 2021 to be one of the most impactful times in market history! Interest rates remain historically low, helping to offset the cost of price appreciation. Rates and the lucrative tech-influenced job market have helped pending sales outpace new listings.

Additionally, the convergence of Millennials, Gen Xers, and Baby Boomers making big lifestyle moves due to the low cost of debt service, work-from-home options, and formidable equity has the market frothy. Nationally, 30% of all homeowners have over 50% equity in their home, leading people to make moves with large down payments.

Days on market were swift and price gains were well above average in Q1. As we head into Q2, we are confident the months ahead will provide traditional inventory gains providing buyers more selection. We would welcome a tempering in price growth as it has been abundant and is affecting affordability. If you or someone you know is curious about how today’s real estate market relates to your financial and lifestyle goals, please reach out. It is my mission to help keep my clients informed and empower strong decisions.

Seattle Metro Quarterly Market Trends – Q1 2021

Q1 2021 signified a measurable shift in the real estate market. Demand since the first of the year has been brisk, proving Q1 2021 to be one of the most impactful times in market history! Interest rates remain historically low, helping to offset the cost of price appreciation. Rates and the lucrative tech-influenced job market have helped pending sales outpace new listings.

Additionally, the convergence of Millennials, Gen Xers, and Baby Boomers making big lifestyle moves due to the low cost of debt service, work-from-home options, and formidable equity has the market frothy. Nationally, 30% of all homeowners have over 50% equity in their home, leading people to make moves with large down payments.

Days on market were swift and price gains were well above average in Q1. As we head into Q2, we are confident the months ahead will provide traditional inventory gains providing buyers more selection. We would welcome a tempering in price growth as it has been abundant and is affecting affordability. If you or someone you know is curious about how today’s real estate market relates to your financial and lifestyle goals, please reach out. It is my mission to help keep my clients informed and empower strong decisions.

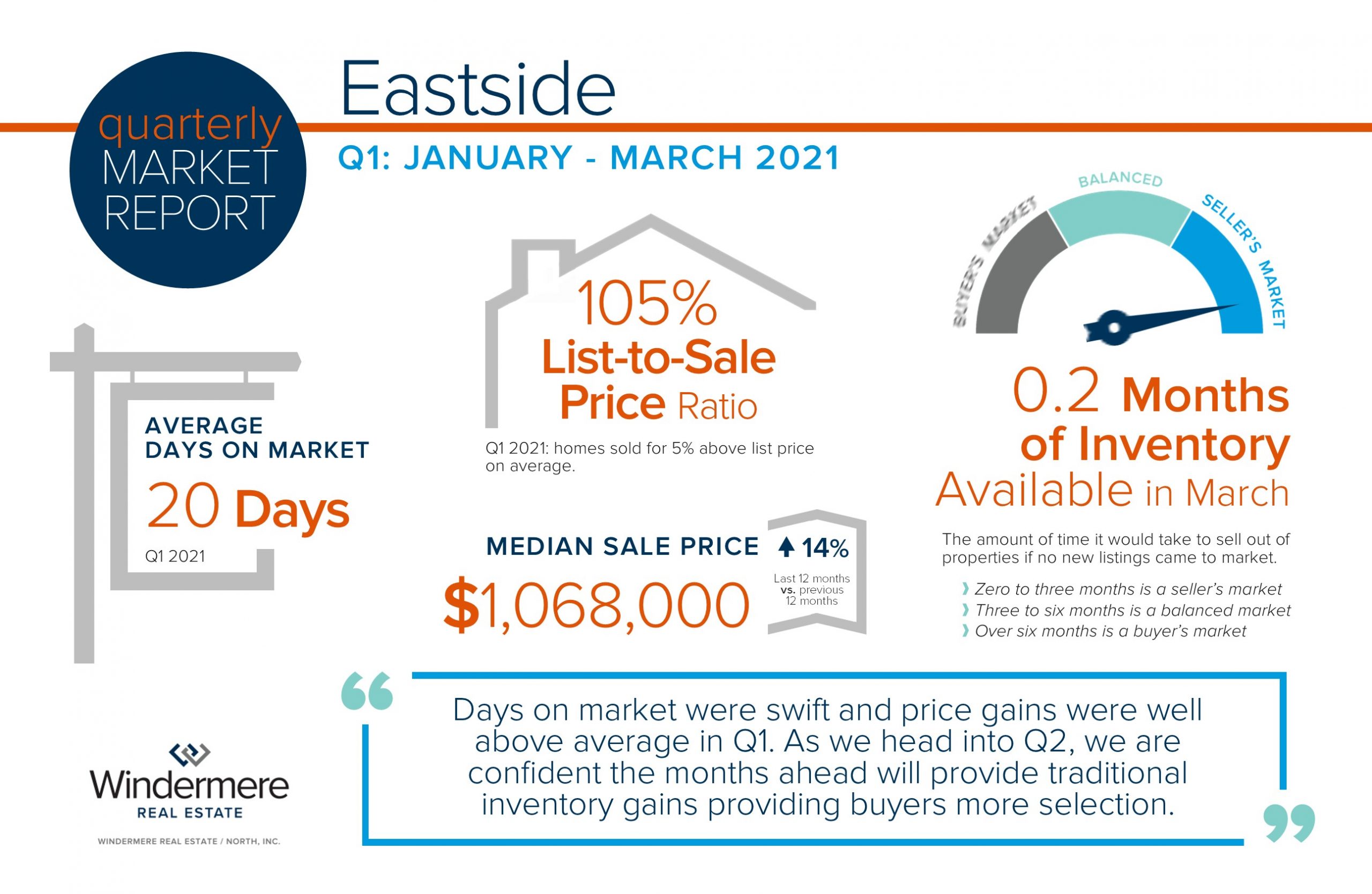

Eastside Quarterly Market Trends – Q1 2021

Q1 2021 signified a measurable shift in the real estate market. Demand since the first of the year has been brisk, proving Q1 2021 to be one of the most impactful times in market history! Interest rates remain historically low, helping to offset the cost of price appreciation. Rates and the lucrative tech-influenced job market have helped pending sales outpace new listings.

Additionally, the convergence of Millennials, Gen Xers, and Baby Boomers making big lifestyle moves due to the low cost of debt service, work-from-home options, and formidable equity has the market frothy. Nationally, 30% of all homeowners have over 50% equity in their home, leading people to make moves with large down payments.

Days on market were swift and price gains were well above average in Q1. As we head into Q2, we are confident the months ahead will provide traditional inventory gains providing buyers more selection. We would welcome a tempering in price growth as it has been abundant and is affecting affordability. If you or someone you know is curious about how today’s real estate market relates to your financial and lifestyle goals, please reach out. It is my mission to help keep my clients informed and empower strong decisions.

