There is no doubt that 2022 has been one of the most eventful years in real estate. This is saying a lot after experiencing the record-breaking years of the pandemic. We will probably never see anything like 2020 and 2021 again. During this time the market responded to a historical event that motivated the rearrangement of our communities due to societal shifts while we had the lowest interest rates ever. It was a doozy of a time! Demand was spurred by the option to work from home; buyers craved the perfect space to be at home and cheap money made these moves desirable and plentiful.

The market had a slight pause at the onset of the pandemic in the spring of 2020 and then it took off like a freight train. Heightened demand, cheap money, and low inventory caused prices to increase at the most significant rate we have ever seen. How was this train barreling down the tracks going to slow down? The speed at which this train was moving was not safe or sustainable. The only way to stop it was an increase in interest rates.

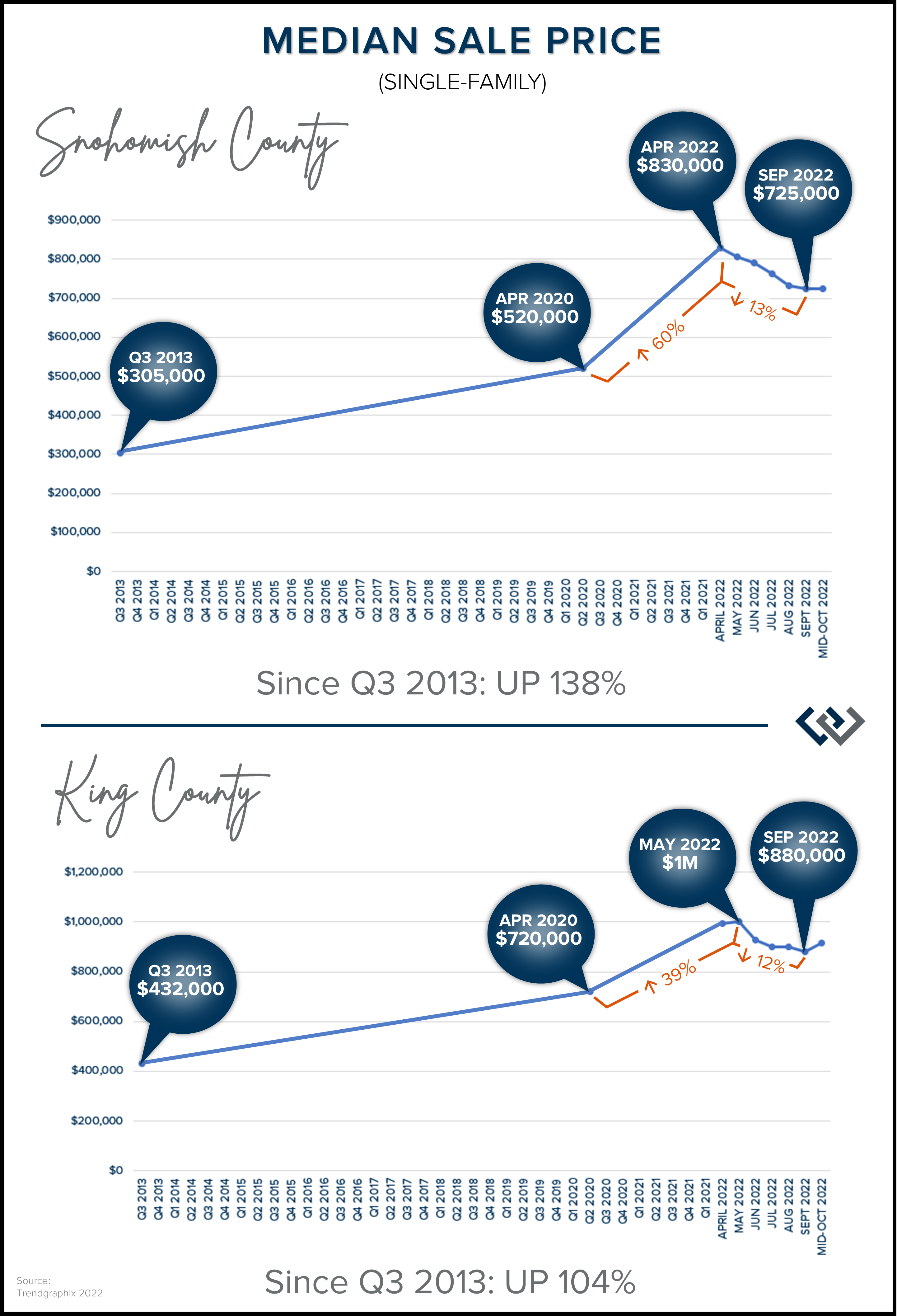

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year period unlike any other! The Fed needed to make the cost of borrowing money more expensive to slow down inflation. This applied to the entire economy, not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year period unlike any other! The Fed needed to make the cost of borrowing money more expensive to slow down inflation. This applied to the entire economy, not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

Since the peak, mortgage interest rates have increased by 1.5% and this has put downward pressure on house prices and slowed demand. There is a rule of thumb in our industry called the 1/10 rule: for every 1-point change in interest rates, buying power shifts by 10%. For example, if a buyer is pre-approved for a $750,000 purchase at a rate of 5.5% and then the rate increases by 1-point to 6.5% for the buyer to have the same monthly payment they must decrease their purchase price by 10% to $675,000. This rule applies when rates go down too, which led to the fierce increase in prices over the pandemic years.