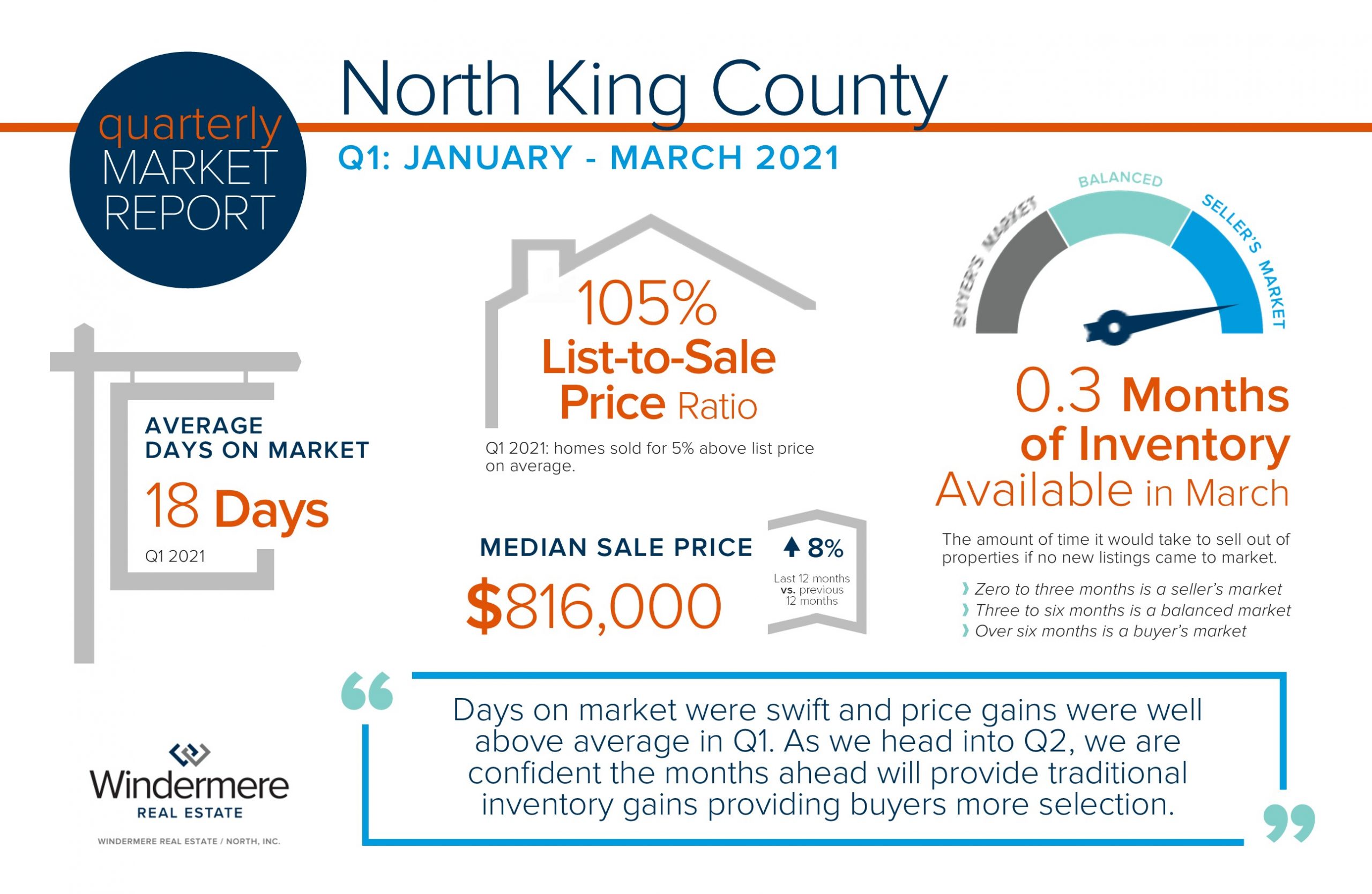

North King County Quarterly Market Trends – Q1 2021

Q1 2021 signified a measurable shift in the real estate market. Demand since the first of the year has been brisk, proving Q1 2021 to be one of the most impactful times in market history! Interest rates remain historically low, helping to offset the cost of price appreciation. Rates and the lucrative tech-influenced job market have helped pending sales outpace new listings.

Additionally, the convergence of Millennials, Gen Xers, and Baby Boomers making big lifestyle moves due to the low cost of debt service, work-from-home options, and formidable equity has the market frothy. Nationally, 30% of all homeowners have over 50% equity in their home, leading people to make moves with large down payments.

Days on market were swift and price gains were well above average in Q1. As we head into Q2, we are confident the months ahead will provide traditional inventory gains providing buyers more selection. We would welcome a tempering in price growth as it has been abundant and is affecting affordability. If you or someone you know is curious about how today’s real estate market relates to your financial and lifestyle goals, please reach out. It is my mission to help keep my clients informed and empower strong decisions.