Buyers most often make buying decisions based on the monthly payment and it is no surprise that the new interest rate environment has caused prices to decrease. As you can see from the graph, prices in Snohomish County are down from the peak by 13% and in King County by 12%, which reflects the 1/10 rule, as rates went from 5% on average in April to 6.5% in September. Month-to-date this October, prices in Snohomish County remain even over September prices, and up slightly in King County.

Expect home prices to adjust based on rate increases, decreases, or stabilization based on the 1/10 rule, not because the sky is falling. Buyers that bought at or around the peak need to keep the faith and understand that real estate is a long-term hold investment with the average homeowner spending at least 8 years in their home. A correction in the market is solved with time and most likely these buyers secured their homes with very low debt service making their payments lower to help them offset this adjustment. The Fed’s plan is working to slow down the economic train and help us return to a more sustainable market.

While interest rates are higher than they have been they are still lower than the 30-year average of 7.5% and prices are coming off the peak, but they are not crashing. To illustrate, in Snohomish County, prices are up 40% from April 2020, and in King County, they are up 22%. Most importantly, long-term price growth over the last decade is up by 138% in Snohomish County and up 104% in King County. In fact, more than 50% of homeowners in WA state have at least 50% equity in their homes making them prepared to make a move when their life-needs motivate a change. Keeping all of this in perspective will lead sellers to successful moves with a calm understanding of our new normal after an unprecedented time in history.

Buyers are enjoying an increase in selection and more time to make their buying decisions. They now have time to discern these big life changes and to analyze the financial aspect of a move versus needing to decide in a 15-minute showing appointment before a home was gobbled up in multiple offers. They are also afforded the opportunity to do further due diligence on the properties they are interested in and negotiate contract contingency terms that protect them throughout the transaction. It is also not uncommon for a buyer to negotiate work orders to be included in their contract. We are seeing the occasional multiple offers on homes that are special and priced perfectly, so aligning with a broker who can identify value and opportunity is key, so a buyer doesn’t miss out.

Another important aspect for a buyer to consider is their mortgage financing terms. With rates higher than they have been and the need to manage monthly payments, creative financing options such as rate buy-downs and ARMs (Adjustable Rate Mortgages) are options to consider when making a purchase. Make sure the broker you work with has a collection of reputable lenders that can provide options as each lender will have different programs to choose from.

We are even seeing sellers pay credits on behalf of buyers to buy their rate down to make the monthly payment more attainable. The negotiations we are seeing in this market are being dictated by buyer affordability which requires collaboration from all the parties. Since most sellers have large amounts of equity, we have seen successful meeting-of-the-mind solutions to create win-win outcomes for both sides. As the market comes into balance we are seeing more give-and-take and the importance of navigating these changes is critical.

When a market shifts, skilled and experienced agents rise to the top. Listings that are well prepared for the market and priced appropriately will be the winners. Cutting corners and overpricing will lead to frustration and loss. Sellers need to seek out trusted advisors who can properly analyze the new market conditions, bring perspective to their goals, keenly negotiate, and assist them in showcasing their home in the best light possible. Buyers need to align with a professional who understands current market values, can negotiate with data and rapport, assist them in their lending options and help create win-win outcomes.

We are coming off two years of trying to hold onto a speeding train and now we have the opportunity to bring it into the station through expertise. Expertise is earned and takes time. I could not be more passionate about helping my clients navigate the new normal and any market changes we encounter with the tools and experience I bring to the table. I am invested in my clients’ goals and strive to empower strong decisions with thorough research, sound counsel, and clear advocacy. Please reach out if you are curious about how today’s market matches up with your goals or if you know someone I can help.

Did you know Windermere is the official real estate company of the Seahawks?!

The best part of this partnership is our #TackleHomelessness campaign. For every defensive tackle made by the Hawks at their home games throughout the season, The Windermere Foundation donates $100 to Mary’s Place. Our current total is over $200k donated over the last 6 seasons of partnering with the Seahawks.

Since 1999, Mary’s Place has helped thousands of women and families move out of homelessness into more stable situations. Across five emergency family shelters in King County, they keep families together, inside, and safe when they have no place else to go, providing resources, housing and employment services, community, and hope.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link