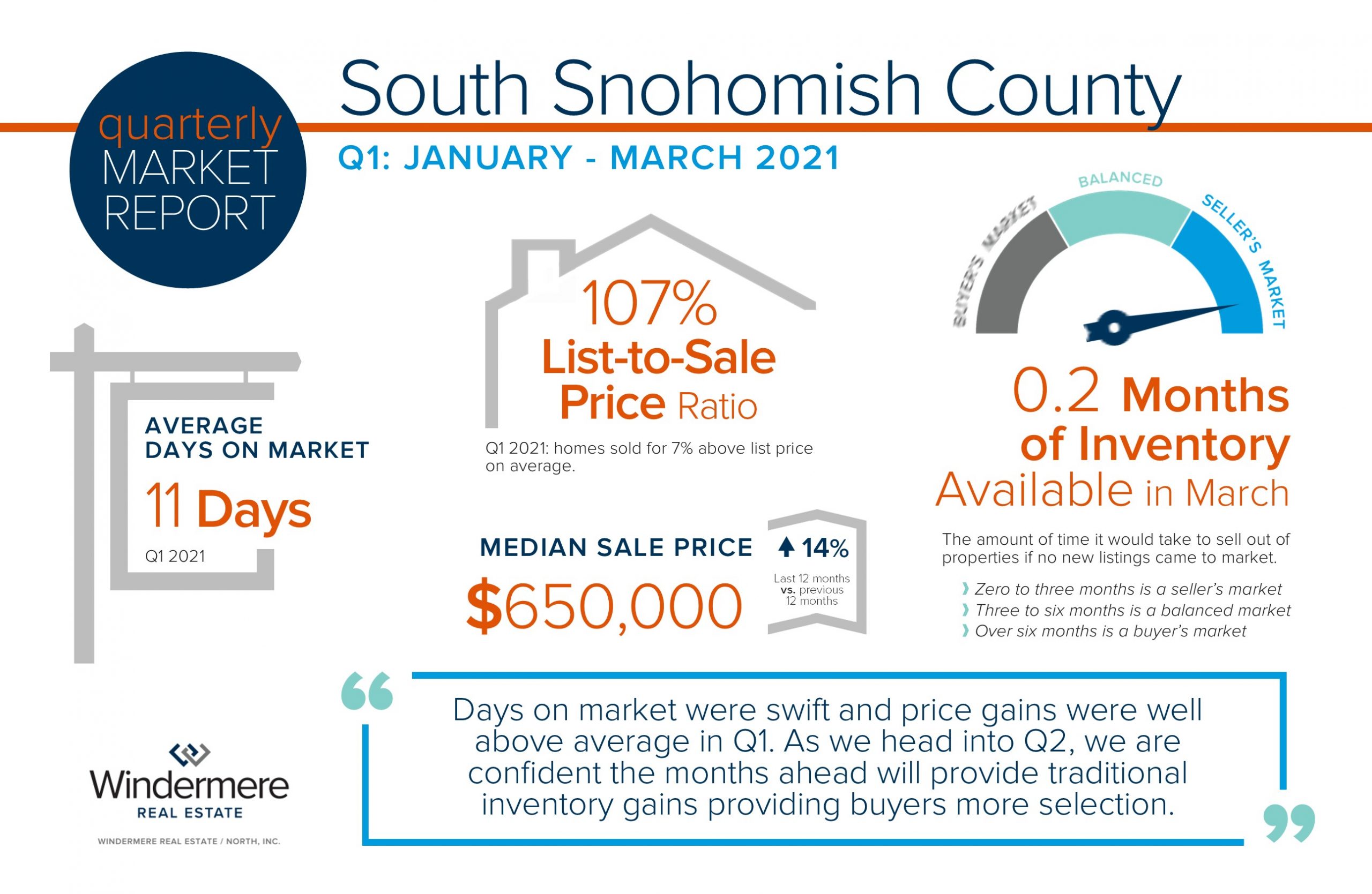

South Snohomish County Quarterly Market Trends – Q1 2021

Q1 2021 signified a measurable shift in the real estate market. Demand since the first of the year has been brisk, proving Q1 2021 to be one of the most impactful times in market history! Interest rates remain historically low, helping to offset the cost of price appreciation. Rates and the lucrative tech-influenced job market have helped pending sales outpace new listings.

Additionally, the convergence of Millennials, Gen Xers, and Baby Boomers making big lifestyle moves due to the low cost of debt service, work-from-home options, and formidable equity has the market frothy. Nationally, 30% of all homeowners have over 50% equity in their home, leading people to make moves with large down payments.

Days on market were swift and price gains were well above average in Q1. As we head into Q2, we are confident the months ahead will provide traditional inventory gains providing buyers more selection. We would welcome a tempering in price growth as it has been abundant and is affecting affordability. If you or someone you know is curious about how today’s real estate market relates to your financial and lifestyle goals, please reach out. It is my mission to help keep my clients informed and empower strong decisions.

Local Farmer’s Markets 2021

When you shop at a local Farmers Market, you’re buying outstanding freshness, quality and flavor. Knowing exactly where your food comes from and how it was grown provides peace of mind for your family. Plus, you’re supporting a sustainable regional food system that helps small family farms stay in business; protects land from over-development, and provides the community with fresh, healthy food. Find one near you on the list below!

SOUTH SNOHOMISH

Arlington Farmers Market

Legion Park: 114 N. Olympic Ave

Saturdays. 10am-2pm

May 8 — September 25

Bothell Park Ridge Community Market

Park Ridge Church: 3805 Maltby Road, Bothell

Wednesdays 4pm-8pm

June 2—September 29

Edmonds Garden Market

Historical Museum: 5th & Bell Street

Saturdays 9am-2pm

May 1—June 12

Edmonds Summer Market

Downtown: 5th St from the fountain

Saturdays 9am-2pm

June 19—October 9

Everett Farmers Market

2930 Wetmore Ave

Sundays 11am-3pm

May 9—October 31

Marysville Farmer’s Market

Grocery Outlet: 9620 State Ave

Sundays 12pm-6pm

April 18—September 26

Monroe Farmer’s Market

Galaxy Theater: 1 Galaxy Way

Wednesdays 2:30pm-7pm

May 26-September 1

Snohomish Farmers Market

Cedar Ave & Pearl St.

Thursdays 3pm-7pm

May 6—September 30

EASTSIDE

Bellevue Farmers Market

First Presbyterian: 1717 Bellevue Way NE

Thursdays 3pm-7pm

May 13—October 7

Bellevue Crossroads Farmers Market

East Parking Lot: 15600 NE 8th St

Tuesdays 12pm-6pm

June 1—September 28

Issaquah Farmers Market

Pickering Barn: 1730 10th Ave NW

Saturdays 9am-2pm

May 1—September 25

Juanita Friday Market

Juanita Beach: 9703 NE Juanita Dr

Fridays 3pm-7pm

June 4—September 24

Kirkland Wednesday Market

Marina Park: 25 Lakeshore Plaza

Wednesdays 3pm-6pm

June 2—September 29

Mercer Island Farmers Market

Mercerdale Park: 7700 SE 32nd St

Sundays 10am-3pm

June 7—September 27

Redmond Saturday Market

Redmond Town Center: 7730 Leary Way NE

Saturdays 9am-3pm

May 1—October 30

Sammamish Farmers Market

City Hall Plaza: 801 228th Ave SE

Wednesdays 4pm-8pm

May 5—September 29

Woodinville Farmers Market

DeYoung Park: 13680 NE 175th St

Saturdays 9am-3pm

May 1—September 25

SEATTLE

Ballard Farmers Market

Ballard Ave NW

Sundays. 9am-2pm

YEAR ROUND

Capitol Hill Broadway Farmers Market

E Denny Way (between Broadway & 10th Ave)

Sundays 11am-3pm

YEAR ROUND

Columbia City Farmers Market

37th Ave S & S Edmunds St

Wednesdays 3pm-7pm

May 12—October 13

Fremont Sunday Market

Corner of 3410 Evanston Ave N

Sundays 10am-4pm

YEAR ROUND

Lake City Farmers Market

125th St and 28th Ave NE

Thursdays 3pm-7pm

July 1—September 23

Lake Forest Park Farmers Market

Third Place Commons: 17171 Bothell Way NE

Sundays 10am-2pm

May 9—October 17

Madrona Farmers Market

1126 Martin Luther King Jr. Way

Fridays 3pm-7pm

May 14—October 15

Magnolia Farmers Market

Magnolia Village: 33rd Ave W & W McGraw

Saturdays. 10am-2pm

June 5—September 25

Phinney Farmers Market

Closed for 2021

Queen Anne Farmers Market

W Crockett Street & Queen Anne Ave N

Thursdays 3pm-7:30pm

June 3—October 7

Shoreline Farmers Market

15300 Westminster Ave N

Saturdays 10am-2pm

June 5—October 2

University District Farmers Market

University Way NE

Saturdays 9am-2pm

YEAR ROUND

Wallingford Farmers Market

Meridian Park: Meridian Ave N & N 50th St

Wednesdays 3pm-7pm

June 9—September 29

West Seattle Farmers Market

California Ave SW & SW Alaska St

Sundays 10am-2pm

YEAR ROUND

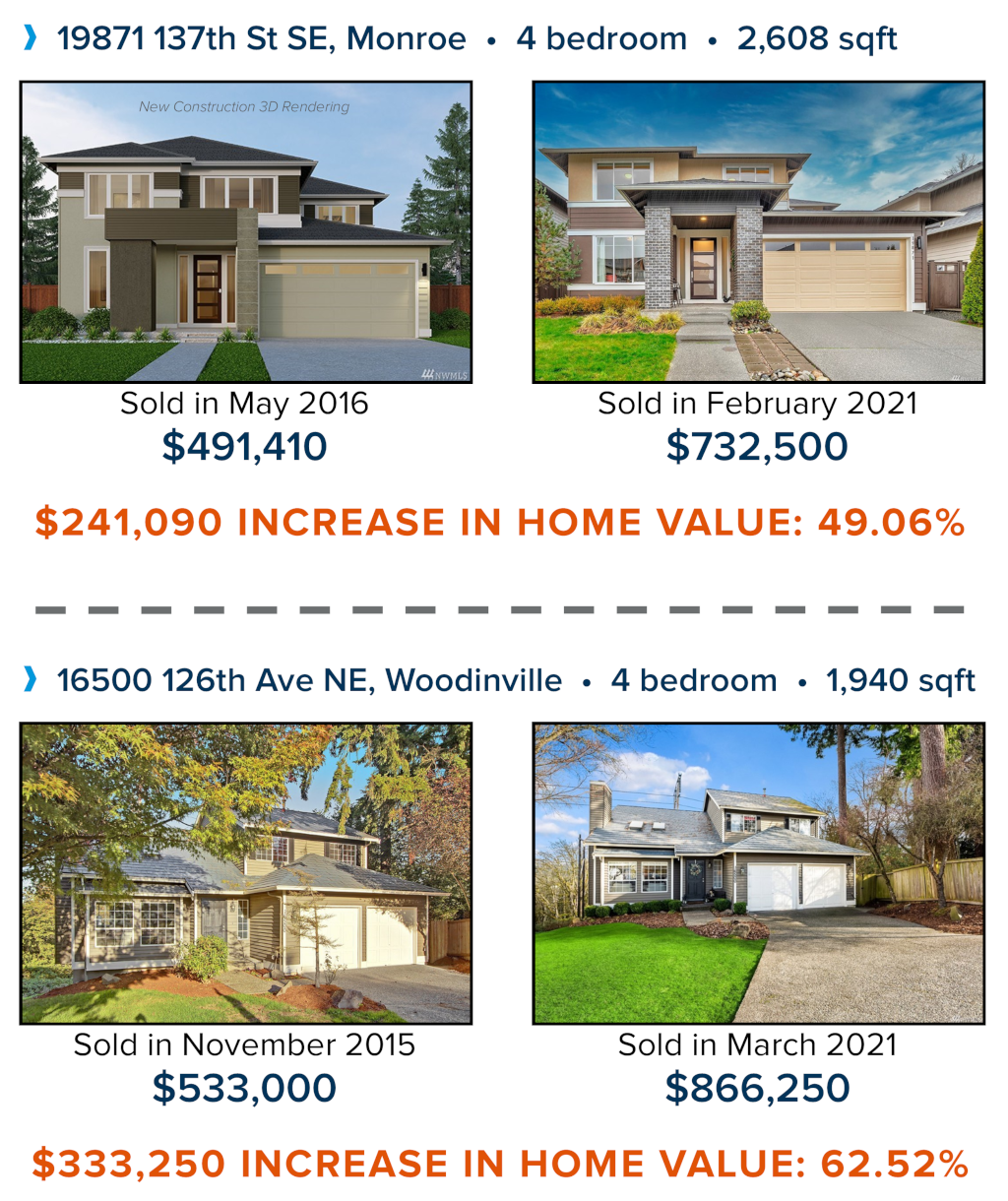

Newsletter – What is your home worth? Price Appreciation Case Studies in Snohomish & King Counties

Over the last 6 years, the median price for a single-family home in King County has grown by 65%, and in Snohomish County 69%. Above are examples of actual homes sold in late 2015 to early 2016 that also sold in early 2021. Note, they were not remodeled or significantly improved in between sales. These examples show the growth in home values that we have experienced over the last three years due to our thriving local economy. I pulled these examples to show you actual pound-for-pound market data versus the statistical percentages I often quote in these market updates. I thought these examples were pretty telling and quite exciting.

This phenomenon has been driven by interest rates being under 5% for the last five years and under 4% for the last 2 years. In addition to low debt service, the tech-influenced job market has kept the local economy humming. Couple all of this with the convergence of Millennials breaking into the market as first-timers or moving up, Gen-Xers moving up, and Baby Boomers cashing out to the right-size house in our area or relocating altogether, and demand is high. This high demand has put pressure on available inventory, driving up price appreciation.

The more recent influence on home values is the effect of the work-from-home lifestyle on housing. Many companies have announced that post-pandemic they plan to let their employees permanently work from home or do so in a hybrid model. This has changed the preference to be closer to the in-city job centers to avoid a long commute. Now, more and more people are attracted to the suburbs and in some cases more rural settings in order to enjoy larger interior and exterior spaces. According to Matthew Gardner, Windermere’s Chief Economist, over 30% of all homeowners in America have over 50% equity. These moves to the suburbs are also propped up on liquidating their equity elsewhere and utilizing it to make a large down payment on the next purchase. Check-out Matthew’s latest video update here.

I see this as a re-organization of lifestyle propped up by strong equity growth, low debt service, and the flexibility to live further from one’s job. Homes in-city are still experiencing favorable appreciation with the median price up 7% year-over-year in Seattle proper, but there is stronger year-over-year growth in suburban locations. For example, in Lynnwood the median price is up 11% year-over-year. Where this has been a challenge is the typical suburban buyer is now competing with far more buyers for these coveted locations. The former suburban buyer accepted a longer commute for a less expensive home. With commute times a lesser concern, now we have a larger audience vying for homes outside the in-city core, making the suburbs more expensive.

The large price gains might seem familiar to the gains of the previous up market of 2004-2007 that resulted in a bubble, but this environment is much different, which is why we are not headed toward a housing collapse. Previous lending practices allowed people to get into homes with risky debt-to-income ratios, minimal down payments, low credit scores, and undocumented incomes. A large part of why the housing bubble burst 14 years ago was due to people getting into mortgages that were not sustainable, which led to the eventual fall of sub-prime lending and the bubble bursting.

It is supply and demand that is creating these huge gains in prices, not predatory lending. We are starting to see an uptick in homes coming to market which is both seasonal and catch-up from the pause the pandemic created last spring. With the vaccine becoming more and more available, more home sellers will become more comfortable bringing their homes to market. The shake-out of the work-from-home shift will eventually temper as some will choose to stay closer in-city and some employers may revert back to in-person work forces. The suburbs are not for everyone, but for now the puzzle of how housing and lifestyle relate to one another is being re-built.

We are anticipating an increase in inventory as we head into spring and summer which will temper price growth and simmer the frenzy. Many folks who have been waiting out the pandemic to make a move based on retirement or upgrading homes are well-positioned to enter the market. If you are one of those people, I hope these examples provide insight on the increase in home values and how they might pertain to your goals.

Potential buyers might shy away from the market due to affordability. While it is expensive to buy a home in the Greater Seattle area, the people that have become homeowners over the last six years have built some amazing wealth. Interest rates remain low, helping to absorb the cost of a home in our area. Last month, I wrote an article about wanting to sell but needing to also buy, which helped layout some strategies to successfully participate in today’s market. If you or anyone you know is considering making a purchase, it is worth the read.

As we head into the active spring and summer months, if you’d like me to provide you a complimentary Comparable Market Analysis (CMA) on your home so you have a better understanding of your home’s value, I’d be happy to do that. This would be an important component in charting your 2021 financial goals. Please reach out, it is my goal to help keep my clients informed and empower strong decisions.

4211 Alderwood Mall Blvd, Lynnwood

We are partnering with Confidential Data Disposal for our 10th year; providing you with a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

We will also be collecting donations to benefit Concern for Neighbors food bank. Donations are not required but are appreciated.

Hope to see you there!

**This is a Paper-Only event. No x-rays, electronics, recyclables, or any other materials.

You Want to Sell, but Need to Buy, too: What to do?

Homeowners across our region are enjoying incredibly healthy equity levels due to an upswing in the real estate market over the last five years. In fact, the median price in King County is up 50% over the last five years and up 55% in Snohomish County. Over the last 10 years, the median price is up 96% in King County and 106% in Snohomish. This growth in equity has given homeowners the exciting option to sell their home for a high price and move on to their next chapter, such as a move-up, down-size, or second home. This price growth is great news and provides many opportunities; however, we have also faced some challenges in how to make these transitions due to tight inventory.

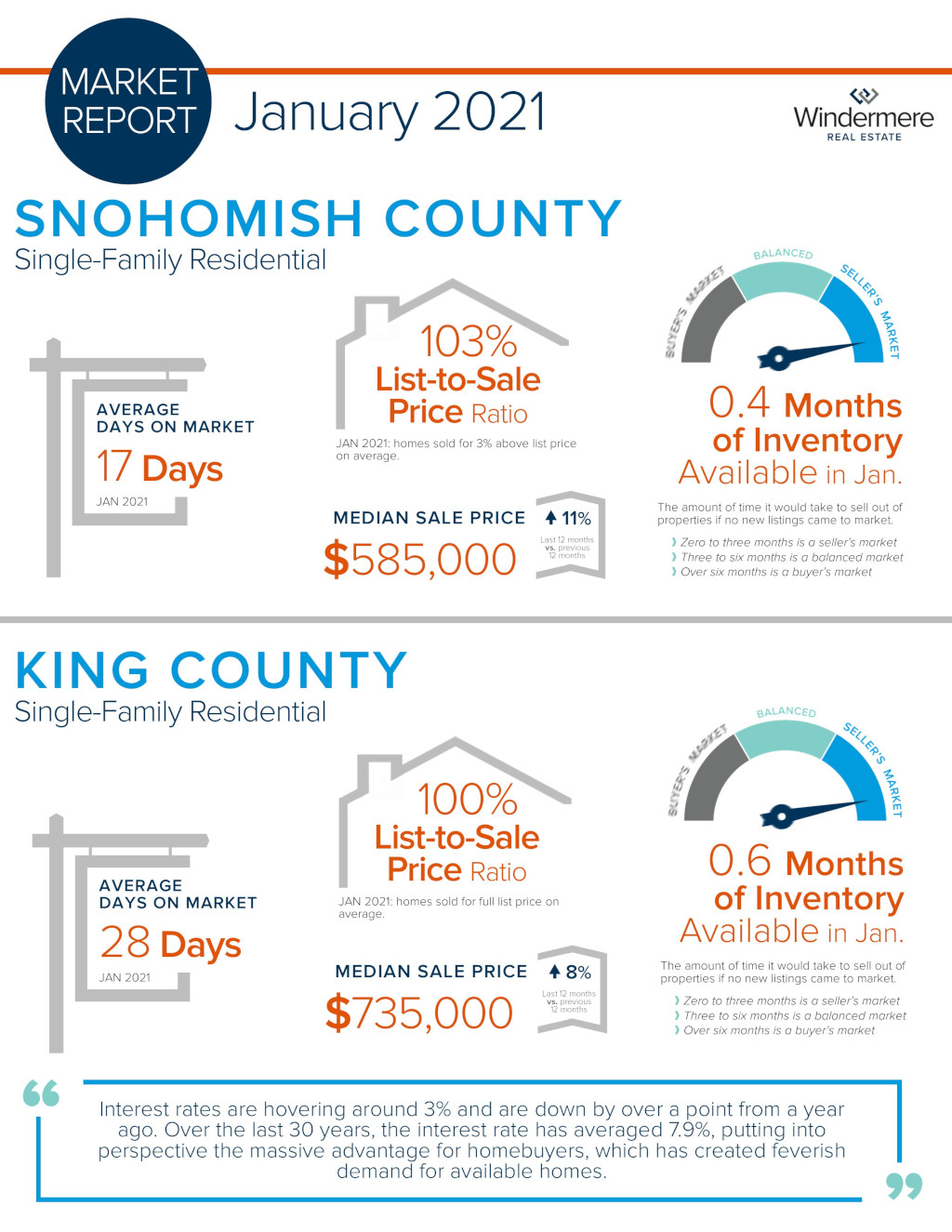

The biggest challenge for buyers, which is conversely a benefit for sellers in the marketplace right now, is limited inventory levels. Buyers who need to sell their homes first in order to buy want to benefit from the upward pressure on prices for their home sale but are fearful of finding their next home in a timely manner. Currently, King County sits at 0.6 months of inventory and 0.4 in Snohomish based on pending sales data. These levels create a multiple-offer environment that is tough for buyers whose down payment is not readily available. Historically, buyers that are also sellers (those who have their down payment tied up in the equity of their home) would commonly secure a new home contingent on the sale of their current home. Meaning the seller of the new home they are buying would give them a month or so to get their current house sold in order to buy theirs. In this market, that is only rarely an option- like unicorn status.

So, the million-dollar question is this: how does one who has gained so much equity, now itching to get that bigger house, more functional floorplan, different location, or perfect rambler for settling into retirement, make this transition? We need to get creative, have a strategy and be ready to take on some possible short-term discomfort for long-term gain. Three options that are proven to be successful are: negotiating a rent-back for my sellers, using the Windermere Bridge Loan program, or having the bold courage to sell first and possibly move twice.

1. RENT-BACK

First, negotiating a rent-back has become a great option for someone who needs to first sell their current home in order to buy. The way it works is we put their home on the market, price it competitively to create demand, and ask for a rent-back as one of the preferred terms. If this rent-back is successfully negotiated, then the seller closes on their home and collects their funds but gets to stay in the house anywhere from 30-60 days post-closing. This enables the seller, who is now a buyer, to have their cash-in-hand, time to find a new house, get it under contract, and close the sale when their rent-back is ending. This eliminates the need to move twice. There is a bit of calculated risk in this plan, but I’ve seen it work several times, always with a plan B (interim place to move) ready just in case. Rarely has plan B needed to be executed, and often we’ve even been able to negotiate under market rent rates during the rental period.

2. WINDERMERE BRIDGE LOAN

The second option is the Windermere Bridge Loan program. This is an amazing tool for homeowners that own their homes free and clear, or who have sizable equity. This is an efficient, low-cost option where a buyer who needs to sell can pull the equity out of their house prior to selling it in order to make a non-contingent offer. The way it works is we establish the market value of the house the homeowner currently owns, via comparative market analysis (CMA) that I complete and is signed off by my managing broker. We then take 75% of the CMA value and subtract any debt owed, and that is the maximum amount the homeowner can borrow for their next down payment (max limit $1M).

They can then make a non-contingent offer on a new home as long as their lender approves that they can hold the current home and qualify for the new mortgage at the same time. What is really great about this program, is that it doesn’t require an appraisal (like a HELOC does), and these can easily be turned around in 5-7 business days. This tool provides the opportunity to quickly and inexpensively utilize your equity, be competitive to win the next house, and eliminates the double move.

The fees associated with this program are a 1% loan fee on the equity that is pulled, a title report, and interest that is incurred between the loan funding and being paid off once the subject home is sold. That interest is conveniently wrapped up in the closing costs when they close the sale of their home, eliminating the need to make monthly interest payments. In a strategy that is somewhat mind-blowing- we can sometimes use these bridge loans and never have to actually fund them. For example, if we secure a property non-contingent with the bridge loan and immediately get the bridge loan home on the market, we can often secure a sale with a simultaneous closing, and never have to fund the loan. This eliminates the loan fee, interest, and the need to carry two mortgages.

3. SELL FIRST, MOVE TWICE

The third option is to tie up your bootstraps and get your home sold before you start actively shopping for the next. By all means, study the market, get pre-approved and have an idea of where and what you want, but remain committed to selling your home first. The benefits of selling your home first are being up against less competition and knowing exactly how much money you have to work with in the end.

Typically, we see more inventory come to market in Q2 and Q3, the earlier in the year a home comes to market the less competition they experience which is always favorable for the seller’s financial outcome. Knowing exactly how much you are going to net from your home sale is an empowered position to be in as is having the cash in the bank when vying for your next home. In this market, we are seeing shocking price escalations and this “extra” cash could be the difference-maker to obtain your dream home.

It does take bold courage to sell your home first as it often requires a double move. I know, that sounds miserable, moving is hard and disruptive. What is also costly and miserable is spinning your wheels as a buyer as prices appreciate and missing out on opportunities. The advent of VRBO and AirBnB has created a much more available short-term rental market and can provide an interim place to land while you shop for your next home. Some folks have friends and family that will take them in, it’s all in the name of getting creative. Having your cash in hand will make you more competitive and you will have a clear financial picture. Most things in life that are meaningful are hard. If it was easy, everyone would do it. Be bold, be courageous! Short-term discomfort for long-term gain is the focus with this strategy and after 2020 our resilience muscle seems to be a bit stronger, making this option more viable.

If you are excited about the equity you have grown and want to pair it with today’s low interest rates to obtain your next home, but have been fearful of how to do it all – I can help! These three options, along with great attention to detail, hand-holding, and careful planning have helped many people make these exciting transitions. It is my goal to help keep my clients informed and empower strong decisions. Please contact me if you would like further information on how this might work for you or someone you know.

4211 Alderwood Mall Blvd, Lynnwood

We are partnering with Confidential Data Disposal for our 10th year; providing you with a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

We will also be collecting donations to benefit Concern for Neighbors food bank. Donations are not required, but are appreciated.

Hope to see you there!

**This is a Paper-Only event. No x-rays, electronics, recyclables, or any other materials.

Newsletter – Real-Time Market Update: Where We Are Now February 2020

The 2021 real estate market is off to a very brisk start. Historically low interest rates are driving buyer demand. This is coupled with a needed “catch-up” in available homes for sale. In 2020, we saw a stall in new listings during our normally plentiful spring market due to the pandemic. From April to June of 2020, new listings were only a portion of what would have been typical for that time of year. Where it became tricky was in May of 2020 when buyer activity rebounded, and we started to record higher levels of pending sales in 2020 over 2019. This led to the inventory deficit that we currently find ourselves in.

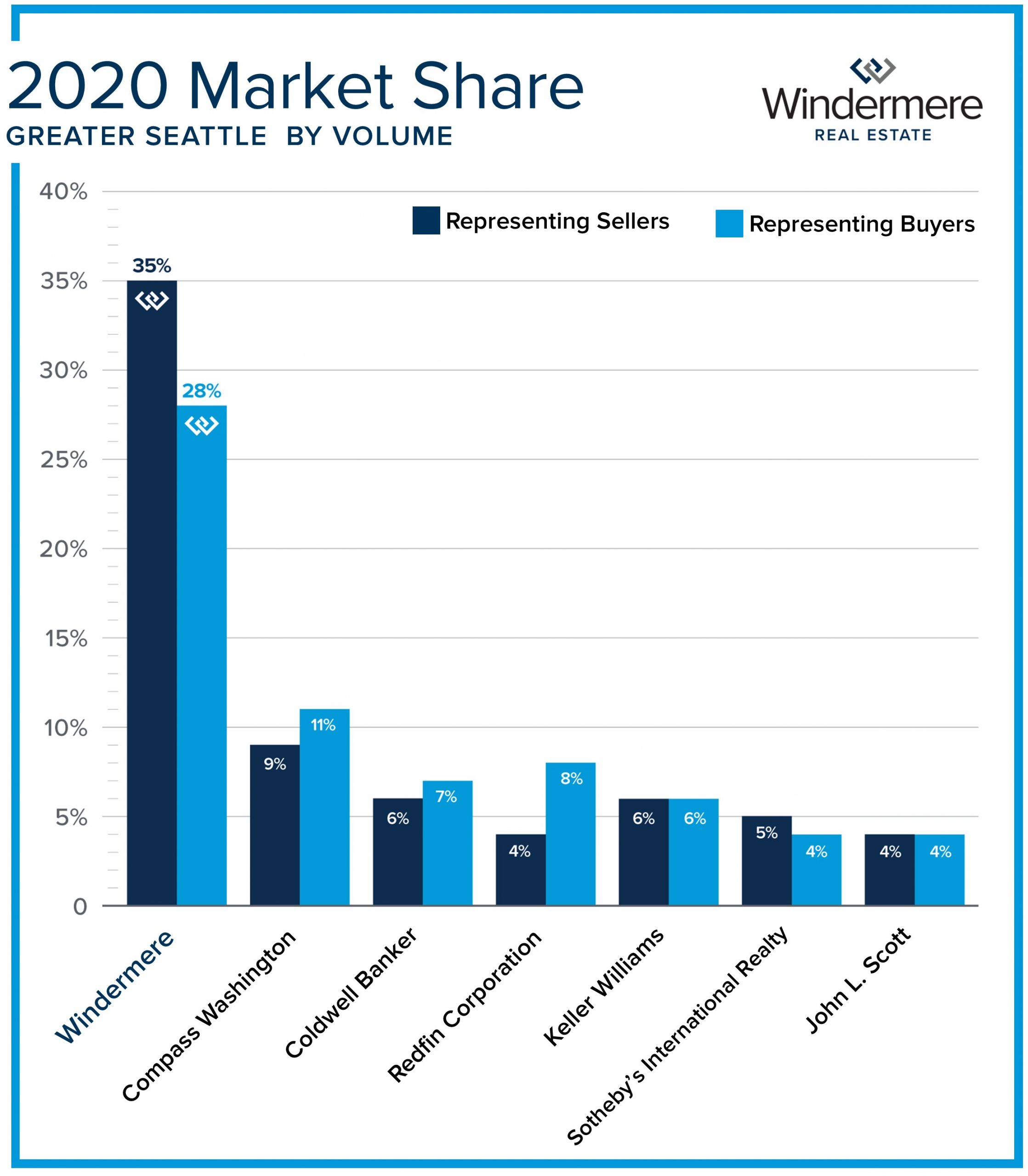

The stats above for King and Snohomish counties highlight the January statistics. In both markets, prices are up year-over-year and well above average appreciation levels. This is due to the phenomenon described above which is a classic case of supply and demand. This has led to months of inventory remaining tight, with mere weeks’ worth of available homes. Days on market have reduced by 38% in King County and 41% in Snohomish County year-over-year, and homes are consistently selling at or above list price.

What does this market mean for sellers? We have already seen sellers that have come to market in Q1 enjoying large buyer audiences and great results. Note that the stats in the image are closed sales in January, which means most of them went under contract (pending) in December. Transactions that closed over the last 7 days and most likely went pending after the first of the year are recording very favorable results for sellers. For example, in King County, there were 305 closed sales from 2/9/21 to 2/15/21 with average days on market at 24 days and a 108% list-to-sale price ratio. In Snohomish County, there were 101 closings in the same timeframe, with average days on market at 14 days and a 104% list-to-sale price ratio. Tight inventory and motivated buyers are creating these results. As we head into spring, we expect to see more homes come to market which could soften these escalations. This would not be a bad thing as sellers are sitting on 9 years of equity growth and these recent gains have been a bonus.

What does this market mean for buyers? Well, you must have a plan! Pre-underwritten financing, pre-offer performed due diligence, organized funds for the down payment, and possible appraisal cushions have been key elements for success. In addition, aligning with a skilled broker to help a buyer prevail is paramount. A responsive broker who is a good communicator can be the difference-maker in winning a home. Listing agents and sellers will not only vet the elements of an offer, but they will also consider the working relationship established with buyers’ brokers as they review offers. There is a special magic to developing these relationships and it takes extra effort. Windermere as a company has been a market leader for many years and continues to work hard to make strong connections for success.

What does this market mean for buyers? Well, you must have a plan! Pre-underwritten financing, pre-offer performed due diligence, organized funds for the down payment, and possible appraisal cushions have been key elements for success. In addition, aligning with a skilled broker to help a buyer prevail is paramount. A responsive broker who is a good communicator can be the difference-maker in winning a home. Listing agents and sellers will not only vet the elements of an offer, but they will also consider the working relationship established with buyers’ brokers as they review offers. There is a special magic to developing these relationships and it takes extra effort. Windermere as a company has been a market leader for many years and continues to work hard to make strong connections for success.

Buyers are anxious to secure their next home with today’s interest rates helping to off-set the expense of price appreciation. With debt service so low, buyers are hungry for more inventory and will most likely start to see an increase in selection in the spring and summer months. Fortitude is the name of the game for buyers, but it will be worth it in the end as the interest rates are amazing and price gains don’t seem to be going away anytime soon.

If you are curious about how today’s market relates to your real estate goals or know someone that needs real estate assistance, please reach out. I am constantly studying the activity in the market to anticipate where we are headed in order to provide sound guidance. It is always my goal to help keep my clients informed and empower strong decisions.

At Windermere, we help people buy and sell homes, but we also help build community. I’m proud to support the Windermere Foundation which has raised over $43 million in the past 32 years for low-income and homeless families right here in our local community.

At Windermere, we help people buy and sell homes, but we also help build community. I’m proud to support the Windermere Foundation which has raised over $43 million in the past 32 years for low-income and homeless families right here in our local community.

In 2020, the Windermere Foundation provided over $2.5M in funds to 569 organizations, while keeping administrative expenses to 2%. The Foundation has been dedicated to helping homeless and low-income families and individuals since 1989. A portion of every commission is donated to this effort along with funds raised from special projects in individual offices.

In 2020, my office donated 5,600 lbs of food and $24K to various food banks associated with The Volunteers of America of Snohomish County as a result of four separate food drives we held throughout the year. We partnered with the YMCA’s Camps Orkila and Colman and donated just over $9K in order to keep the camp operating even though they were not able to open due to the pandemic. This will ensure they will be ready to have kids enjoy the benefits of camp when it is safe. We also sponsored 24 teenage foster boys at Christmas and made sure they had gifts on Christmas morning. We aligned with Pioneer Human Services to create this connection as well as provided grocery gift cards totaling over $3K to eleven families so they could enjoy well-stocked cupboards during the holidays. These opportunities to give back bring purpose to our work and we will continue to work with these organizations in 2021.

Newsletter: Matthew Gardner’s Top 10 Things to Look for in 2021 in the Economy and Our Housing Market

Last week I had the pleasure of attending Matthew Gardner’s 2021 Economic Forecast. Matthew is Windermere’s Chief Economist and coveted expert in our region often called upon by the local and national media for his insights on the economy and housing. Windermere has relied upon his forecasts and advice for over 15 years, and we were lucky to appoint him Chief Economist in 2015. He has been a huge asset to Windermere brokers who utilize his knowledge to help educate their clients in order for them to be empowered to make strong decisions.

Here are Matthew’s Top 10 Things to Look for in 2021:

#1 THE ECONOMY. Matthew expects the economy to continue to recover from the impact caused by the pandemic. He notes that we have already started to see jobs return, but with the vaccine starting to be administered he predicts additional gains in jobs over the second half of the year as businesses start to re-open at full capacity. In addition to jobs, he shared that many Americans have not been spending money like they typically do and have excess cash to spend, leaving many folks eager to travel, make big purchases, or just go out to dinner. The combination of re-opening and more disposable spending will help re-build industries hit hard like entertainment, hospitality, and dining. Supporting small businesses within your community was also something he encouraged consumers to engage with as that will trickle back into the recovery of the overall economy. He expects an increase in spending and additional job creation to boost the economy as we head into spring and summer.

#2 SURGE TO THE ‘BURBS. In 2020 we saw a large number of buyers moving to the suburbs due to the work from home (WFH) phenomenon and affordability. Living in urban areas is more expensive, and with many companies planning on continuing to let their employees WFH indefinitely or half-time moving forward, this has reduced the importance of commute time on a buyer’s wish list. This has also afforded buyers larger homes and yards in comparison to the more compact urban options. Do note however, that Seattle is not losing population, as the net in-migration figure for Seattle in 2020 was up 3.3%.

#3 PREFERRED HOME FEATURES. What buyers are looking for in a home is changing. Open-concept floorplans used to be all the rage, but now buyers are looking for separate spaces where an at-home office or Zoom space can be incorporated. Outdoor living areas are also coveted due to the option for year-round entertaining and/or exercise/home gym space. Rural homes with high-speed internet are coming at a premium as these properties create room to roam and the option to WFH. Not all rural areas have the infrastructure in place to support the technology needed to WFH, so the areas that do are in demand.

#4 INTEREST RATES. In 2020, we broke the all-time low for interest rates 16 times! We are currently under 3% and down an entire point from the previous year. This has fueled demand in all segments of the market, particularly first-time homebuyers, luxury buyers, retirees downsizing, and move-up buyers. Note that a one-point drop in interest rate gives a buyer 10% more buying power, which is helping off-set the expense of price growth. While Matthew anticipates rates rising in 2021, he expects them to settle around 3.1%. With the long-term average at 7.9%, a bump up above 3% is still something to celebrate and will continue to be the gas in the tank of buyer demand.

#5 MORTGAGE FORBEARANCE. In the spring of 2020, the banks were quick to offer the option of mortgage forbearance in response to the job losses created by the pandemic. Many homeowners that needed to, took advantage of this option. The good news is that since May there has been a 43% reduction in participants in the program. Currently, there are 2.7M people in the program, many of which are returning to work and will be able to continue with their mortgage payments. For those that will not be able to afford the monthly payments, the option to sell after double-digit year-over-year price appreciation in markets such as WA, CO, OR, MT, and ID will provide a financial benefit. Matthew disagrees with the naysayers that think we are sitting on the brink of a wave of foreclosures in our region as equity levels are in favor of a homeowner selling vs. giving their home back to the bank. Buyer demand is also at an all-time high ensuring a plentiful homebuyer audience.

#6 HOME PRICES & SALES. Strong buyer demand will continue due to low interest rates and lifestyle moves influenced by the option to WFH and Baby Boomers retiring. Matthew believes we will have an increase in closed sales in 2021 and that we will continue to have price appreciation. Bear in mind that we are coming off above-average year-over-year price appreciation in 2020 (up 12% in Snohomish County & 7% in King County), and he expects price growth to temper in 2021 year-over-year which will help with affordability and rate increases.

#7 LUXURY HOME MARKET. 2020 was an amazing year for the luxury home market, with closed sales over $1M in King and Snohomish Counties up 30% and over $2M up 28%. There was a brief stall in the spring when jumbo loan rates surged and were in some cases unavailable at some banks. By May, jumbo loans found their place in the market, and homebuyers in the upper price points were able to enjoy the historically low interest rates as well. Matthew sees this continuing in 2021 along with more foreign buyers coming to the market with international travel opening back up in the second half of the year.

#8 ZONING. Matthew sees affordability as the biggest challenge in our market and zoning changes are the most efficient way to solve it. He expects legislators to have more discussions about adjusting zoning policies to create more affordable housing. He does not expect this to happen overnight or even in 2021, but for the stage to start to be set to make progress in this arena.

#9 APARTMENT RENTAL MARKET. The pandemic has been rough on the rental market, especially apartment rentals in big cities such as Seattle. The WFH option and a newfound aversion to shared living spaces have driven increases in vacancy rates. This has caused rental rates to decrease, and with an anticipated bumper crop of new apartments set to come to market in 2021 this segment of the market will take some time to recover due to supply and demand. Single-family rentals have fared much better than apartments. We expect the eviction moratorium to be lifted in tandem with increased vaccination rates and the rebound of the job market.

#10 ADAPTIVE REUSE. While the expense to convert apartments to condominiums is cost-prohibitive, he sees some opportunity to convert some hotel spaces to residential living. This goes in-line with creating more affordable housing and could be a positive economic option for motel or inn owners that have suffered during the pandemic. Other adaptive reuse options due to the surge in online commerce would be shopping malls converting to mixed-use (commercial with residential) space, and strip malls being bought out by developers for residential units.

Overall, Matthew’s take on the economy as we head into 2021 is hopeful and on the housing market extremely positive. If you would like the recording of his forecast or the Power Point slides in PDF format to review the data yourself, please reach out. It is always my goal to help keep my clients informed and empower strong decisions.

I am pleased to present the fourth quarter 2020 edition of the Gardner Report, which provides insights into select counties of the Western Washington housing market. This analysis is provided by Windermere Real Estate Chief Economist Matthew Gardner. I hope that this information will assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

I am pleased to present the fourth quarter 2020 edition of the Gardner Report, which provides insights into select counties of the Western Washington housing market. This analysis is provided by Windermere Real Estate Chief Economist Matthew Gardner. I hope that this information will assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

Windermere and the Seattle Seahawks partnered for the fifth season to #TackleHomelessness, raising an additional $32,100 for Mary’s Place to support homeless children and families, bringing our total raised to $160,300! Read more on the Windermere blog.

Windermere and the Seattle Seahawks partnered for the fifth season to #TackleHomelessness, raising an additional $32,100 for Mary’s Place to support homeless children and families, bringing our total raised to $160,300! Read more on the Windermere blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link